Where Data Tells the Story

© Voronoi 2026. All rights reserved.

Design & Analytics - Pranav Gavali (Connect with me here)

Follow me on Instagram - Charts & Beyond

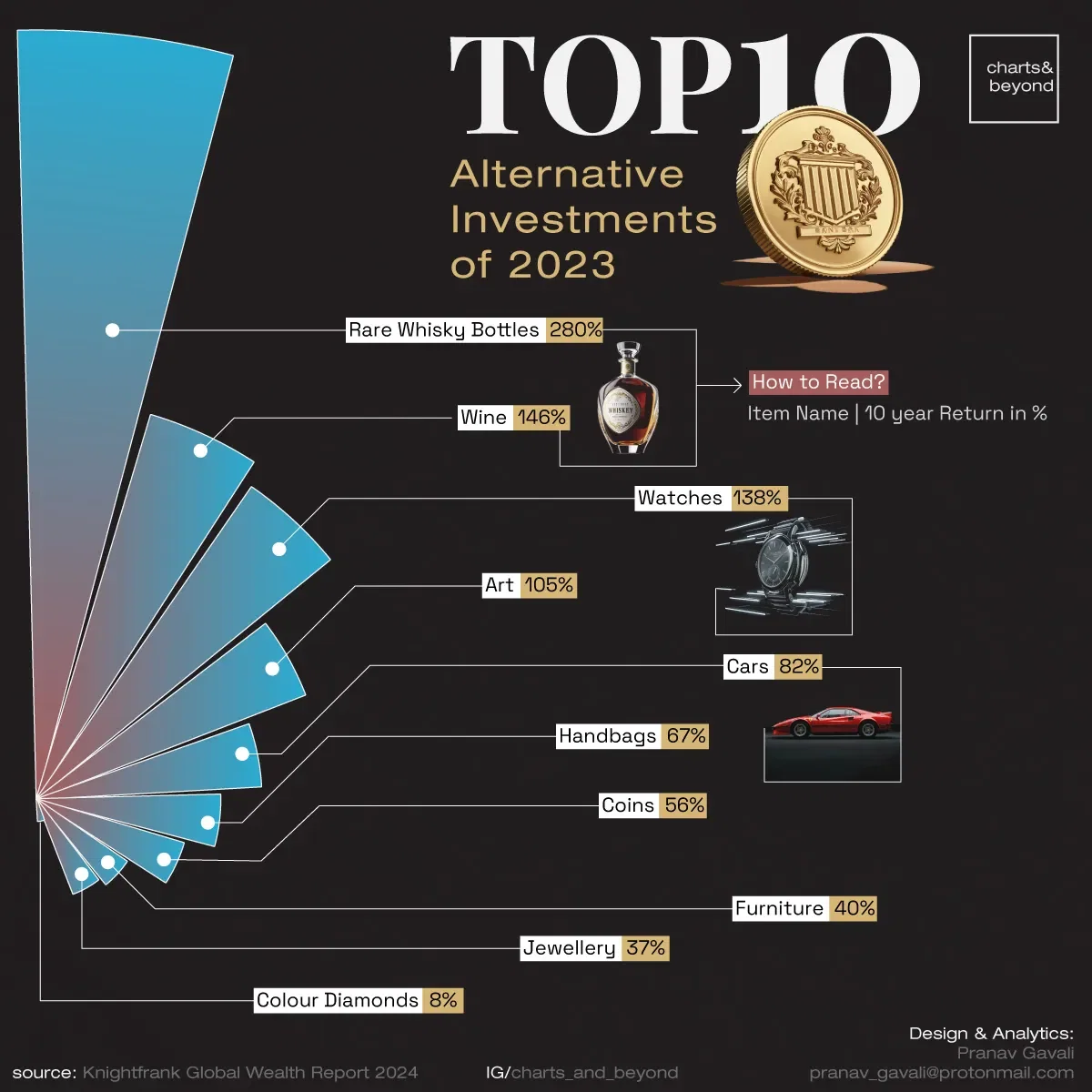

The infographic highlights the top 10 alternative investments of 2023, showing their 10-year returns. Sourced from the Knightfrank Global Wealth Report 2024, it lists assets like rare whisky bottles, wine, watches, art, cars, handbags, coins, furniture, jewelry, and colored diamonds, each with its percentage returns over a decade.

Read Morgan Stanley on - "Strategies that can guide investors on Alternative Investments"

Alternative investments provide diversification beyond traditional assets like stocks, bonds, and real estate. They offer opportunities to hedge against market volatility, inflation, and economic downturns. Incorporating alternative investments into a portfolio can lead to more stable and robust long-term financial growth.

Read BlackRocks article on - "Why to consider alternative investments?"

The upside includes potential high returns and resilience during market fluctuations. For example, rare whisky bottles yielded a 280% return over ten years, and wine saw a 146% return. These investments often have intrinsic value and are less correlated with traditional markets, making them attractive for diversification. They also offer the chance to invest in tangible assets with cultural, historical, and personal significance, adding emotional value to financial gains.