Where Data Tells the Story

© Voronoi 2026. All rights reserved.

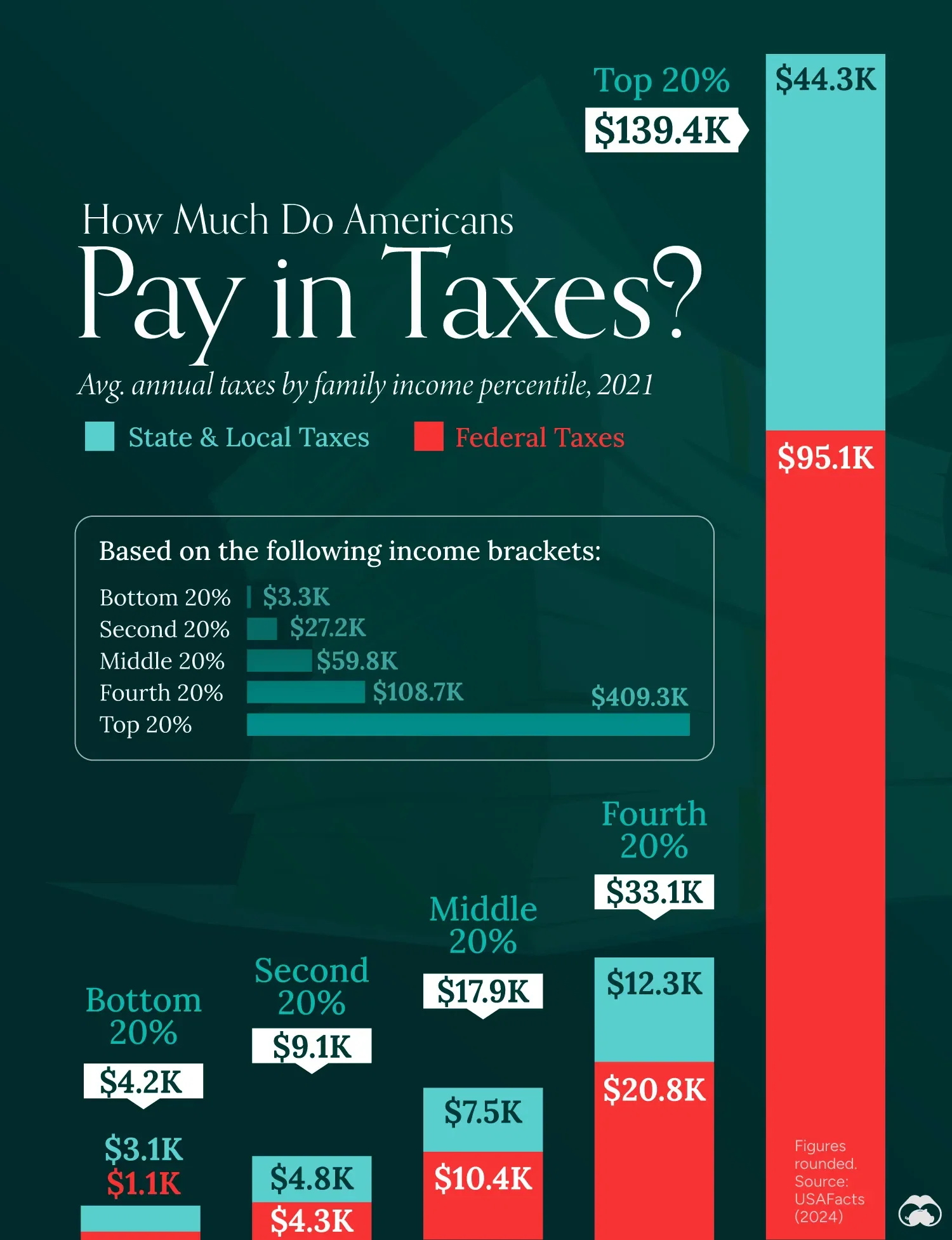

The average annual taxes paid in 2021 by U.S. families, based on income percentile. These figures come from a USAFacts analysis of IRS and Census Bureau data.

These numbers account for both direct taxes (e.g. income tax) and indirect taxes (e.g. payroll taxes).

In 2021, families in the middle 20% of America’s wealth distribution paid an average of $17.9K in taxes.

Due to the tax bracket system, families in the top 20% paid significantly more, averaging $139.4K in 2021.