Where Data Tells the Story

© Voronoi 2026. All rights reserved.

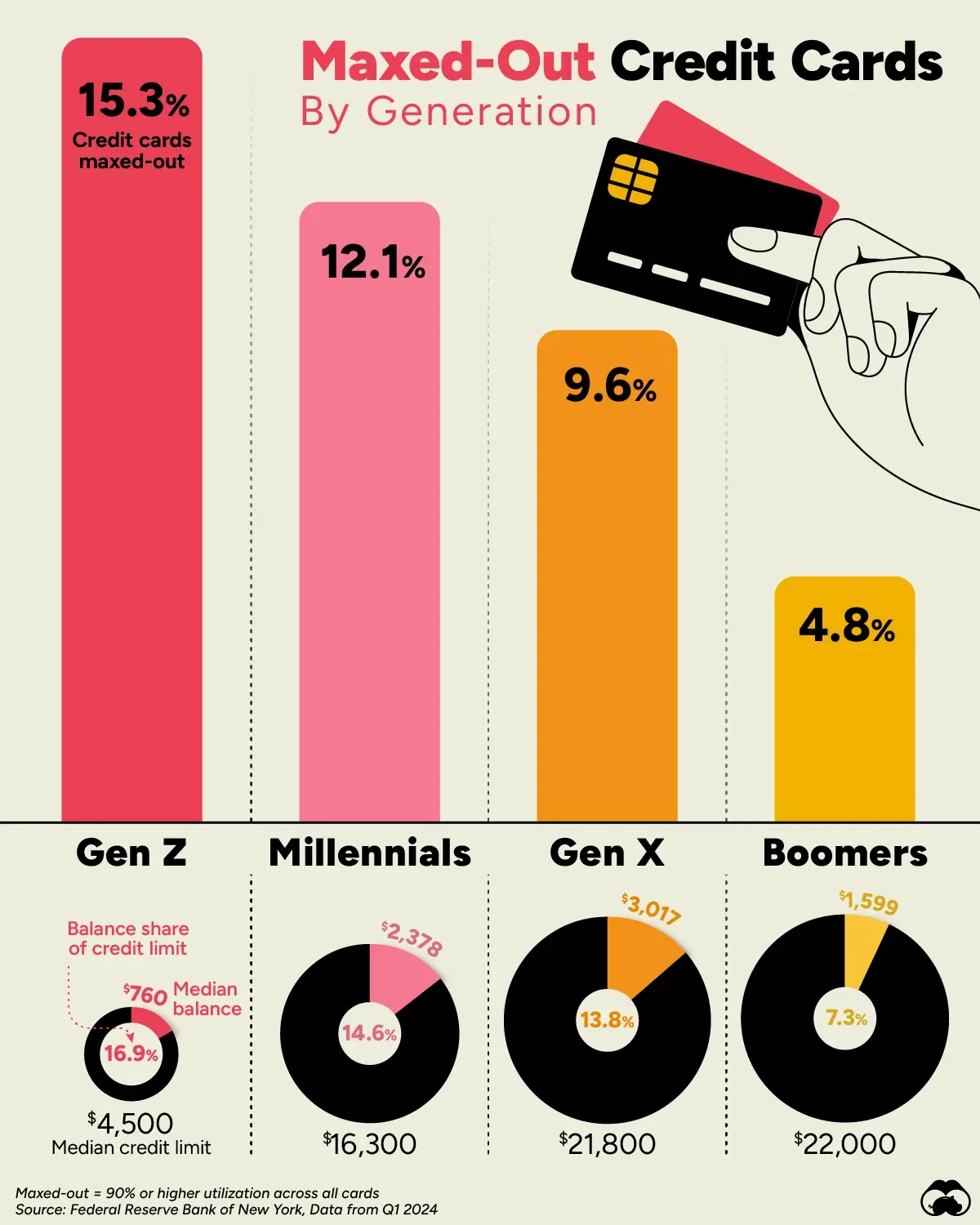

The share of U.S. adults in each generation (Gen Z, Millennials, Gen X, and Baby Boomers) that have maxed-out credit cards as of Q1 2024.

The chart also shows each generation's median credit limit and median balance as of Q1 2024.

Generations are defined as:

Maxed-out denotes borrowers who have 90% or higher utilization across all credit cards. Data comes from the Federal Reserve Bank of New York.

Younger credit card users typically have higher utilization rates, with this trend decreasing among older generations.

As of the first quarter of 2024, less than 5% of Baby Boomers have maxed out their credit cards.

However, Gen Z borrowers have lower median credit limits, averaging $4,500, compared to $16,300 for Millennials and $22,000 for Baby Boomers.

This disparity is largely due to Gen Z's shorter credit histories, which result in lower credit scores, as well as generally lower income.