Where Data Tells the Story

© Voronoi 2026. All rights reserved.

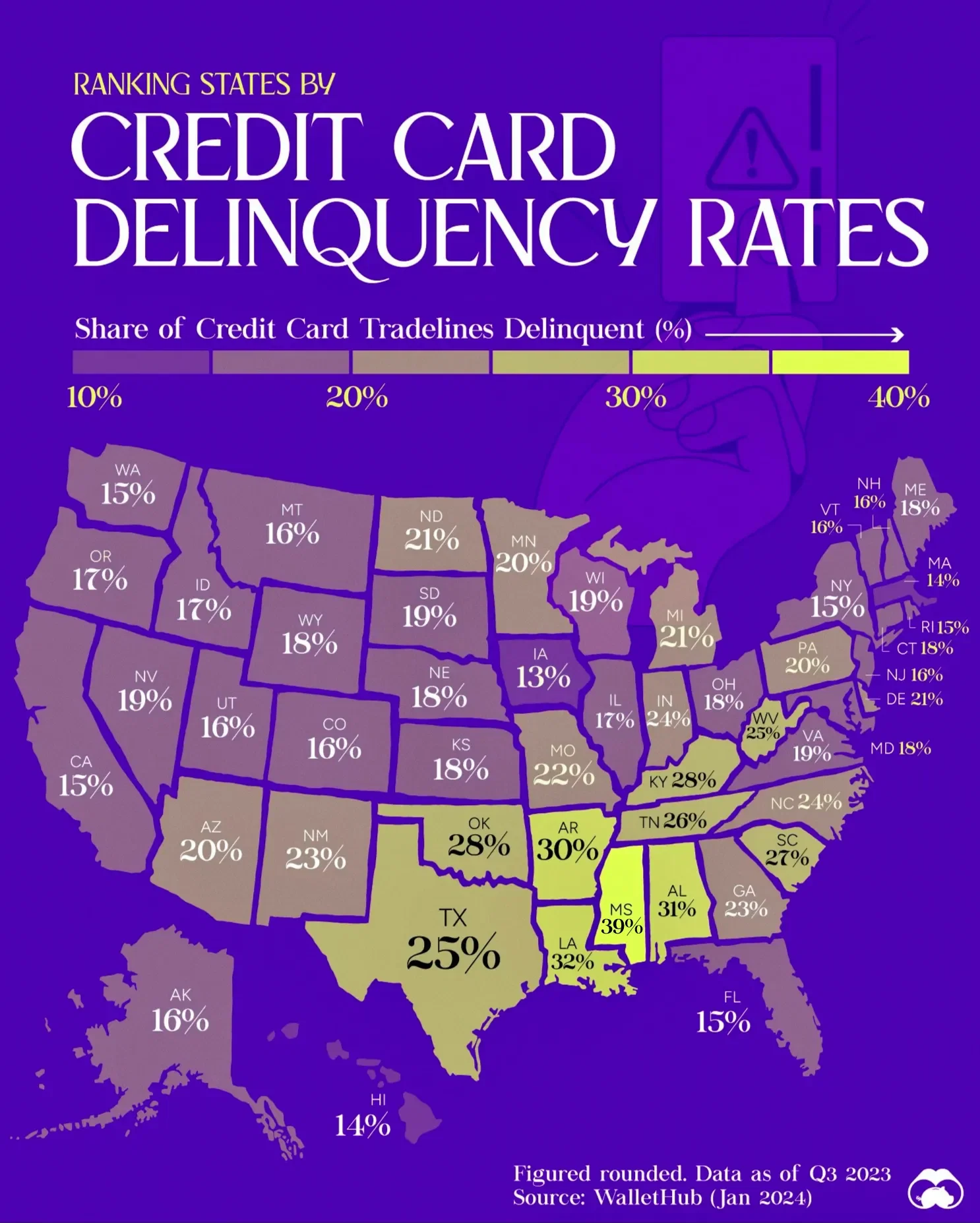

The share of credit card card lines in delinquency across 50 U.S. states, as of Q3 2022. This data comes from a WalletHub study published in January 2024.

Credit card delinquency is when a cardholder falls behind on required monthly payments. Credit agencies are often notified after two months of delinquent payments.

The five states with the highest rates of credit card delinquency (Mississippi, Louisiana, Alabama, Arkansas, Oklahoma) are all located in the southeastern region of the country.

From the source: To determine the states most delinquent on credit cards, we analyzed WalletHub’s proprietary user data on consumer delinquency rates between Q3 2022 and Q3 2023.