Where Data Tells the Story

© Voronoi 2026. All rights reserved.

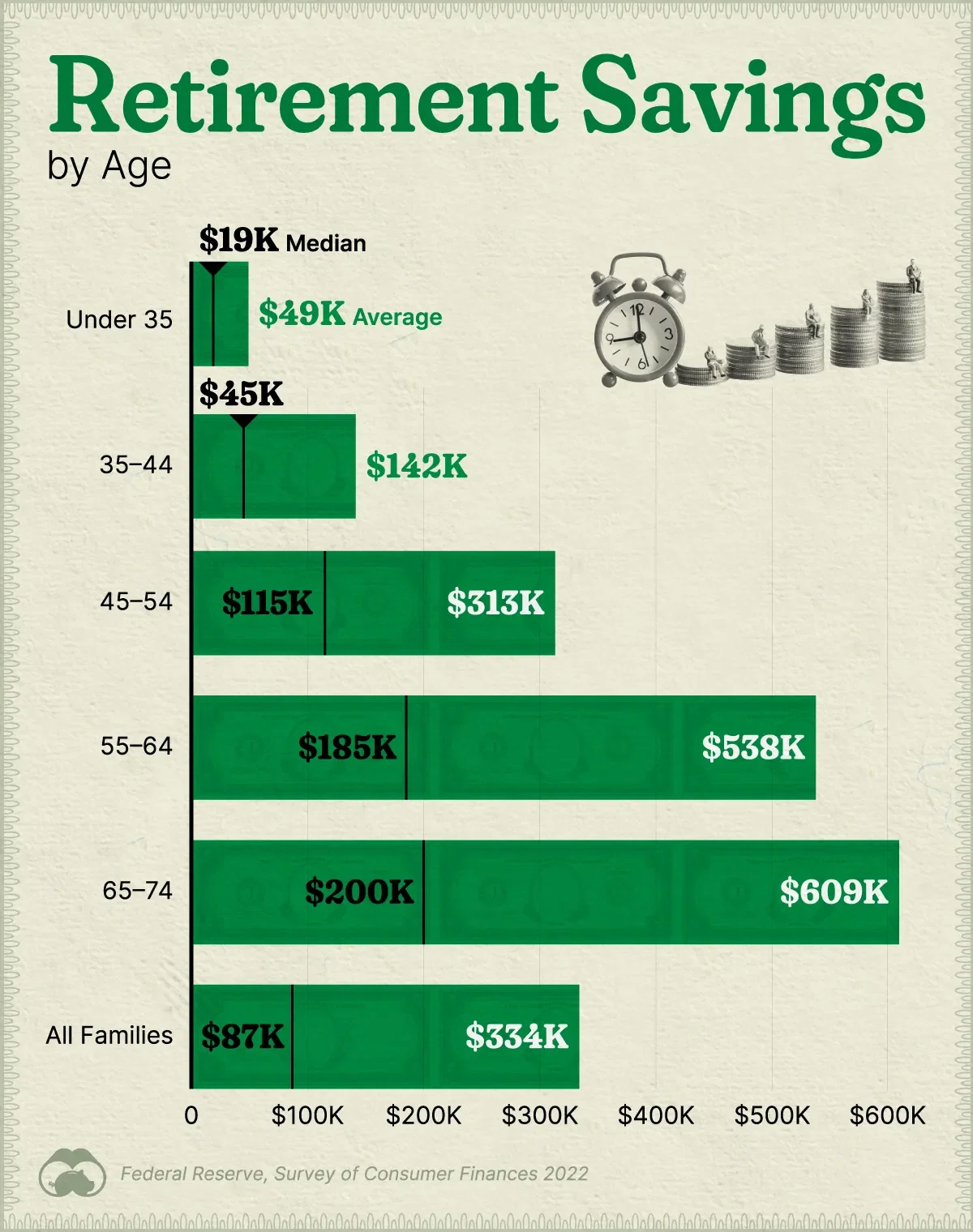

The retirement savings of Americans by age group, based on data from the Federal Reserve’s 2022 Survey of Consumer Finances.

Painting a concerning picture, the median retirement savings for Americans stands at a mere $87,000—a figure far lower than what is needed for a comfortable nest egg. In fact, a recent survey reveals that $1.46 million is the ideal savings target for a comfortable retirement, up from $1.27 million last year.

As of 2022, there were $37.8 trillion held in U.S. pension plans and Individual Retirement Accounts (IRAs). Of these, employment-sponsored plans comprised a substantial 70% share of these assets.

However, for many Americans without employer-sponsored plans—such as with state, local, or federal governments—saving for retirement has become an increasingly uphill battle. In fact, the Census data from 2020 showed that just 58% of Americans aged 55 to 64 have retirement accounts, underscoring the growing challenges faced in preparing for retirement.