Where Data Tells the Story

© Voronoi 2026. All rights reserved.

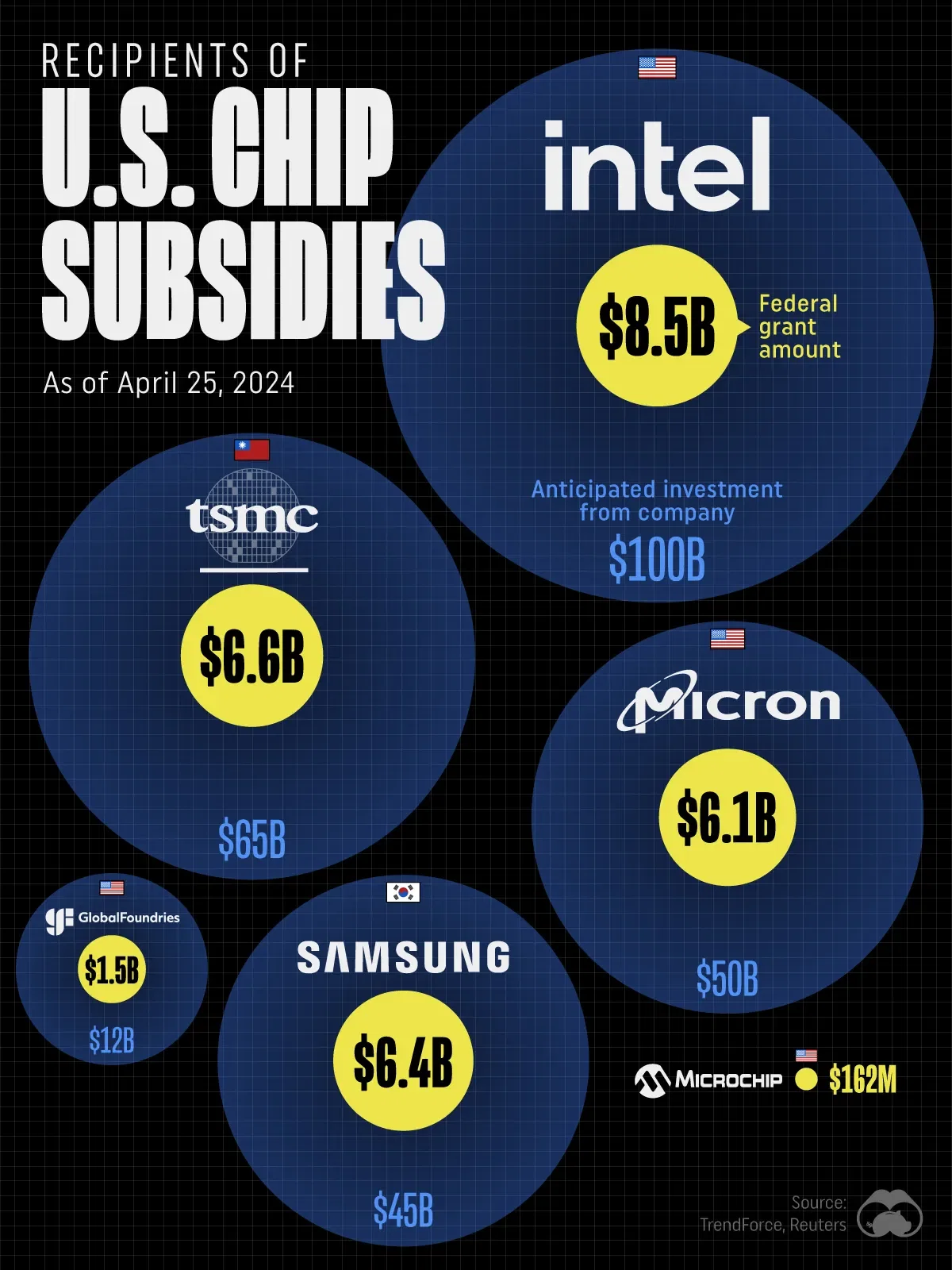

This graphic shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. These grants are intended to accelerate the production of semiconductor fabrication plants (fabs) across the U.S.

Intel is receiving the largest share of the pie, with $8.5B in grants (plus an additional $11B in government loans). This grant accounts for 22% of the Act’s total subsidies for chip production.

Intel is expected to invest $100B to construct plants in Arizona, Ohio, New Mexico, and Oregon, and is also seeking $25B in tax credits.

Meanwhile, TSMC is receiving a hefty $6.6B to construct a chip plant in Arizona. The Taiwanese chipmaker is expected to spend $65B from its end.

The plant’s first fab will be up and running in H1 2025, leveraging 4nm technology.

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1B in grants to support its plans of investing $50B through 2030. This investment will be used to construct new fabs in Idaho and New York.