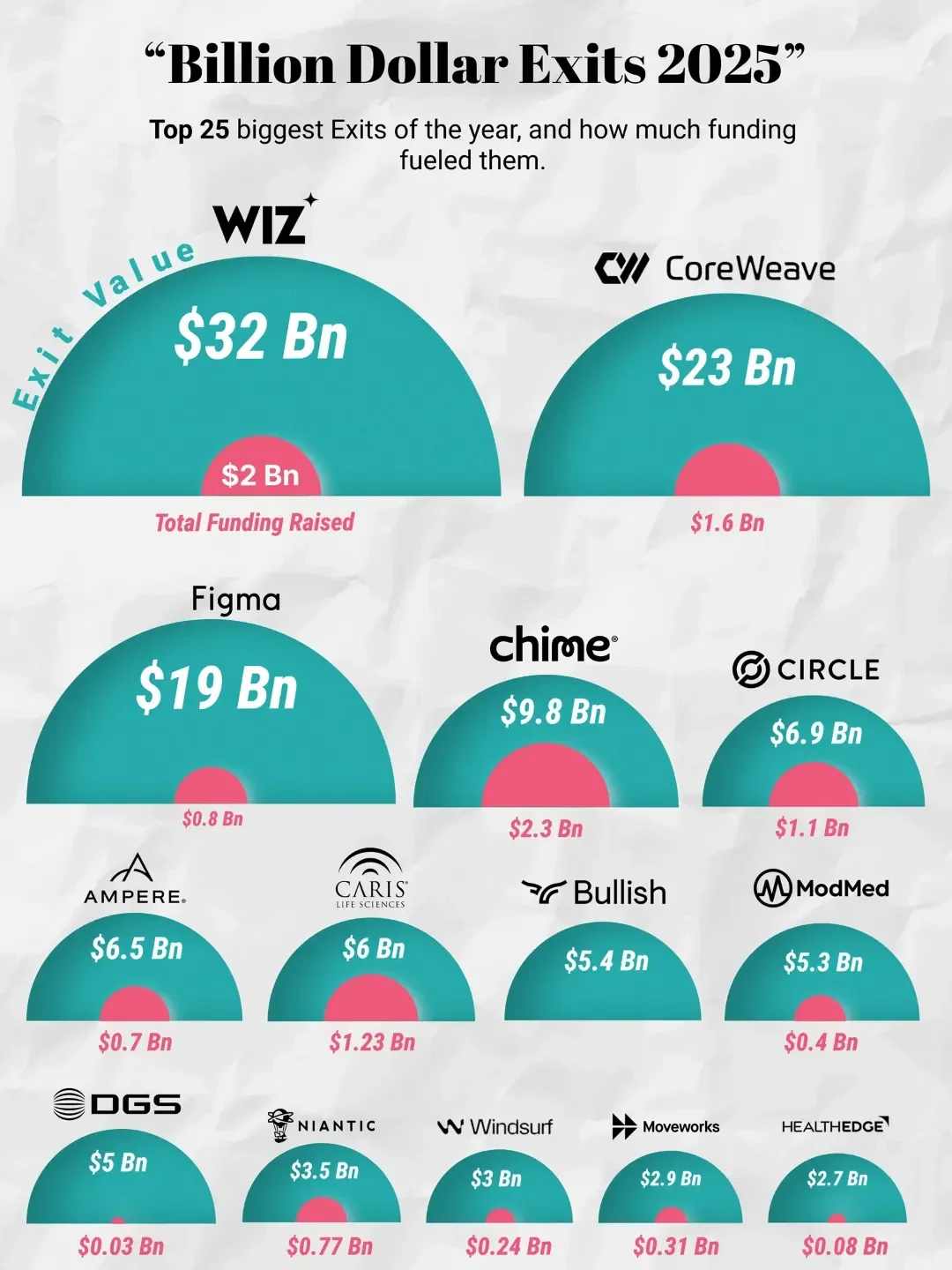

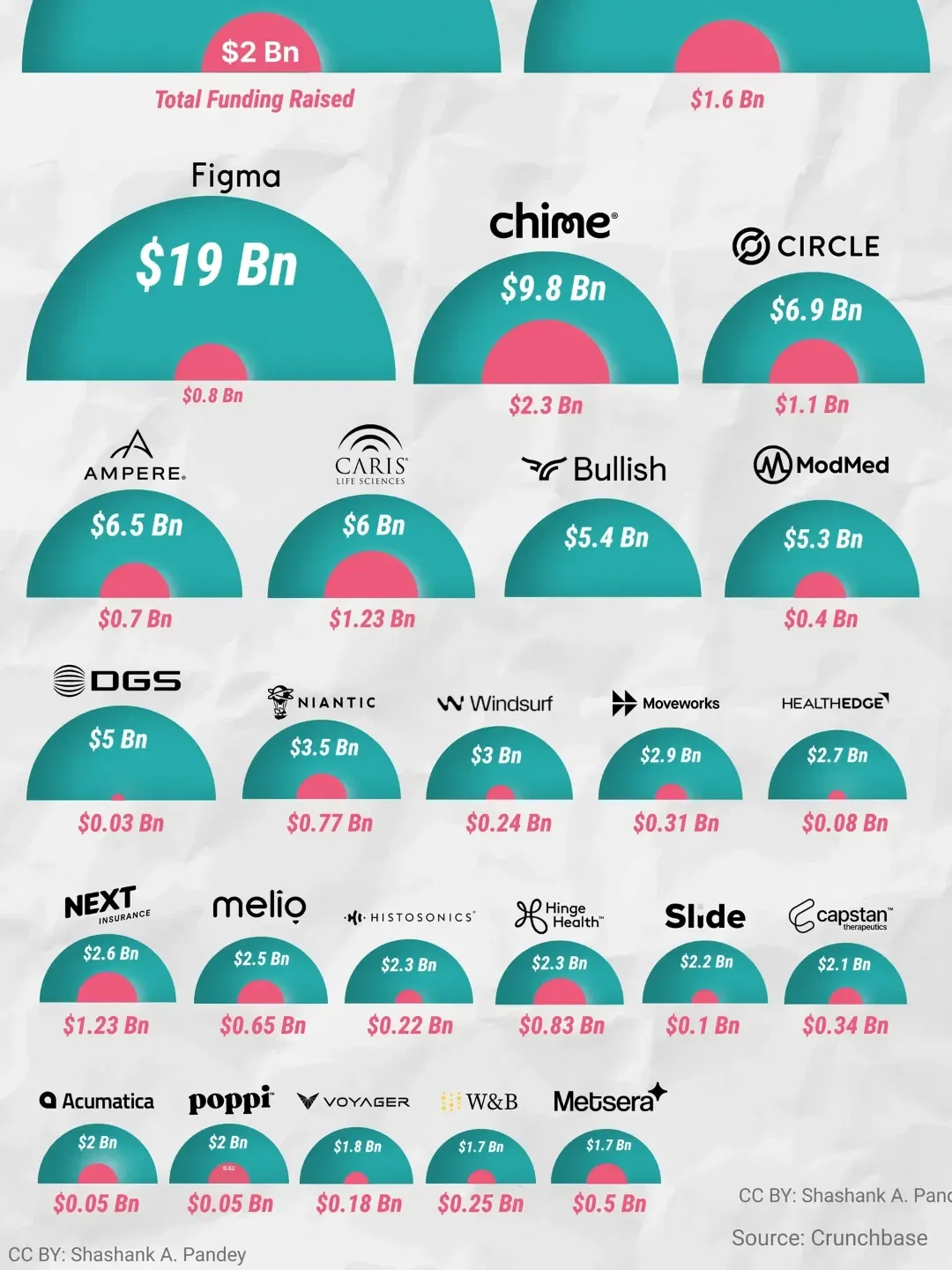

Top 25 Billion Dollar Exits in 2025

After three years of venture winter, 2025 has delivered a spectacular resurgence of billion-dollar exits that's rewriting the playbook on startup success.

Collectively, these 25 companies raised just $15.7 billion to produce that $154.1 billion in exit value and a 9.8× aggregate return that would make even the most seasoned LPs misty-eyed.

Digital Global Systems delivered a jaw-dropping 192× return, turning a modest $26 million into a $5 billion exit. Acumatica and Poppi both achieved 40×+ multiples, proving that lean, bootstrap-driven models can still command premium valuations. Even Figma, with a $19 billion exit at 25× its funding, showed what happens when perfect product-market fit meets impeccable timing.

At the top of the leaderboard sits Google’s $32 billion acquisition of Wiz. After turning down a $23 billion offer just eight months earlier, Wiz’s founders held their ground. That strategic patience paid off handsomely, netting an extra $9 billion and signaling a shift in how power is wielded in late-stage dealmaking.

The 2025 exit class has reset expectations across the startup ecosystem. For founders, it proves that capital efficiency and strategic patience can be more valuable than raw fundraising amounts. For investors, it demonstrates that disciplined deployment and portfolio construction matter more than the size of the check. For the broader market, it signals that startup valuations have found a sustainable floor, ending the correction cycle that began in 2022.