Where Data Tells the Story

© Voronoi 2026. All rights reserved.

Property insurance in the US is getting more expensive and, in some cases, harder to obtain, according to a 2023 Congressional Research Service (CRS) report.

The report links the rising prices and limited access to three main causes:

Public data on how much Americans are spending on property insurance is limited.

According to the Office of Financial Research, the property and casualty insurance industry in the US has struggled in recent years, experiencing industry-wide losses every year from 2017–2022 except for one.

In March 2024, Treasury Secretary Janet Yellen suggested that consumers are dealing with consequences: “Americans across the country are seeing the affordability and availability of their insurance policies decline as a result of increasingly severe climate-related disasters.” That month, the Treasury Department launched a project in partnership with state insurance regulators to collect more data on how climate risk is impacting insurance markets.

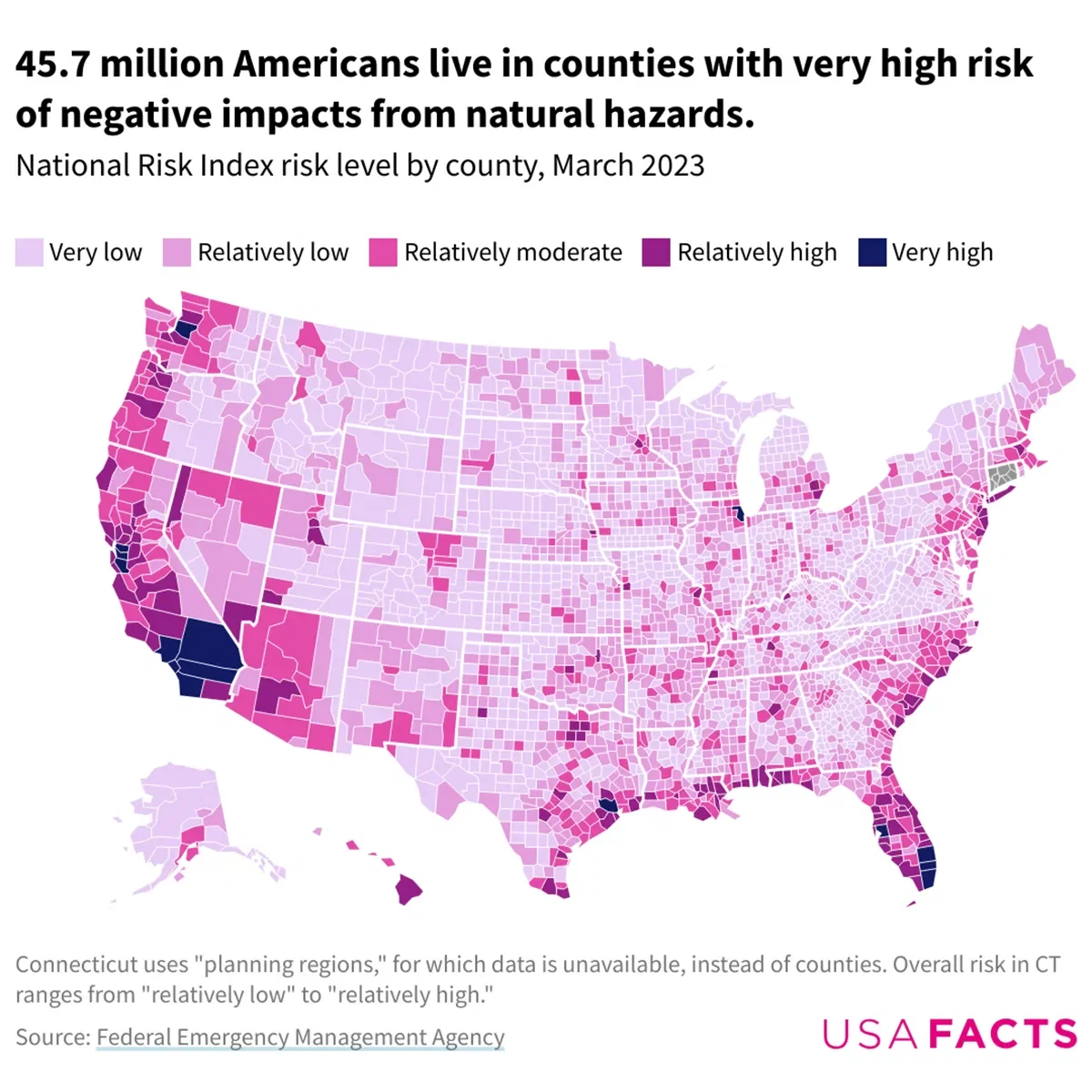

As the risk of damage from a natural disaster increases, insurance providers are responding by raising premiums or restricting coverage.

In some states, insurance providers have limited their business or pulled out altogether. In California, seven out of the top 12 property insurance providers have paused or restricted new policies since 2022. In Florida, some private insurers have become insolvent and left the market, necessitating a state-operated alternative called Citizens Property Insurance Corporation. In 2023, the US Committee on the Budget launched an investigation into the solvency of Citizens.