Where Data Tells the Story

© Voronoi 2025. All rights reserved.

For weeks, more than 33,000 Boeing workers have been on the picket line, battling over wages, bonuses, and retirement options. But one item in particular has been a dealbreaker for each side: pensions.

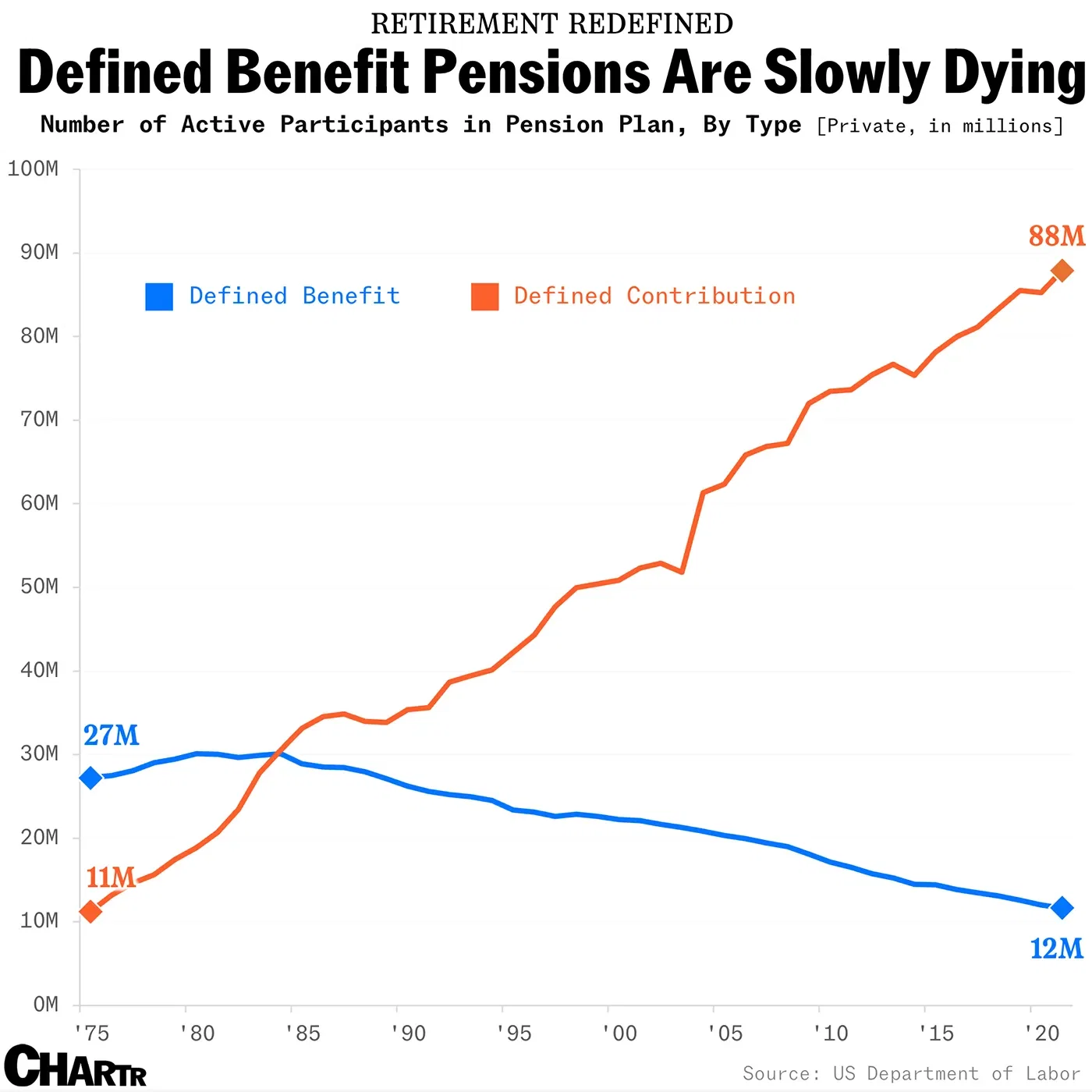

One of the workers’ demands is for the return of a defined benefit (DB) pension, a traditional retirement system that has largely faded in the private sector, replaced by defined contribution (DC) schemes at thousands of employers across the country.

Under a DB plan, employers guarantee the amount you get on your retirement (i.e. the benefit is defined). A common outcome was that workers would accrue between 1% and 2% of their final salary for every year of service. This was typically considered a pretty good deal with many employees not having to worry about funding their retirement, knowing they would receive 50%, or even 60%+, of their final salary when they gave up work.

But in 1978, a new tax code that included Section 401(k) allowed employees to defer income taxes on contributions made to retirement plans, giving birth to the 401(k) and ushering in the era of the defined contribution (DC) pension.

See the full article here.