Where Data Tells the Story

© Voronoi 2025. All rights reserved.

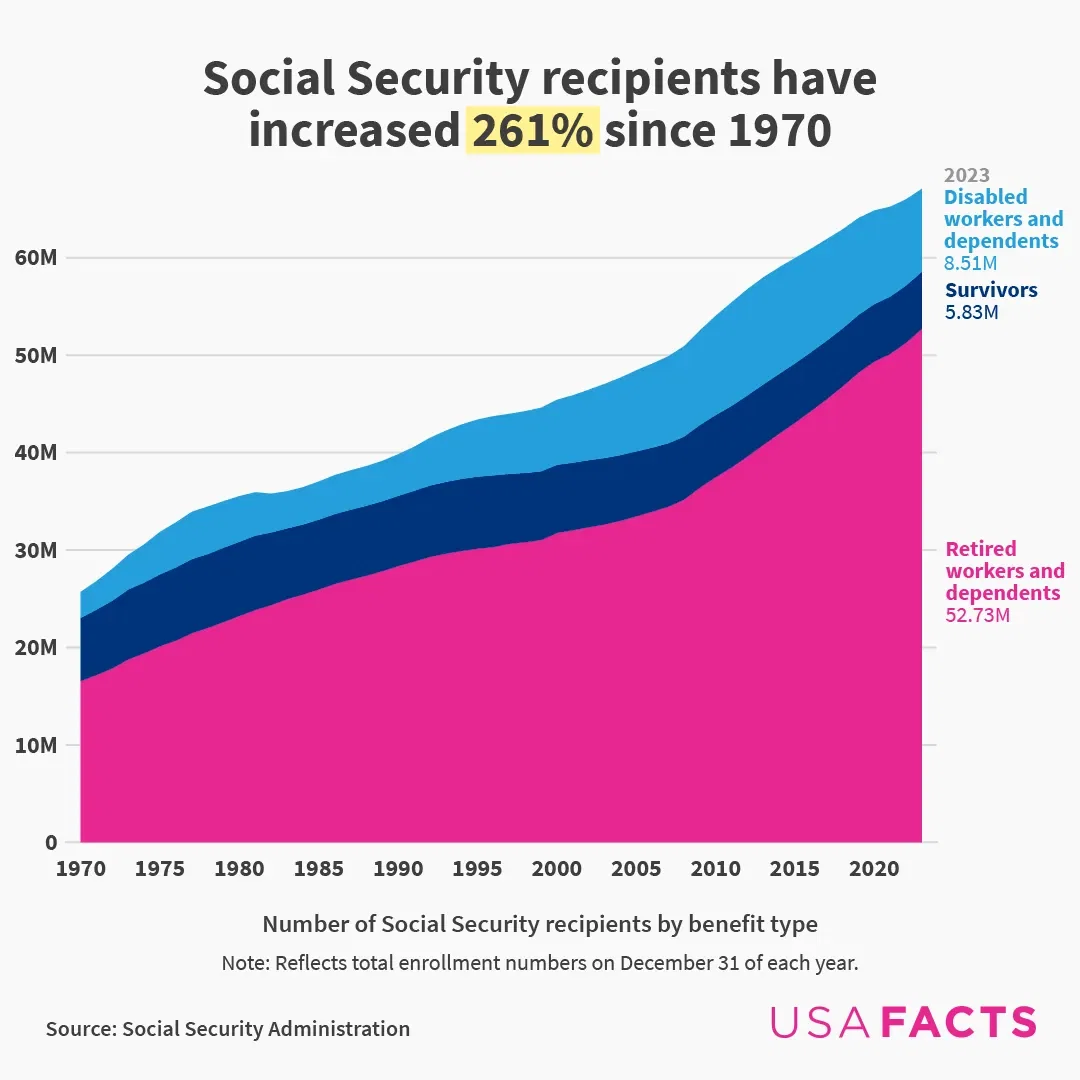

The Social Security Administration (SSA) projects that nearly 68 million people will receive benefits monthly in 2024.

In December 2023, that total was 67.1 million, including:

That month, nearly nine in ten people ages 65 and older were enrolled.

The Old-Age and Survivors Insurance and Disability Insurance trust funds, which were worth a combined $2.8 trillion at the end of 2023, fund Social Security.

US workers pay into the trust funds through payroll taxes and employers match these contributions. Self-employed people are taxed at twice the rate. The SSA estimates that 183 million workers contributed $1.2 trillion to the trust funds in 2023. The funds also generated $51 billion from income taxes on benefits and $67 billion on interest.

In 2023, the trust funds that support Social Security ran a deficit, depleting the funds by $41 billion.

The aging population poses a challenge for Social Security, a system designed for — among other purposes — the nation’s workers to support its retirees. The SSA expects the population number of Americans 65 and older to grow 29% from about 58 million in 2022 to about 75 million in 2035.

In May 2024, the SSA projected that the trust funds supporting Social Security could be depleted by 2035 barring any intervention.