Where Data Tells the Story

© Voronoi 2025. All rights reserved.

The IMF recently joined forces with the Global Trade Alert to monitor developments. Our new research shows that there were more than 2,500 industrial policy interventions worldwide last year. Of these, more than two thirds were trade-distorting as they likely discriminated against foreign commercial interests. This data collection effort is the first step toward understanding the new wave of industrial policies.

The recent surge in such measures has been driven by large economies, with China, the European Union, and the United States accounting for almost half of all new measures in 2023. Advanced economies appear to have been more active than emerging markets and developing economies. Data for the past decade are less precise, but the available information shows that the use of subsidies has historically been more prevalent in emerging economies, contributing to large number of legacy measures still in place.

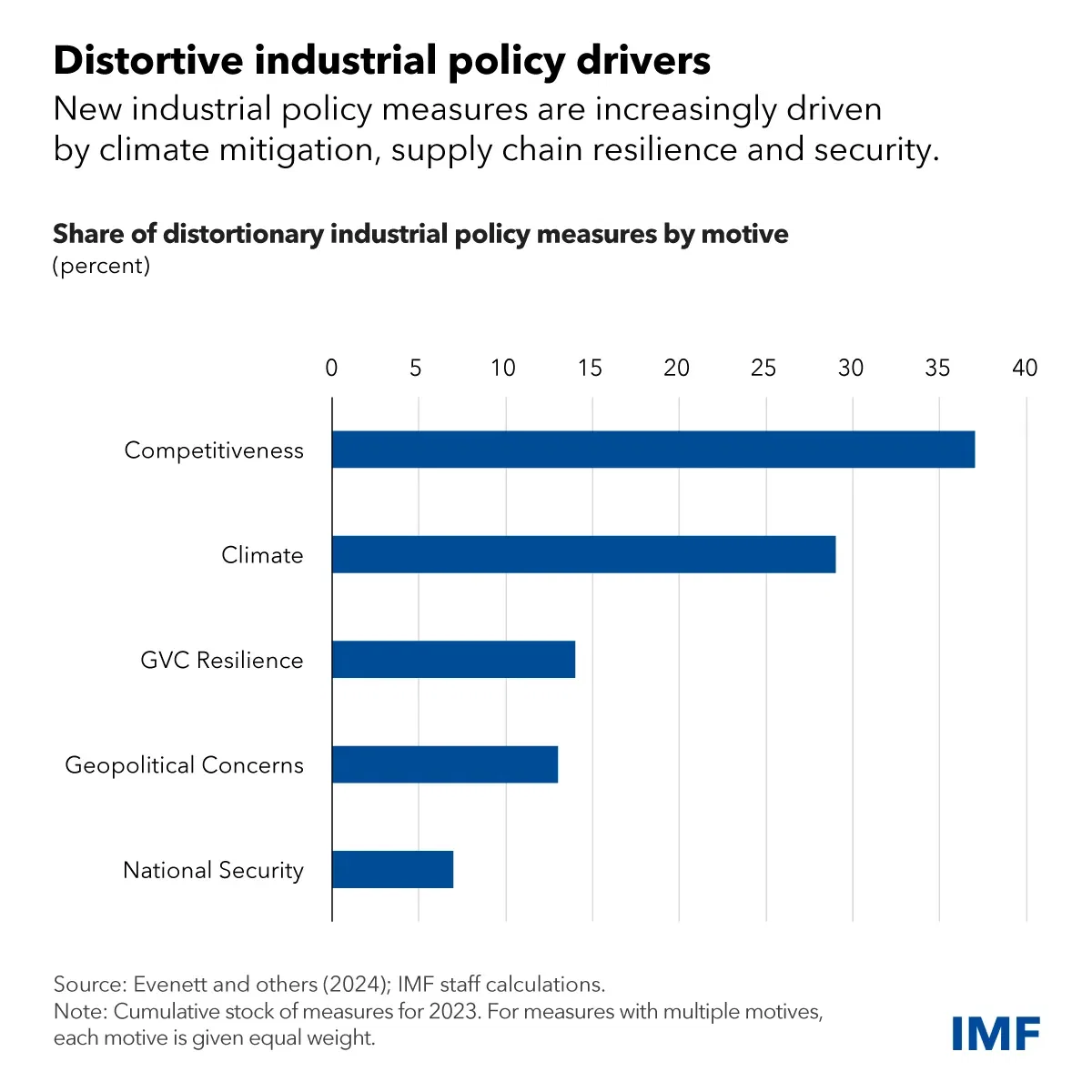

Recent measures focus more on the green transition and economic security, and less on competitiveness. Competitiveness was the objective for one-third of all industrial policy measures last year. The remaining two-thirds were motivated by climate mitigation, supply chain resilience, and security considerations.

Interestingly, the most-active sectors were military-civilian dual use products and advanced technologies, including semiconductors and low-carbon technologies, as well as their components, such as critical minerals.

Industrial policy steers a reallocation of resources toward certain domestic firms, industries or activities that market forces fail to promote in a socially efficient way. To deliver net economic benefits, however, these interventions need to be well-designed, which means they need to be directed to address well-identified market failures, and based on competition-enhancing principles and sound cost-benefit analysis.

See the full blog post here.