Where Data Tells the Story

© Voronoi 2026. All rights reserved.

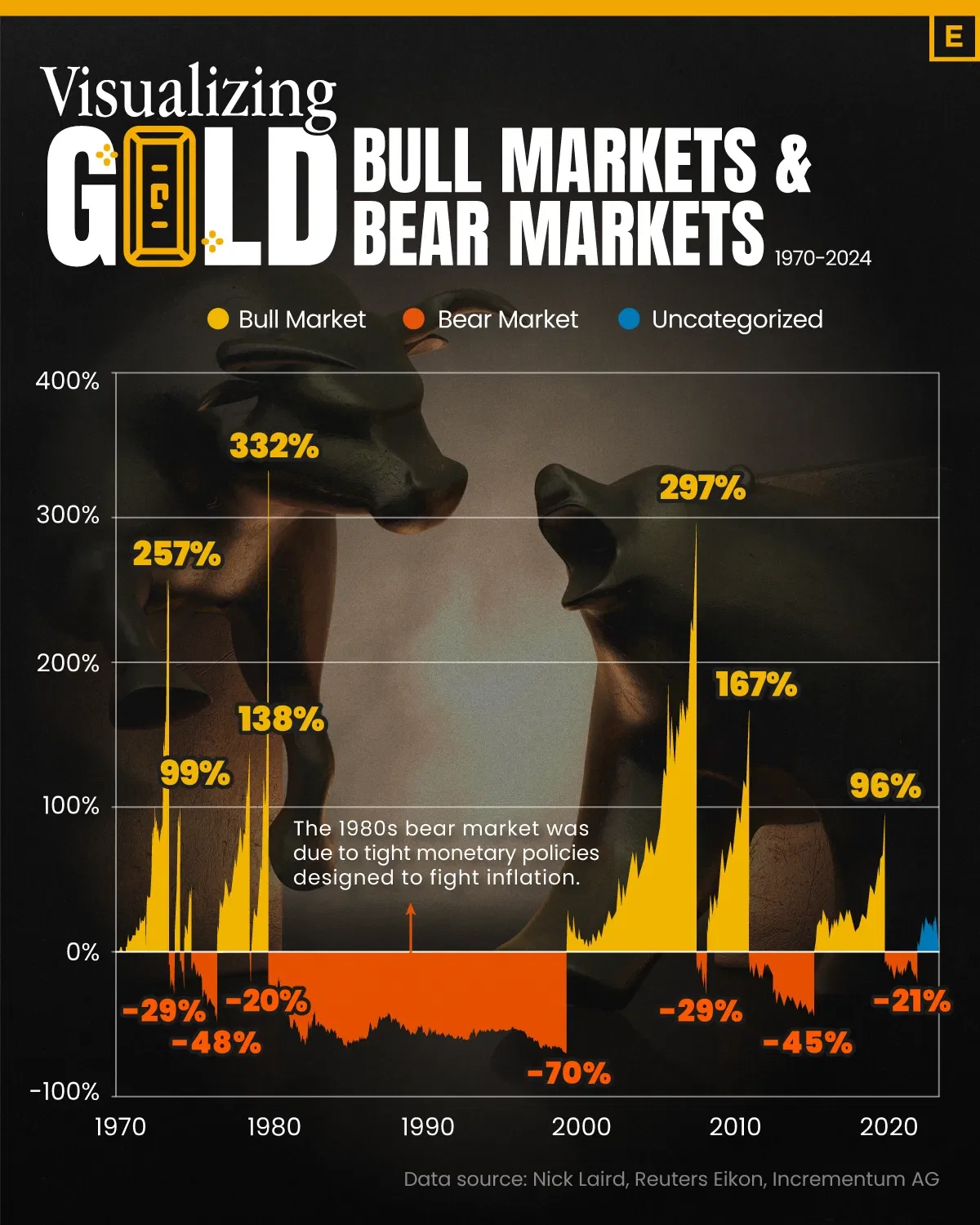

Gold bull and bear markets between January 1970 and March 2024, based on data from Nick Laird, Reuters Eikon, and Incrementum AG.

After a prolonged period of declining prices (bear market) that started in 2020, gold has rebounded, hitting an all-time high in April 2024. In the past, such a movement has signaled the beginning of a bull market.

After decades of declines, central banks' gold holdings have begun to increase, driven by geopolitical risks in the Middle East and Ukraine.

Central banks are significant players in the gold market, holding large reserves of gold as a store of value and a hedge against currency risk.

Furthermore, gold has seen a rise as investors anticipate the Federal Reserve's implementation of three interest rate cuts in 2024. Lower borrowing costs typically benefit gold, which does not bear interest.

With elections occurring in more than 60 countries in 2024, investors are also expected to continue buying gold as a safe haven.