Jan 29, 2026

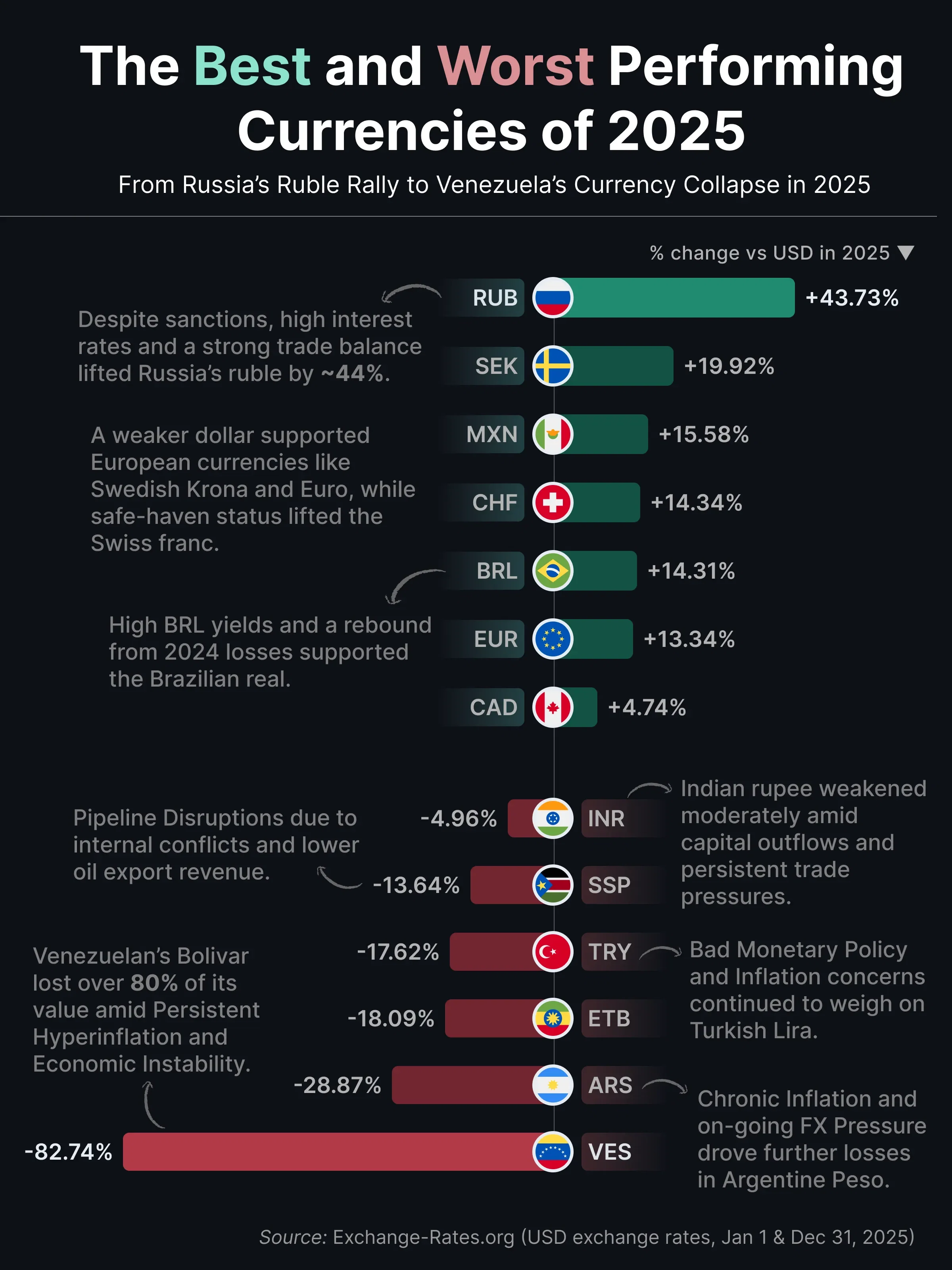

The Best and Worst Performing Currencies of 2025

📊 What this Chart Shows

This visualization highlights the best and worst performing currencies of 2025, measured by their percentage change in value against the U.S. dollar between January 1 and December 31, 2025.

Currency performance in 2025 showed a sharp divide, with a handful of currencies posting strong gains while others suffered steep declines amid inflation, policy uncertainty, and economic instability.

🟢 Currency Winners

- Russia’s ruble was the strongest-performing currency of 2025, rising by nearly 44% against the U.S. dollar despite ongoing sanctions.

- Tight monetary policy, capital controls, and a strong trade balance helped support the currency.

- European currencies posted moderate gains, including the Swedish krona, euro, and Swiss franc, as U.S. dollar momentum weakened.

- The Swiss franc also benefited from its long-standing safe-haven status.

- Latin American currencies such as the Mexican peso and Brazilian real outperformed, supported by high interest rates, carry-trade demand, and a rebound from losses in 2024.

- The Canadian dollar saw modest gains, reflecting relatively stable economic conditions.

🔴 Currency Losers

- Venezuela’s bolívar experienced the steepest collapse, losing over 80% of its value amid persistent hyperinflation and prolonged economic instability.

- Argentina’s peso continued to decline, weighed down by chronic inflation and ongoing foreign exchange pressures.

- Turkey’s lira weakened further, as inflation concerns and loose monetary policy undermined investor confidence.

- Ethiopia’s birr declined sharply, reflecting foreign exchange shortages and broader economic strain.

- South Sudan’s pound fell by around 14%, impacted by internal conflict, pipeline disruptions, and reduced oil export revenues.

- India’s rupee weakened moderately, driven by capital outflows and persistent trade imbalances rather than a sudden economic shock.

🔑 Key Takeaways

- Currency losses in 2025 were far more extreme than gains, highlighting the asymmetric nature of currency risk.

- High interest rates and tight policy frameworks helped support stronger-performing currencies.

- Inflation and weak economic fundamentals remained the primary drivers of severe currency depreciation.

- A softer U.S. dollar amplified both gains and losses across global currencies.

📌 Data & Methodology

- Metric: Percentage change in currency value vs U.S. dollar

- Period: January 1 to December 31, 2025

- Source: Exchange-Rates.org (USD exchange rates)