Where Data Tells the Story

© Voronoi 2026. All rights reserved.

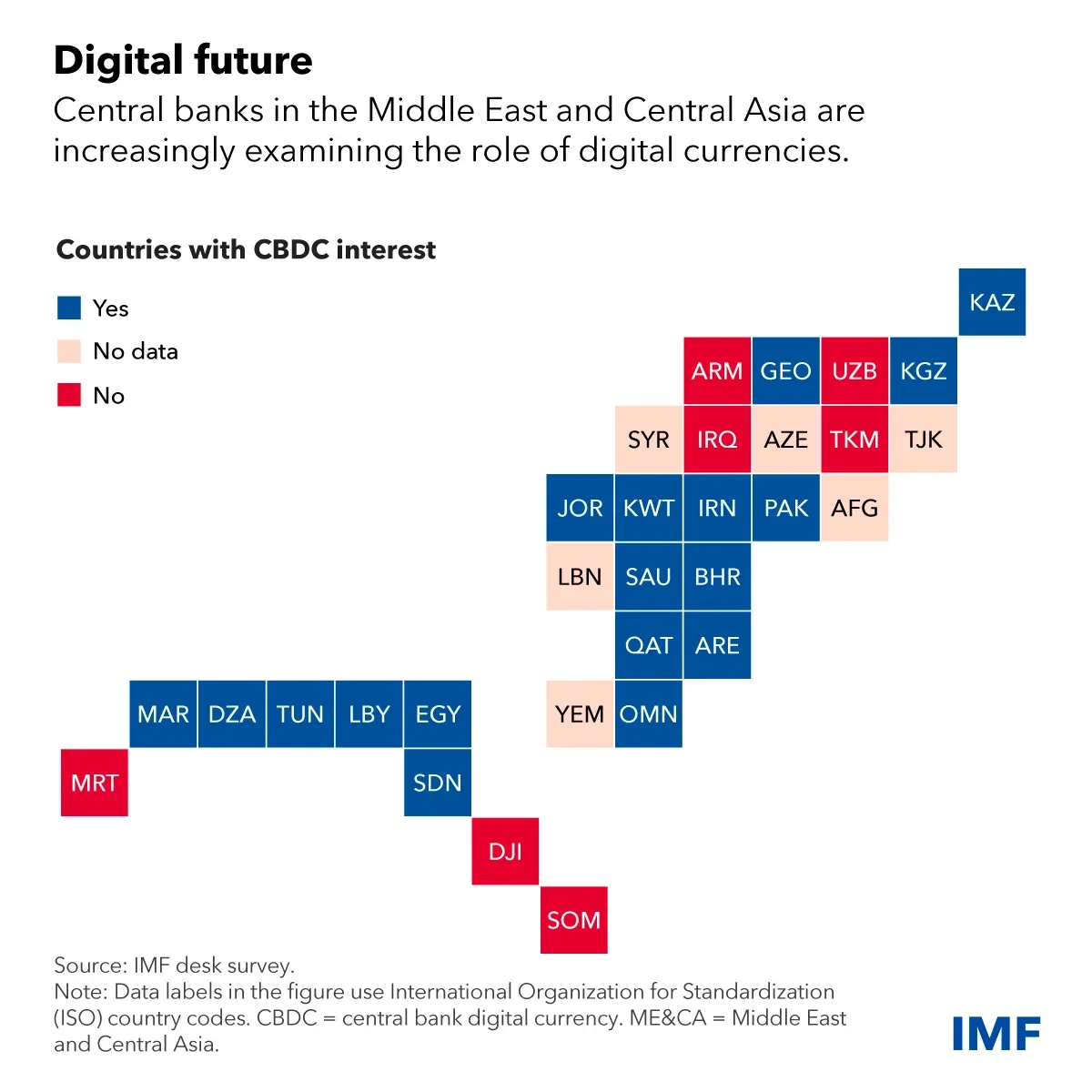

Almost two-thirds of countries in the Middle East and Central Asia are exploring adopting a central bank digital currency as a way to promote financial inclusion and improve the efficiency of cross-border payments.

Adopting a CBDC, however, requires careful consideration. Countries across these regions, spanning a diverse group of economies stretching from Morocco and Egypt to Pakistan and Kazakhstan, each must weigh their own unique set of circumstances.

Many of the 19 countries currently exploring a CBDC are at the research stage. Bahrain, Georgia, Saudi Arabia, and the United Arab Emirates have moved to the more advanced “proof-of-concept” stage. Kazakhstan is the most advanced after two pilot programs for the digital tenge.

CBDCs can potentially help improve the efficiency of cross-border payment services. This appears to be an important priority for oil exporters and the Gulf Cooperation Council countries of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates. That’s because cross-border payments tend to have frictions like varying data formats and operating rules across regions and complex compliance checks. CBDCs that address these inefficiencies could significantly cut transaction costs.

Some countries have already introduced cross-border technology platforms to address these issues and promote digital currency payments between countries. One example is the Buna cross-border payment system, created by the Arab Monetary Fund in 2020.

See the full article here.