Where Data Tells the Story

© Voronoi 2026. All rights reserved.

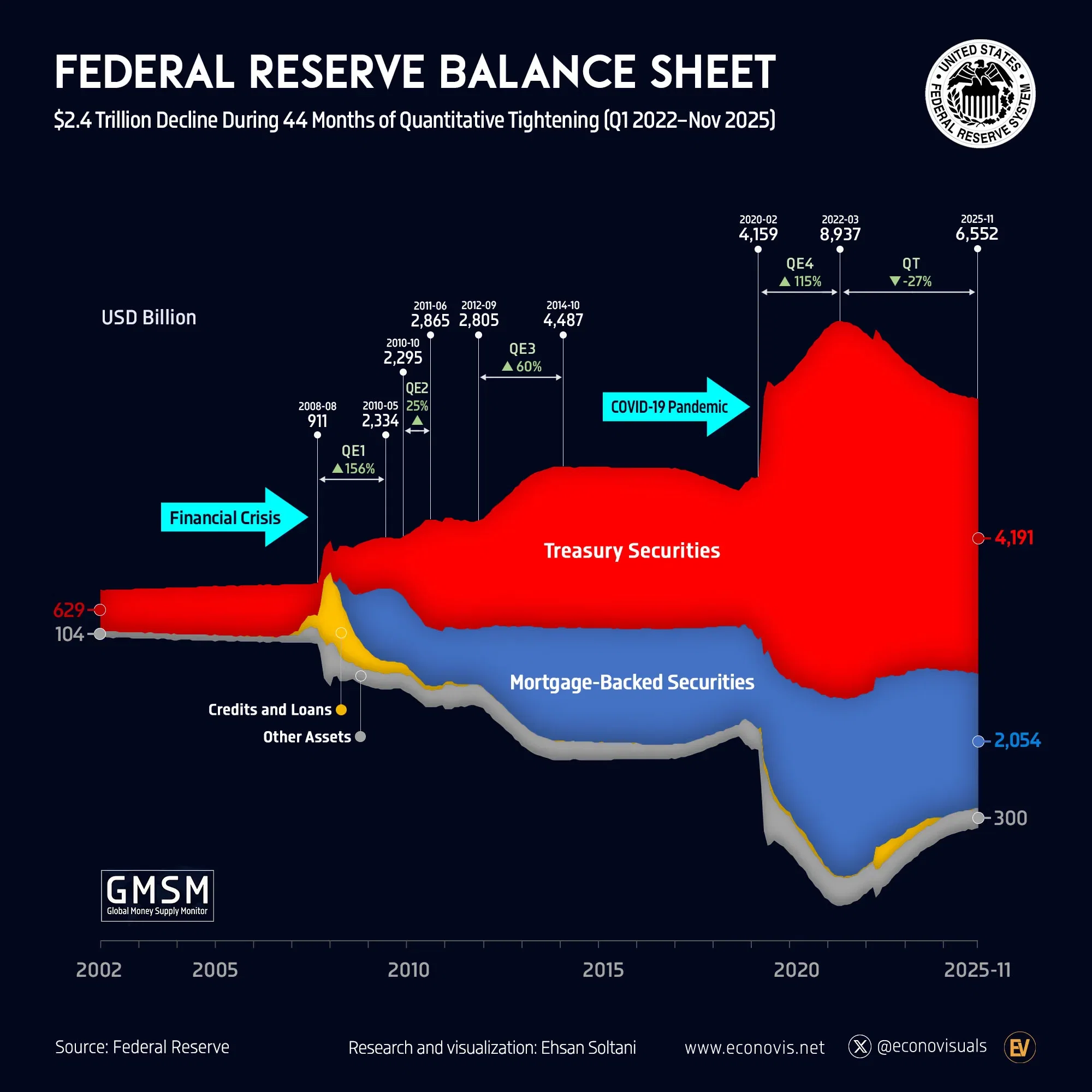

Following the extraordinary expansion during the COVID-19 crisis — when the Federal Reserve more than doubled its balance sheet from $4.16 trillion in February 2020 to a peak of $8.94 trillion in March 2022 — the Fed embarked on a sustained period of quantitative tightening beginning in Q1 2022.

Over the subsequent 44 months, total assets declined by $2.38 trillion (–26.7%), reaching $6.55 trillion by November 2025. Treasury securities accounted for the bulk of the reduction, falling by $1.56 trillion (–27.1%) and representing roughly two-thirds of the overall contraction. Mortgage-backed securities (MBS) fell by $0.62 trillion (–22.7%) over the same period.

By November 2025, the pace of balance sheet runoff had moderated, with the year-over-year decline slowing to 5.1%, signaling a gradual easing in the contraction phase.