Where Data Tells the Story

© Voronoi 2026. All rights reserved.

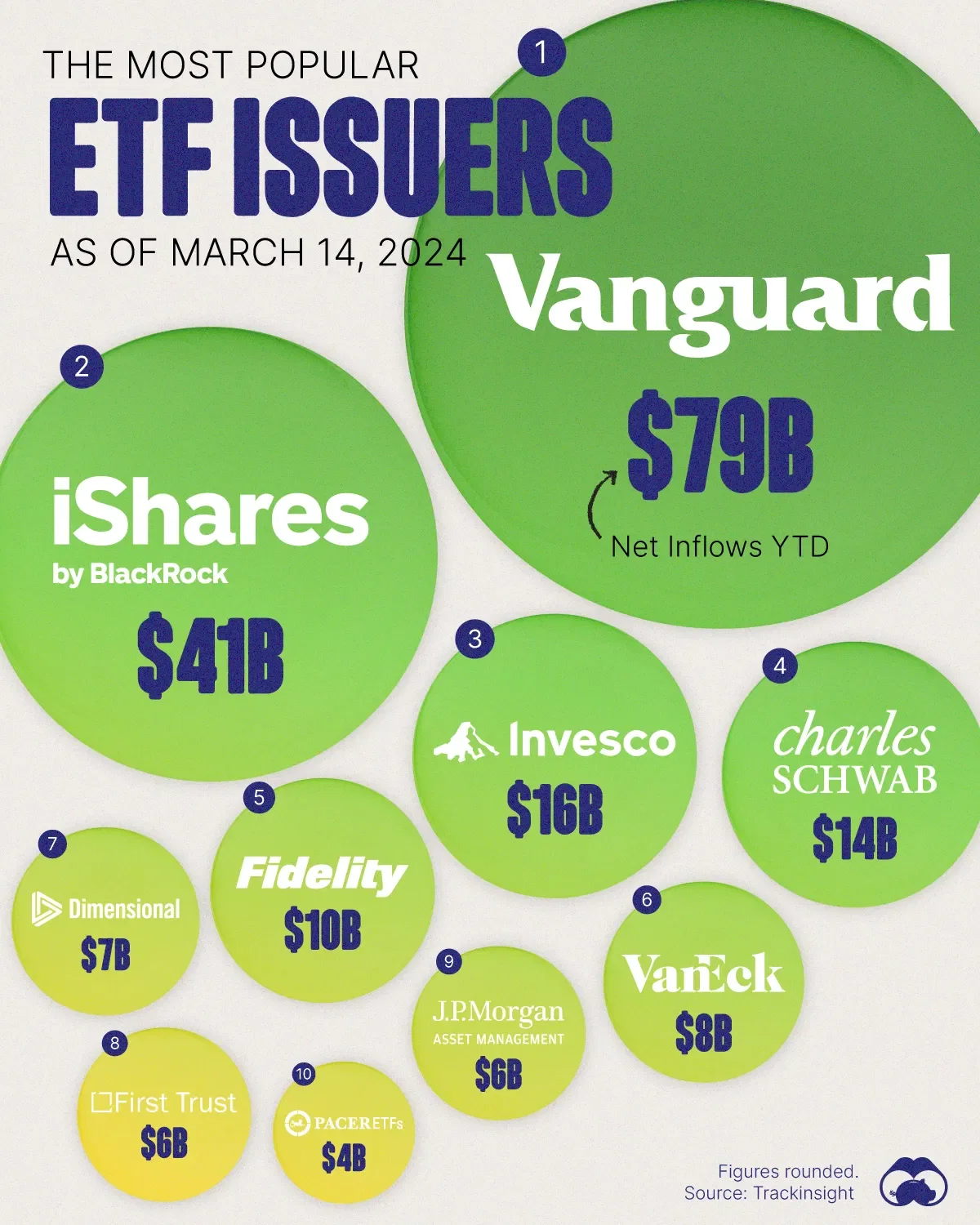

The top 10 ETF issuers, ranked by the net inflows they have attracted YTD in 2024. This data comes from Trackinsight, and is as of March 14.

Vanguard seems to be the top choice for investors so far in 2024. The firm’s largest ETF by assets under management (AUM) is the Vanguard S&P 500 ETF (VOO), which tracks the S&P 500 index.

As of Feb 29, 2024, VOO had $1.1 trillion in net assets.

Pacer ETFs is a relatively small player in the U.S. ETF industry. It’s largest and fastest growing ETF is the Pacer US Cash Cows 100 ETF, which provides exposure to companies that have the highest free cash flow within the Russell 1000 index.

Free cash flow is the money remaining after a company has paid expenses, interest, taxes, and long-term investments. This cash can be used for various things, like paying dividends or buying back stock.