Where Data Tells the Story

© Voronoi 2025. All rights reserved.

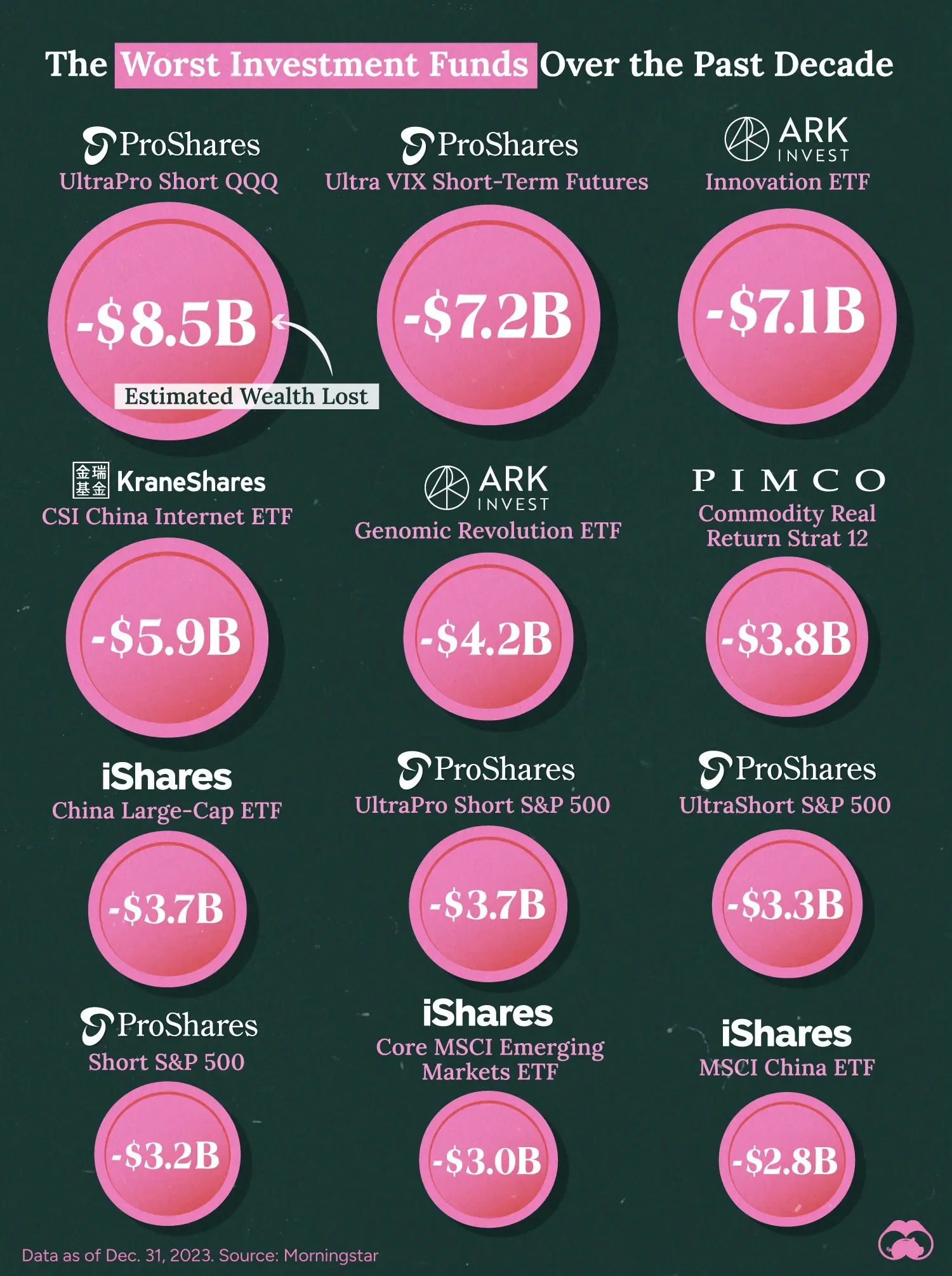

The 10 worst investment funds over the past decade, as of Dec. 31, 2023. This ranking comes from Morningstar, and is based on the amount of shareholder wealth lost.

The U.S. stock market has been in a long-term upward trend since 2009, meaning funds that short major indices like the S&P 500 and Nasdaq 100 have largely suffered over the 10-yr period.

Seeing the heaviest losses is the ProShares UltraPro Short QQQ, which seeks daily investment results that correspond to three times the inverse (-3x) of the daily performance of the Nasdaq-100.

While these funds are most likely unsuitable for a long-term buy and hold strategy, they can be profitable during downturns. One example would be the COVID-19 crash on March 12, 2020, where the S&P 500 fell by 12%.

Another common theme from this ranking are China-focused funds such as the KraneShares CSI China Internet ETF (KWEB).

Since their 2021 peak, Chinese stocks have lost over $6 trillion in market cap. This has been due to various reasons, including a sluggish COVID-19 recovery, a troubled real estate market, and alarming crackdowns on tech firms by government officials.