Where Data Tells the Story

© Voronoi 2026. All rights reserved.

Today, there is roughly $5.7 trillion in commercial real estate debt outstanding—with U.S. banks holding approximately half of this total on their balance sheets.

The commercial property sector, which includes office, retail, healthcare, and multifamily properties, has faced mounting pressures amid high interest rates and lower occupancy levels. Given these headwinds, it poses the risk of higher defaults and steep loan losses in a sector that has not fully recovered since the collapse of Silicon Valley Bank last year.

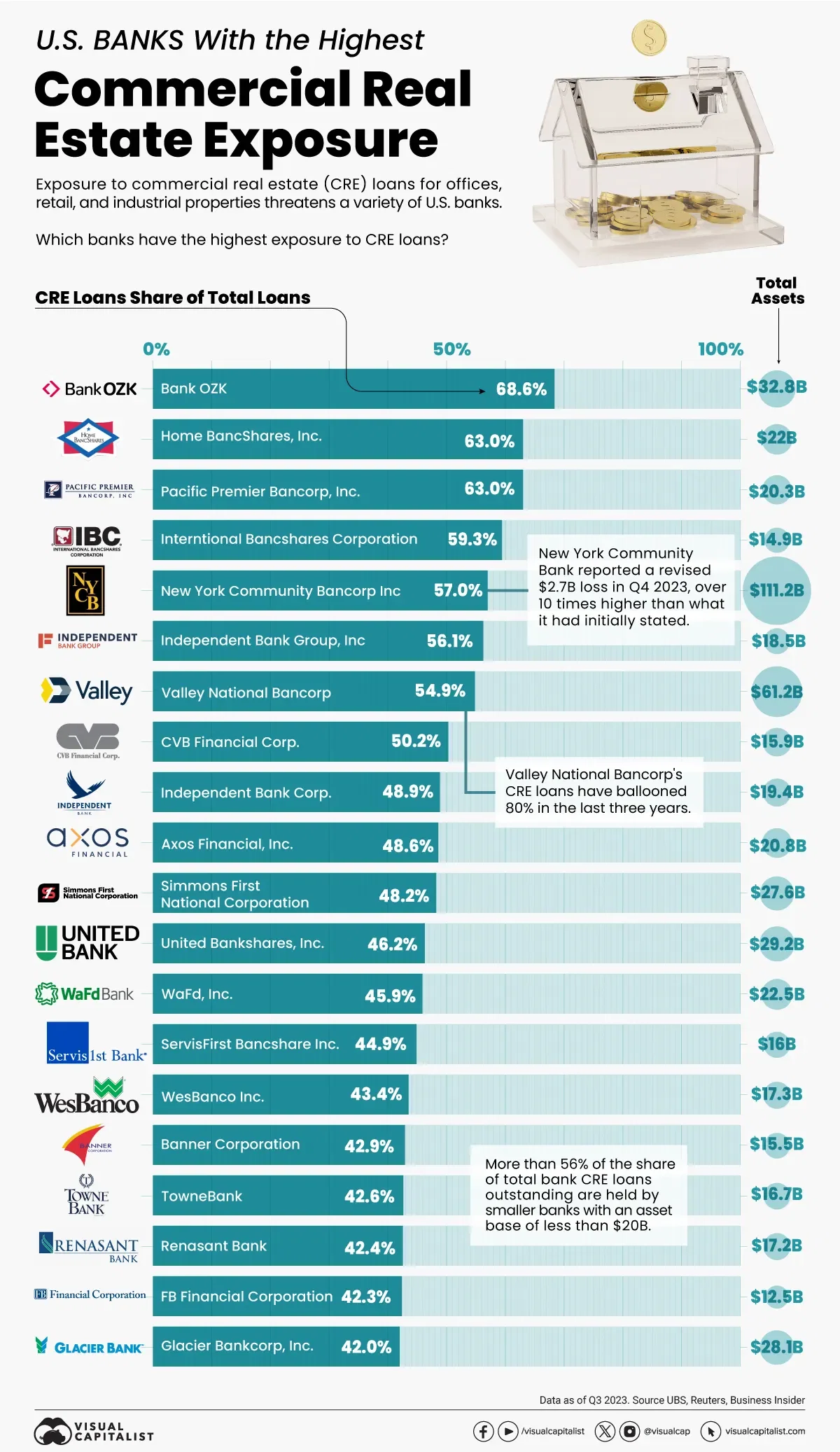

This graphic shows the U.S. banks with the highest exposure to the commercial real estate sector, based on analysis from UBS.

As the above table shows, the vast majority of banks with the greatest exposure are small and medium-sized financial institutions.

Bank OZK, based in Arkansas, has the highest proportion of commercial property loans, at 68.6% of total loans. As one of the country’s most prominent lenders to Manhattan property developers, its share price has outperformed the S&P 500 by tenfold since going public 27 years ago.

New York Community Bancorp, the only big bank on the list, has $49 billion in commercial property loans, making up 57% of its overall loans. At the height of regional banking turmoil last year, one of New York Community Bancorp’s subsidiaries took over the failed Signature Bank in a multi-billion dollar deal.

Since the bank reported $2.7 billion in losses in the fourth quarter of 2023, its share price has plummeted roughly 68%. The surprise loss—which was revised from $252 million—prompted the bank to seek a $1 billion lifeline from investors to help shore up confidence in the institution. Former U.S. Treasury Secretary Steven Mnunchin was a major investor in the deal.

Like New York Community Bancorp, a number of other regional banks have seen their share prices lag due to its fallout.

With 56.1% of all commercial property loans, small U.S. banks face the highest risk compared to other bigger banks.

Given the high share of loans, banks may run the risk of failure especially if credit losses accelerate and valuations decline. At the same time, it could be more challenging to refinance debt as valuations deteriorate.

While these troubles have begun to emerge over the last year, there is also the likelihood that losses could continue over the next several years. In fact, after the global financial crisis, credit losses peaked two years after delinquencies hit their highest point.