Where Data Tells the Story

© Voronoi 2026. All rights reserved.

Modern lithium-ion batteries, prevalent in electric vehicles (EVs) and electronic devices, utilize lithium compounds rather than pure lithium metal. These batteries typically incorporate lithium in various forms such as lithium cobalt oxide (LCO), lithium manganese oxide (LMO), lithium iron phosphate (LFP), lithium nickel manganese cobalt oxide (NMC), or lithium nickel cobalt aluminum oxide (NCA), among other formulations.

The cathode, typically composed of lithium and other battery metals such as nickel, cobalt, and manganese, accounts for around 40% of the cost of a lithium-ion battery pack. According to a visualization published by Visual Capitalist, the cost of a new lithium-ion battery pack ranges from $6,895 to $25,853 (equivalent to 14% to 32% of the car price).

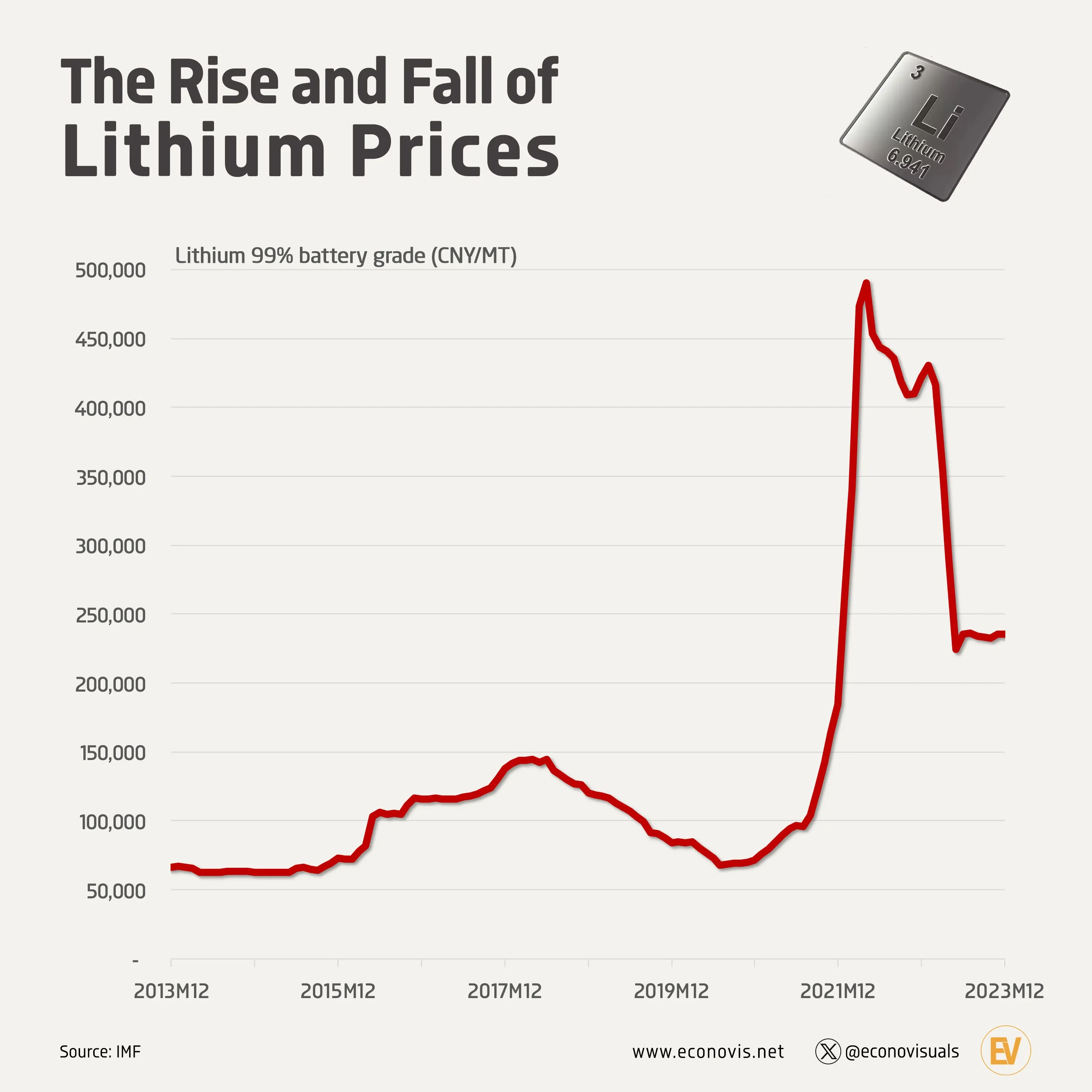

The price of lithium metal, graded at 99% purity for battery use, averaged 103,000 CNY/MT in 2019. It then decreased to 75,000 CNY/MT in 2020 before rising again to 111,000 CNY/MT in 2021. In 2022, the price soared to an average of 417,000 CNY/MT, reaching a peak of 490,000 CNY/MT in April. However, the price declined in the first half of 2023, reaching approximately 235,000 CNY/MT in the fourth quarter of the same year.

Several factors contributed to the surge in lithium prices in 2022. These factors include increased demand stemming from the growing popularity of electric vehicles (EVs), supply chain constraints, technological advancements leading to greater lithium usage in batteries, investment speculation, and geopolitical factors.

The demand for lithium metal is still significant as it is a key raw material for producing these lithium compounds. As the electric vehicle market continues to grow and battery technologies evolve, the demand for lithium is expected to remain strong.