Where Data Tells the Story

© Voronoi 2026. All rights reserved.

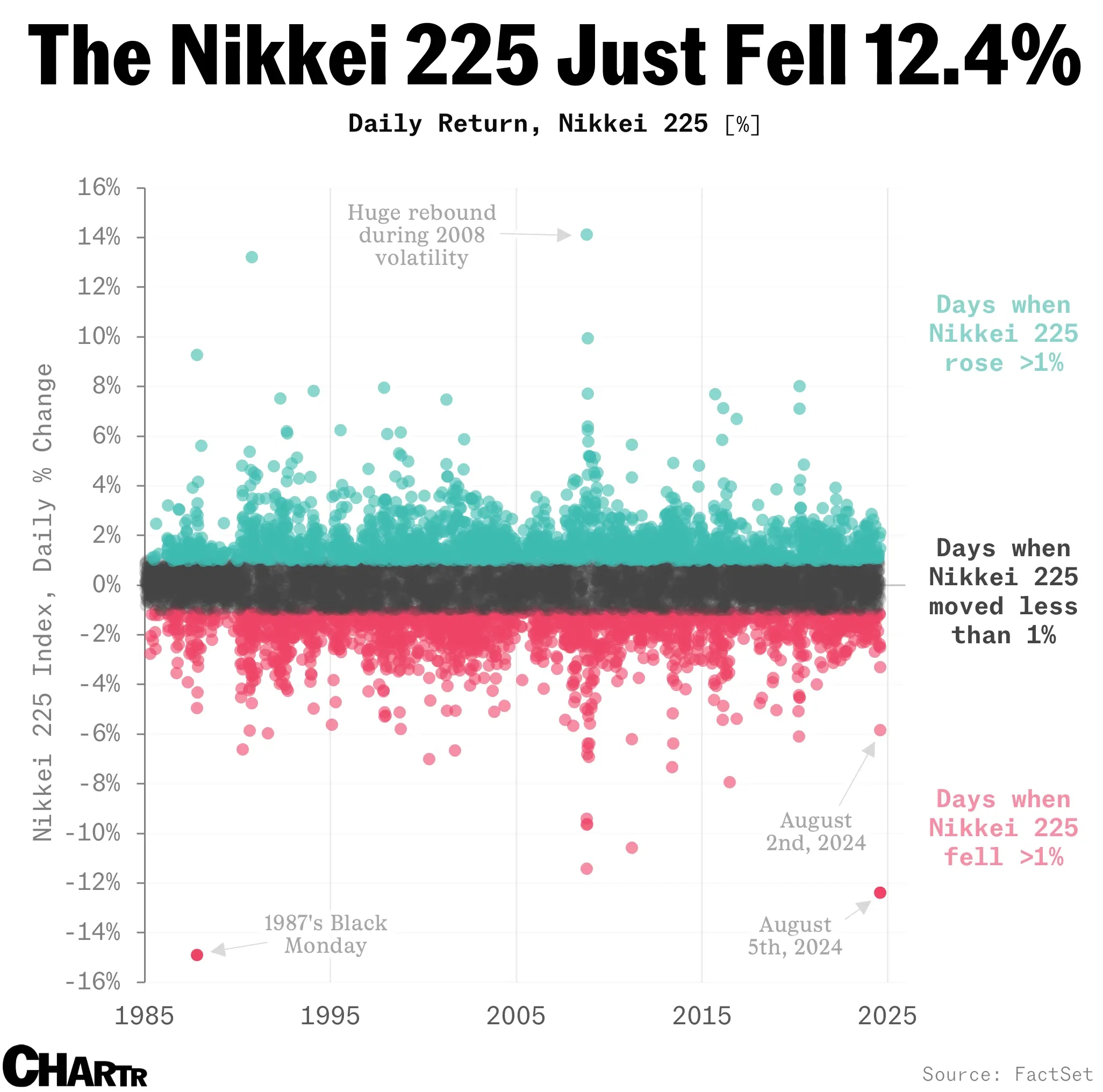

Most notable of this morning’s flashing red charts is that of the Nikkei 225, Japan’s flagship index, which has closed down 12.4%, its worst one-day showing since 1987. That’s a remarkable decline when you consider all that has happened in that time: Japan’s asset bubble bursting in the early 1990s, the dot-com crash, earthquakes, the global financial crisis, nuclear meltdowns, and COVID-19. It builds on the nearly 6% decline seen on Friday, which means that those two days have now wiped out all of the gains — and then some — that the index had notched in 2024.

A rapid appreciation in the Japanese Yen against the US Dollar appears partly to blame for the Nikkei 225’s outsized decline, as investors unwind the “carry trade” which had seen investors borrow in Japan, where interest rates have been very low, and re-invest elsewhere. Last week’s rate hike from the Bank of Japan turned that trade on its head.

See the full article here.