Where Data Tells the Story

© Voronoi 2026. All rights reserved.

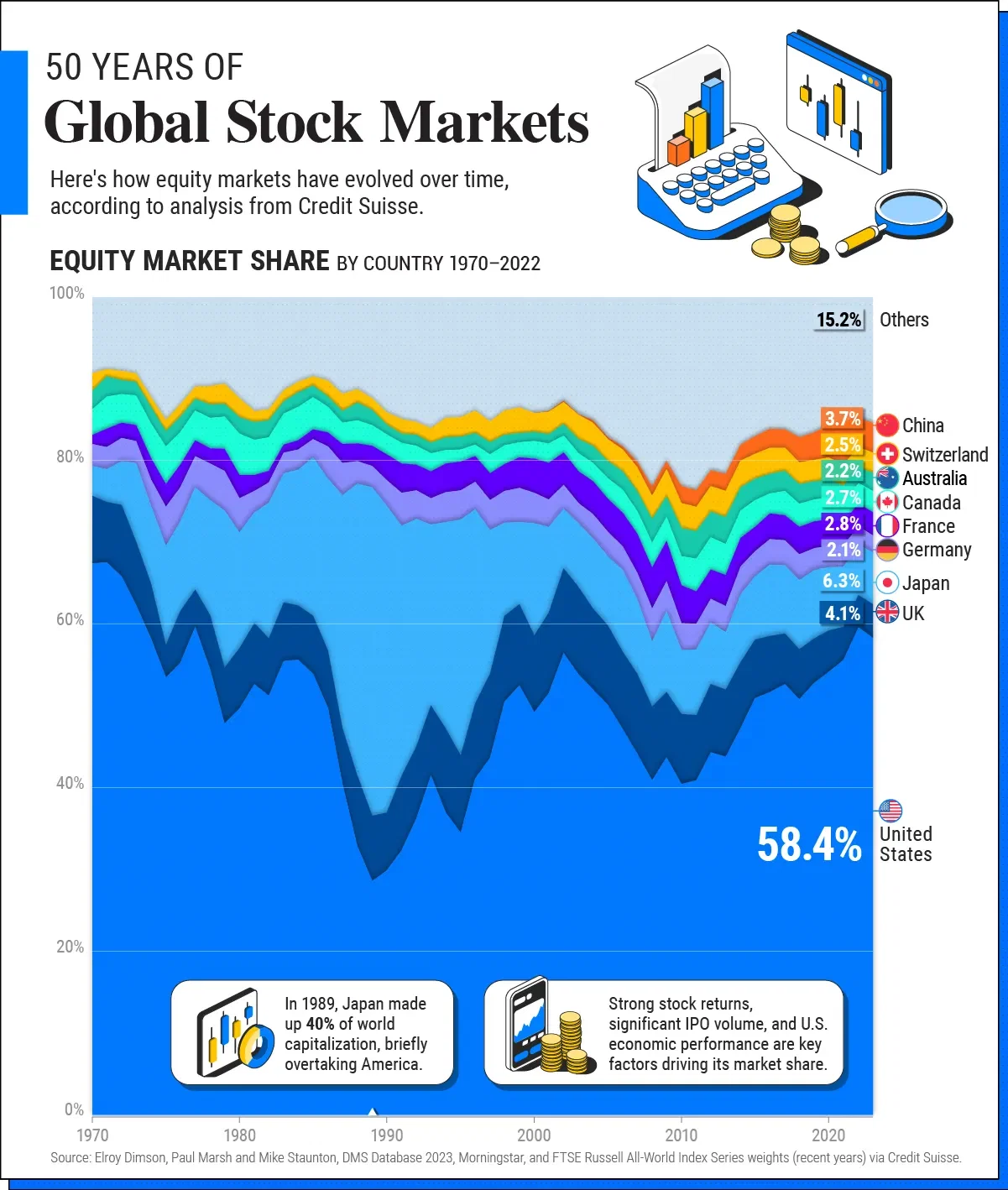

For decades, the U.S. has firmly remained the world’s financial power.

But how long will this continue, and what factors could underscore a new shift? To look at the role of the U.S. in the broader financial system, this graphic shows 50 years of global stock markets, with data from Credit Suisse.

After the U.S., the next largest stock market is Japan, at 6.3% of the global market share. For a brief period in 1989, it overtook the U.S. when the Nikkei hit an all-time high following supercharged economic growth. However, after its subsequent crash and “lost decades”, it would take 33 years for Japan’s stock market to recover to those same highs.

Why is America’s influence over global stock markets unrivaled?

The dollar’s status as a reserve currency plays a central role, along with the depth of its financial markets. Its economic, political, and military strength are other important factors.

America’s stock market returns have also outperformed nearly all other countries since 1900, attracting investors both domestically and abroad.

While American “declinism” has become a cliche, countries have risen and fallen over history. In the early 19th century, Britain’s publicly held debt soared from 109% of GDP in 1918 to roughly 200% by 1934. By around this time, its economic output had been exceeded by America, Germany, and the Soviet Union.

While there are key differences between the U.S. and Britain at that time, history suggests that balances in military power, debt, and economic dominance were key variables in the rise and decline of financial powers.