Where Data Tells the Story

© Voronoi 2026. All rights reserved.

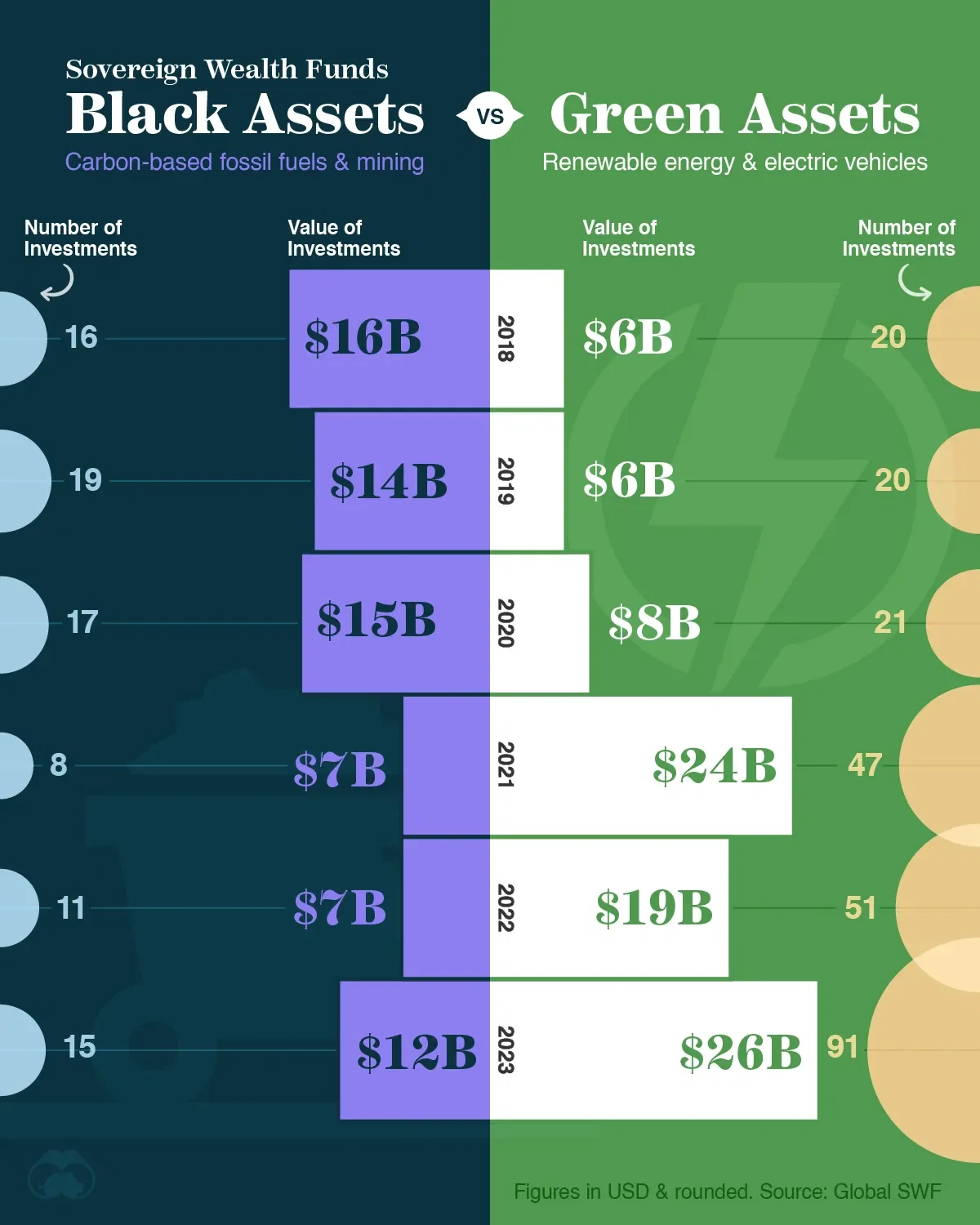

The amount that sovereign wealth funds (SWFs) have invested in black and green assets over the past 6 years. This data comes from Global SWF's 2024 report.

A sovereign wealth fund is a pool of a country's savings invested for future generations or economic stability.

Black assets include finite resources such as fossil fuels and mined materials. This data shows a clear decline in SWF investment in 2021 and 2022, but a slight uptick in 2023.

Green assets, on the other hand, have attracted significantly more investment over the past 3 years. This may have been driven by pressure to accelerate the transition to renewable energy post-COVID.

SWFs that made big commitments in 2023 include Singapore-based GIC and Temasek, with the former deploying $3.2B into the green energy sector.

Elsewhere, Saudi Arabia's Public Investment Fund (PIF) has provided billions in capital to Tesla-rival Lucid. as well as founding Ceer, the first Saudi EV brand.