Where Data Tells the Story

© Voronoi 2026. All rights reserved.

Although we wish it would, splitting a pizza into 6, 8, or 10 slices doesn’t change how much food you’ve got: it just changes how unwieldy the food is to eat. Stocks are similar. Most companies try to split their equity ownership into slices that aren’t too big or too small, usually in the tens or hundreds of dollars, to appeal to as wide a range of investors as possible.

Indeed, numerous companies do stock splits to arbitrarily lower their stock price. Tesla did a 3-for-1 split in August 2022, Walmart announced one in January of this year, and high-flying Nvidia did a 10-for-1 split in June. Berkshire has never split its Class A shares… which is why buying one will set you back some $660,000 and change.

That strategy has attracted shareholders who align more with Buffett and co.’s longer term strategy and thinking. But, as Berkshire’s share price climbed into the many tens of thousands and beyond, people floated the idea of creating entities that “would hold nothing but Berkshire stock, and then parcel out its own shares in smaller denomination pieces to the public” — a potential arrangement that Buffett saw as ripe for abuse. So, in 1996, Berkshire created the Class B share, which is currently worth 1/1,500th of the Class A.

But, if you decide to invest in BRK.B, what are you really buying?

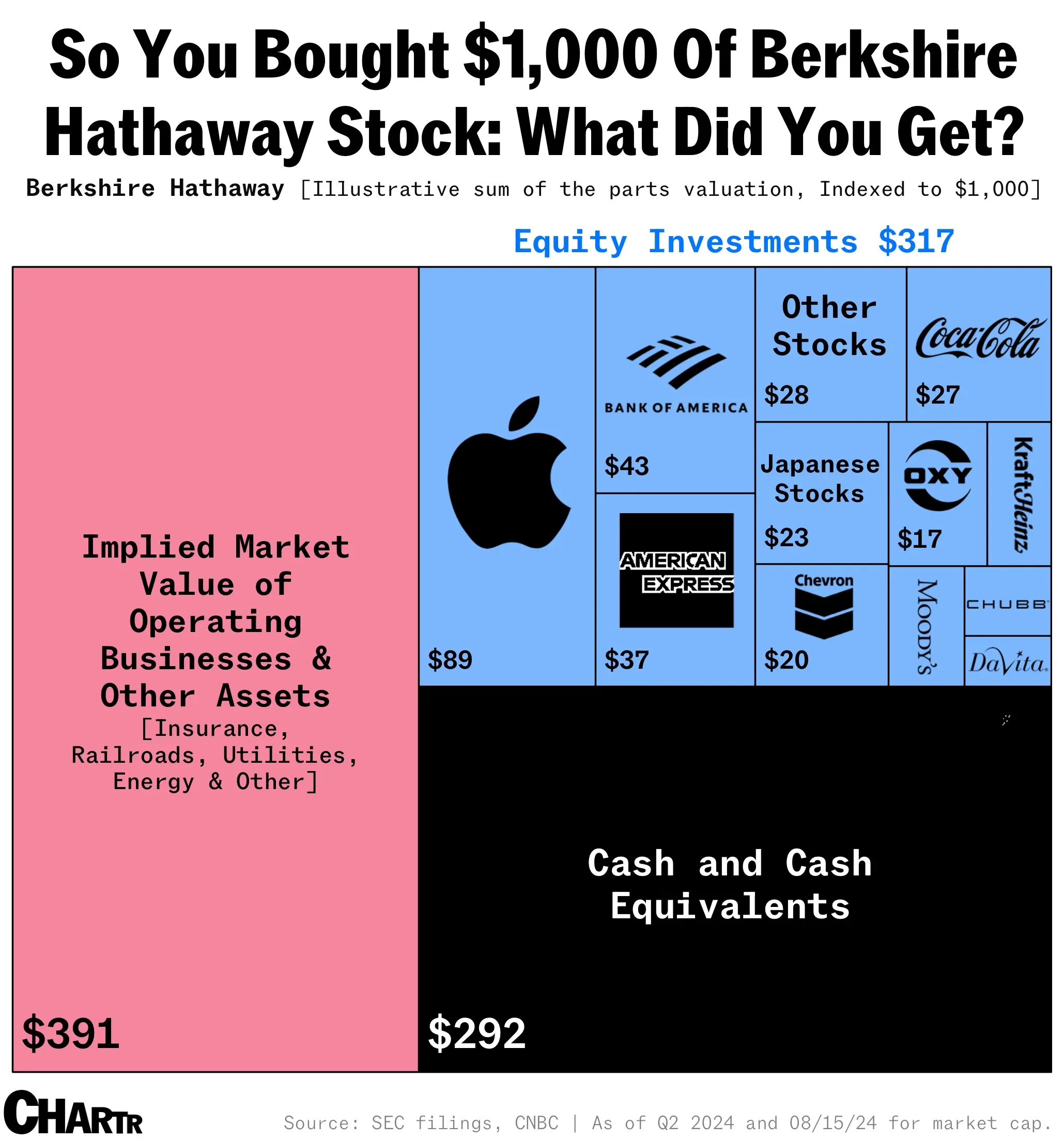

Well, for starters, Berkshire now has more cash than ever, some $277 billion worth at the end of Q2. Taking that at face value (assuming no holding company discounts), that’s roughly 30% of the company’s market value. So $292 of our $1,000 hypothetical investment in our example is just cash.

Next up is the company’s stock portfolio. An updated 13F filing from Wednesday reveals that — again assuming no conglomerate discount — it’s worth about $317 out of our $1,000. That implies that the rest of the business, primarily Berkshire’s actual operating divisions, is worth the remainder, or some $391 in our example. So if you’re buying Berkshire you’re getting exposure to: a bunch of iconic American stocks, some Japanese equities, cash, some railroads, insurance companies, and energy assets. Oh, and Dairy Queen and Duracell, which Berkshire also owns.

See the full article here.