Where Data Tells the Story

© Voronoi 2026. All rights reserved.

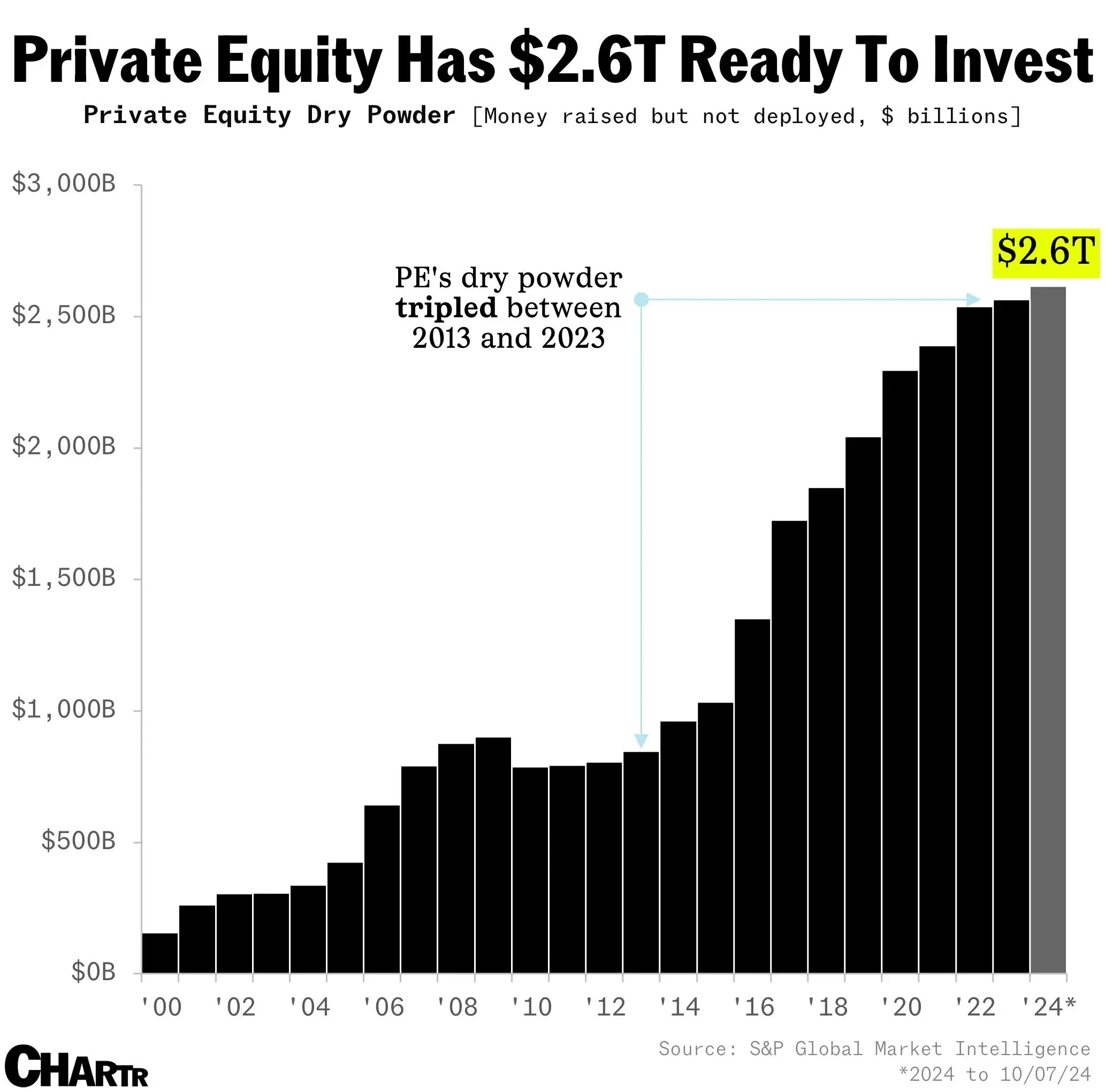

according to data compiled by S&P Global, private equity and venture capital funds currently hold a record $2.6 trillion in uncommitted capital, often referred to as "dry powder".

This enormous sum is burning a hole in the pockets of some firms. After convincing investors to entrust them with their money, which many PE shops did very successfully during massive fundraising efforts in 2020-2021, they then have to actually do something with it — people don’t typically like paying management fees while their money is parked on the sidelines.

See the full article here.