Where Data Tells the Story

© Voronoi 2025. All rights reserved.

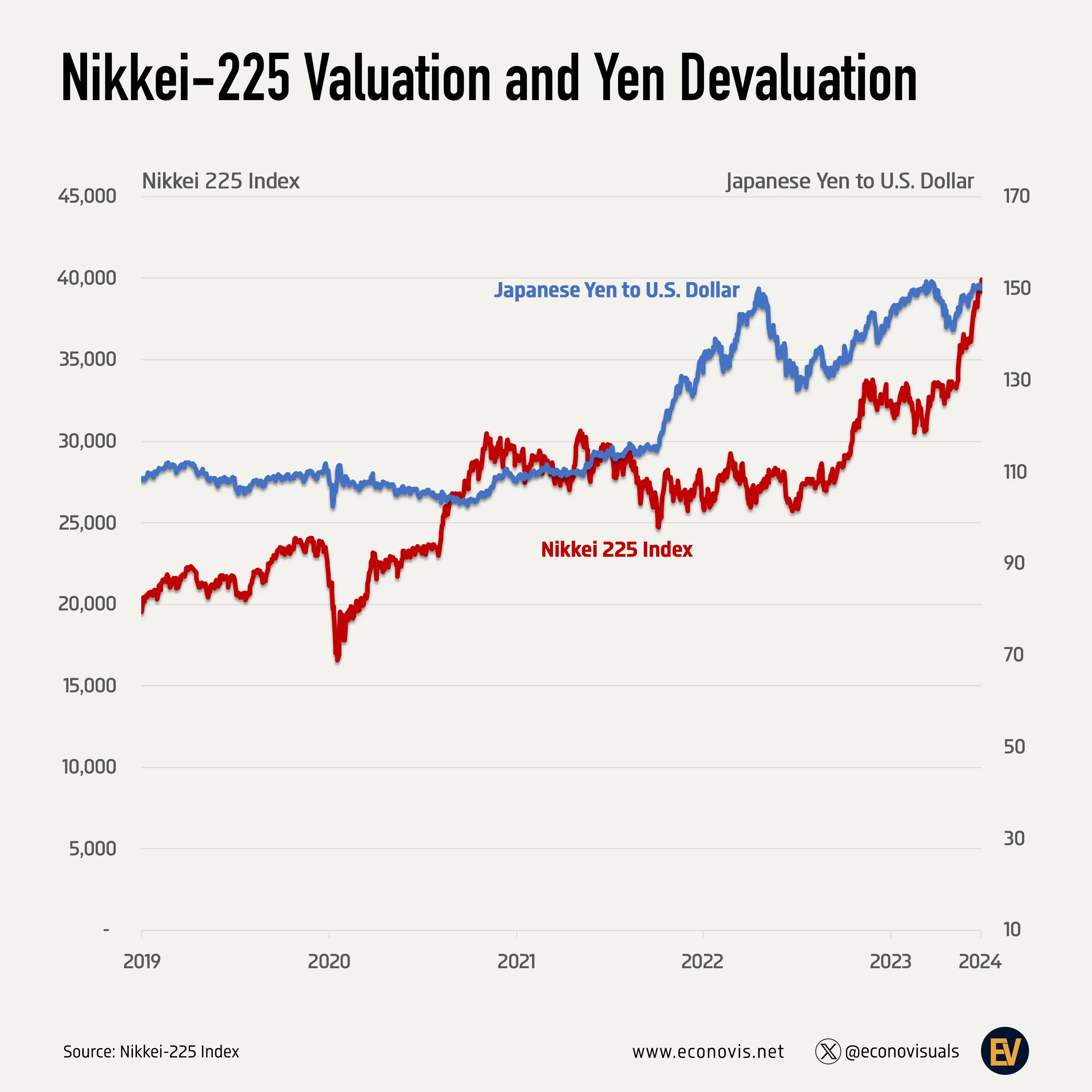

A weakening yen, often termed as devaluation, typically exerts a positive influence on the Nikkei-225 index.

A depreciation of the yen renders Japanese stocks more appealing to foreign investors, enabling them to acquire more shares with the same amount of their home currency. This heightened demand tends to drive up stock prices.

Given that many companies listed on the Nikkei-225 are exporters, a weaker yen translates to cheaper prices for foreign buyers purchasing their products. This dynamic can result in increased sales and profits for Japanese firms, subsequently elevating their stock prices.

However, it's important to recognize that the relationship between the yen and the Nikkei-225 index is nuanced and subject to various factors such as global economic conditions, domestic monetary policy, and geopolitical events. Moreover, while a weakening yen may initially bolster stock prices, prolonged currency depreciation may raise concerns regarding inflation and other economic challenges, potentially eroding investor confidence and adversely affecting the Nikkei-225 index.