Where Data Tells the Story

© Voronoi 2026. All rights reserved.

What We’re Showing

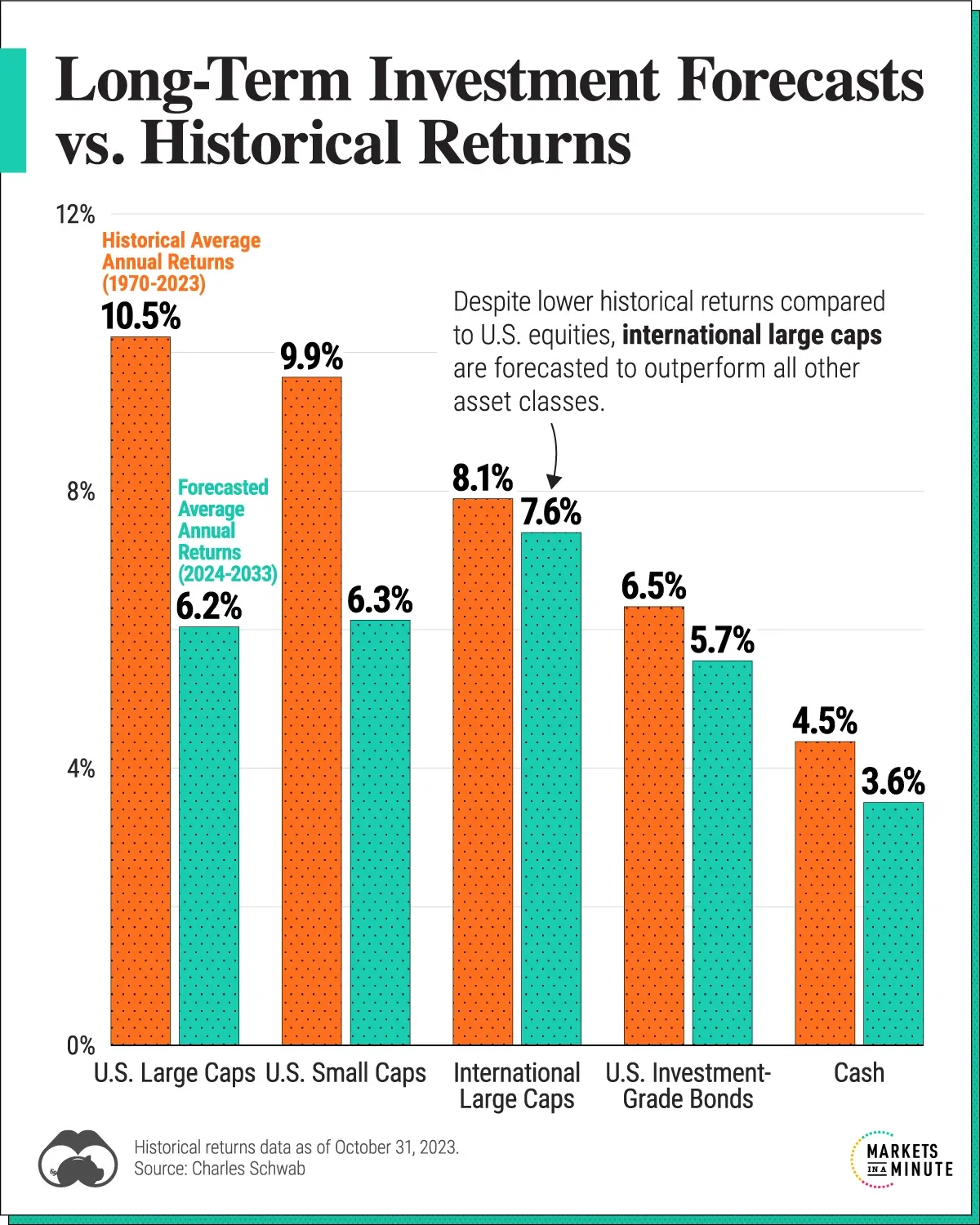

Average annual return projections for different asset classes over a 10-year horizon compared to their historical average annual return from 1970 to 2023, using data and forecasts from the 2024 Charles Schwab Long-Term Capital Market Expectations Outlook.

Key Takeaway

International large cap equities are projected to outperform U.S. large caps over the next decade, driven by their attractive valuations and higher dividend yields.

Between 2024 and 2033, average annual returns are expected to be 7.6% for international large cap stocks.

Subdued Growth for U.S. Large-caps

While domestic stocks have historically seen stronger returns, growth prospects are dampened by elevated valuations in an extended higher-rate environment.

Given that U.S. large cap stock prices are quite high currently, Charles Schwab believes there is less room for return appreciation.

U.S. large caps are projected to return 6.2% on average annually through to 2033, much lower than the 10.5% average since 1970.

Brighter Outlook for Bonds

The ‘higher for longer’ stance by the Fed is favorably impacting bonds, especially those with longer maturities.

Over the next decade, investment-grade bonds are poised to deliver 5.7% annual returns, underpinned by the anticipation of higher interest rates driving up bond yields.

Long-term bonds particularly stand to benefit in this scenario, as they typically offer higher yields given the increased risk for holding them over extended periods.