Where Data Tells the Story

© Voronoi 2026. All rights reserved.

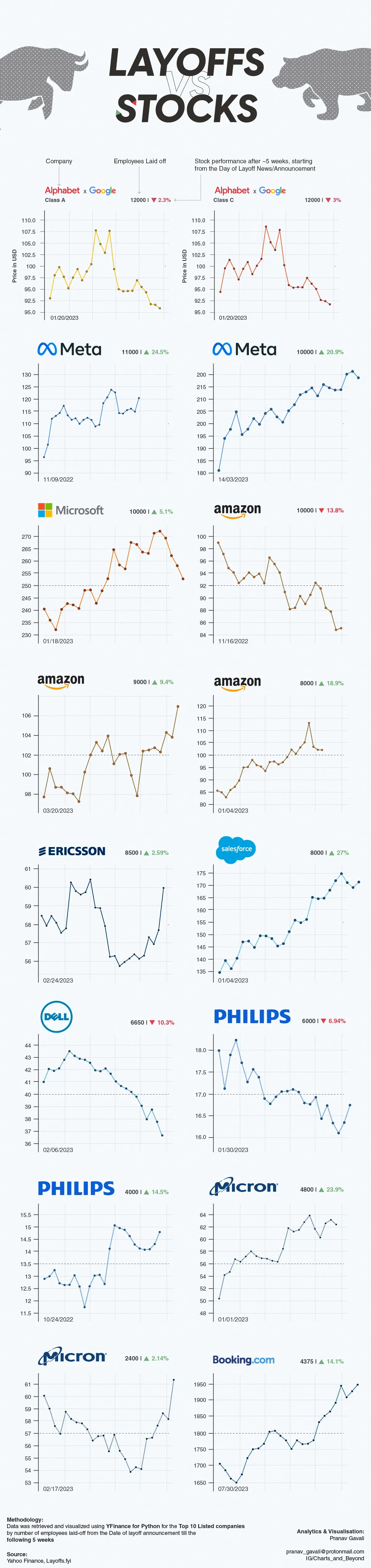

Delve into the intricate relationship between stock performance and corporate layoffs as we analyze the market dynamics post-executive announcements. This infographic unveils the impact on stock prices over 5 weeks following layoffs, shedding light on how investors respond to workforce restructuring.

Key Insights:

1. Alphabet (Google): Witnessed a downturn with Class A and Class C stocks showing -2.3% and -3% changes after 12,000 layoffs on 1/20/2023.

2. Meta: Experienced a notable upswing of 24.5% after an 11,000 layoff announcement on 11/9/2022, and another 20.9% on 3/14/2023 post 10,000 layoffs.

3. Amazon: Varied responses with a surge of 13.8% on 11/16/2022 (10,000 layoffs), a dip of 18.9% on 1/4/2023 (8,000 layoffs), and a moderate 9.4% rise on 3/20/2023 (9,000 layoffs).

Global Players:

- Microsoft: Recorded a 5.1% increase on 1/18/2023 after announcing 10,000 layoffs.

- Ericsson: Marginal change of 2.59% on 2/24/2023 following an 8,500 layoff announcement.

- Salesforce: Notable surge of 27% on 1/4/2023 post 8,000 layoffs.

- Dell: Showcased a 10.3% increase on 2/6/2023 after a 6,650 layoff announcement.

- Others: Philips, Micron, and Booking.com with varied stock movements post layoffs.

Conclusion:

This 5-week analysis provides a nuanced understanding of stock reactions to layoff announcements. While some companies experience volatility, others see notable gains, emphasizing the importance of considering broader market sentiments and strategic factors when assessing the impact of layoffs on stock performance. Stay tuned for more insights into the dynamic world of corporate finance and market trends.