Where Data Tells the Story

© Voronoi 2026. All rights reserved.

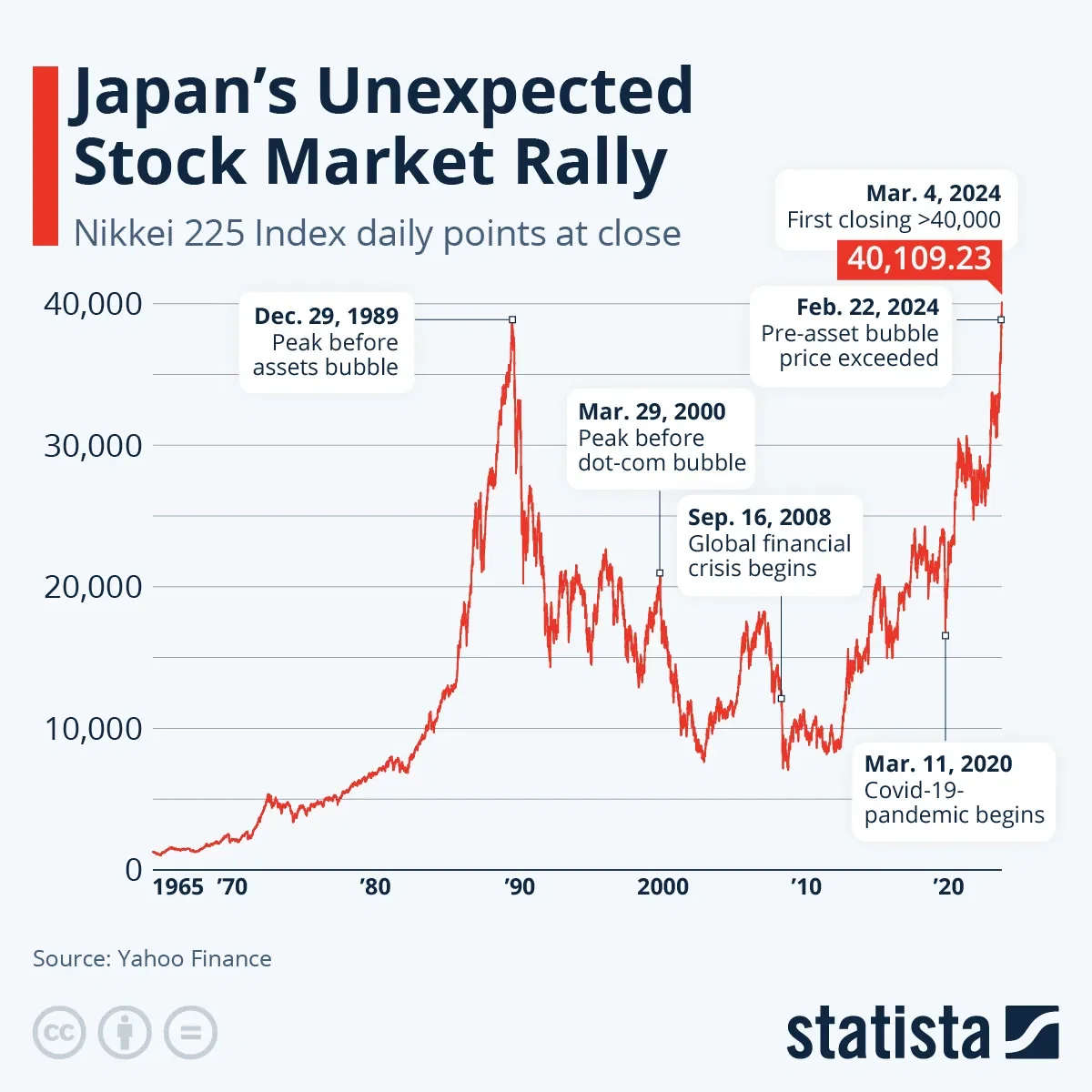

Japanese benchmark index Nikkei 225 surpassed the 40,000 point mark for the first time on Monday in a surprising stock market rally that has been continuing despite the generally weak Japanese and world economy. The AI boom boosted Japanese semiconductor stocks more than expected, contributing majorly to the good results.

In mid-February, the index had for the first time surpassed levels from before the country’s devastating assets bubble burst in 1989/1990, from which the economy is thought to have never recovered. Around the same time, the Japanese economy slid from the world’s third-largest to its fourth-largest – having been overtaken by Germany's - to much international coverage. While Japanese stocks are aided by the weak yen and cheap buying prospects in internationally known companies, experts believe that the index’s strength could show that the Japanese economy is regaining stream amid better company earnings, stronger hiring and corporate governance reforms.

The Japanese central bank other than elsewhere in the world held out from increasing its interest rates during the inflation crisis as the sluggish Japanese economy did not react as negatively as those in other regions and it was feared that the move could destroy any signs of life it was still showing. Now, potential rate cuts in the U.S. could aid the Japanese stock market even more in its unlikely return to success.