Where Data Tells the Story

© Voronoi 2026. All rights reserved.

What We’re Showing

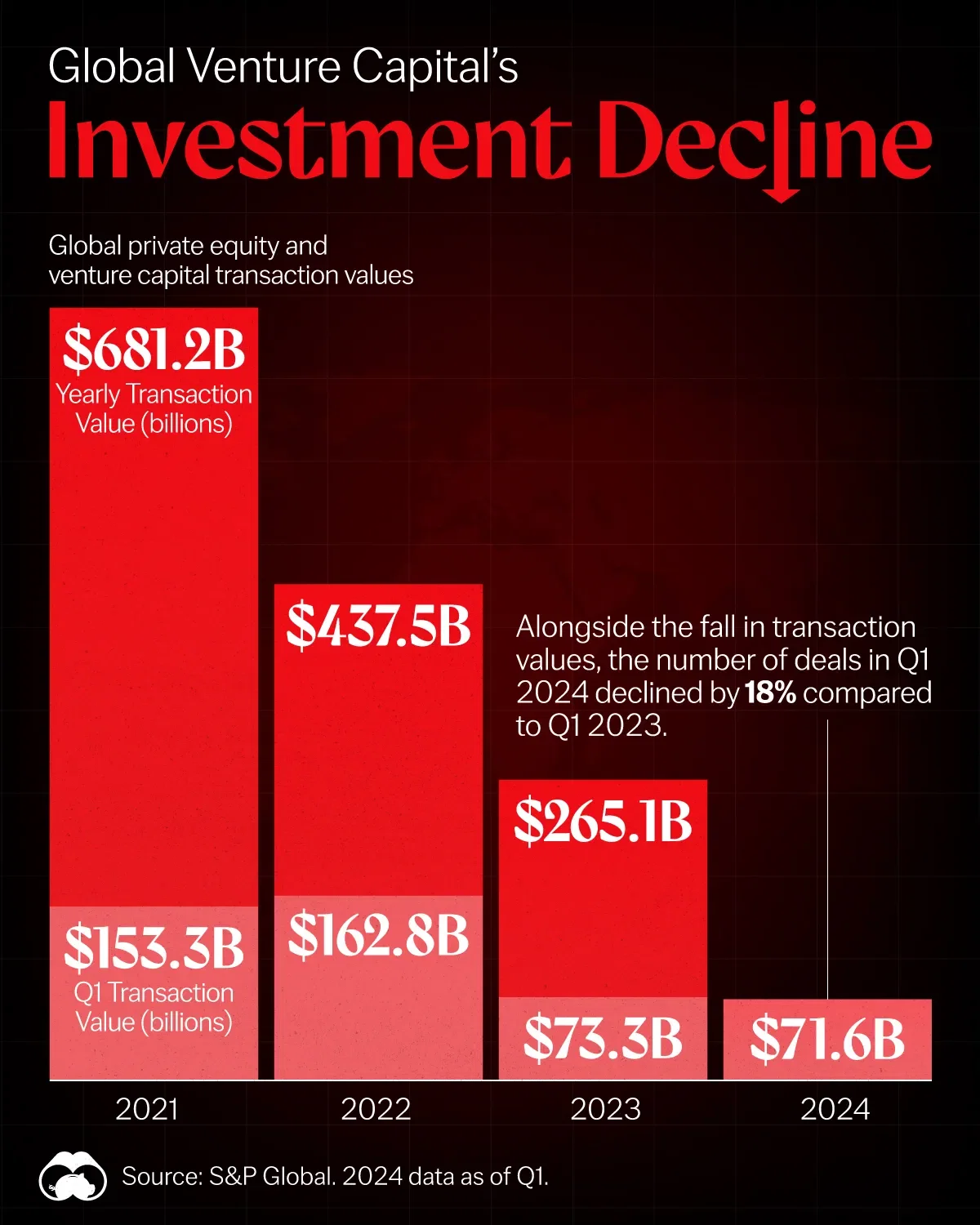

The steep drop in global venture capital (VC) and private equity (PE) transaction values since 2021. Data is from S&P Global, with 2024 figures as of Q1.

Key Takeaway

High interest rates and an uncertain economic environment have led to a decline in deal activity across the global venture capital investment. VC firms inject capital into startups with high growth potential in exchange for a partial ownership in the company.

In the first quarter of 2024, transaction values stood at just $71.6 billion—a 53% decline compared to the same period in 2021 ($153.3 billion).

Reddit and Astera Labs IPOs

Debuting at a $6.4 billion valuation, the Reddit IPO in March has been a bright spot for its VC and PE backers so far this year, which include Y Combinator, Sequoia Capital, and Andreessen Horowitz.

Additionally, Astera Labs, which provides chips for AI infrastructure, went public last month at a $5.5 billion valuation. Astera Labs’ VC backers include Intel’s investment arm, Nvidia, and Fidelity Management and Research.

These two IPOs dominated the U.S. venture capital landscape, making up over 73% of VC exits in the first quarter of 2024. Notably, they were the first venture-backed IPOs in the U.S. since September 2022.