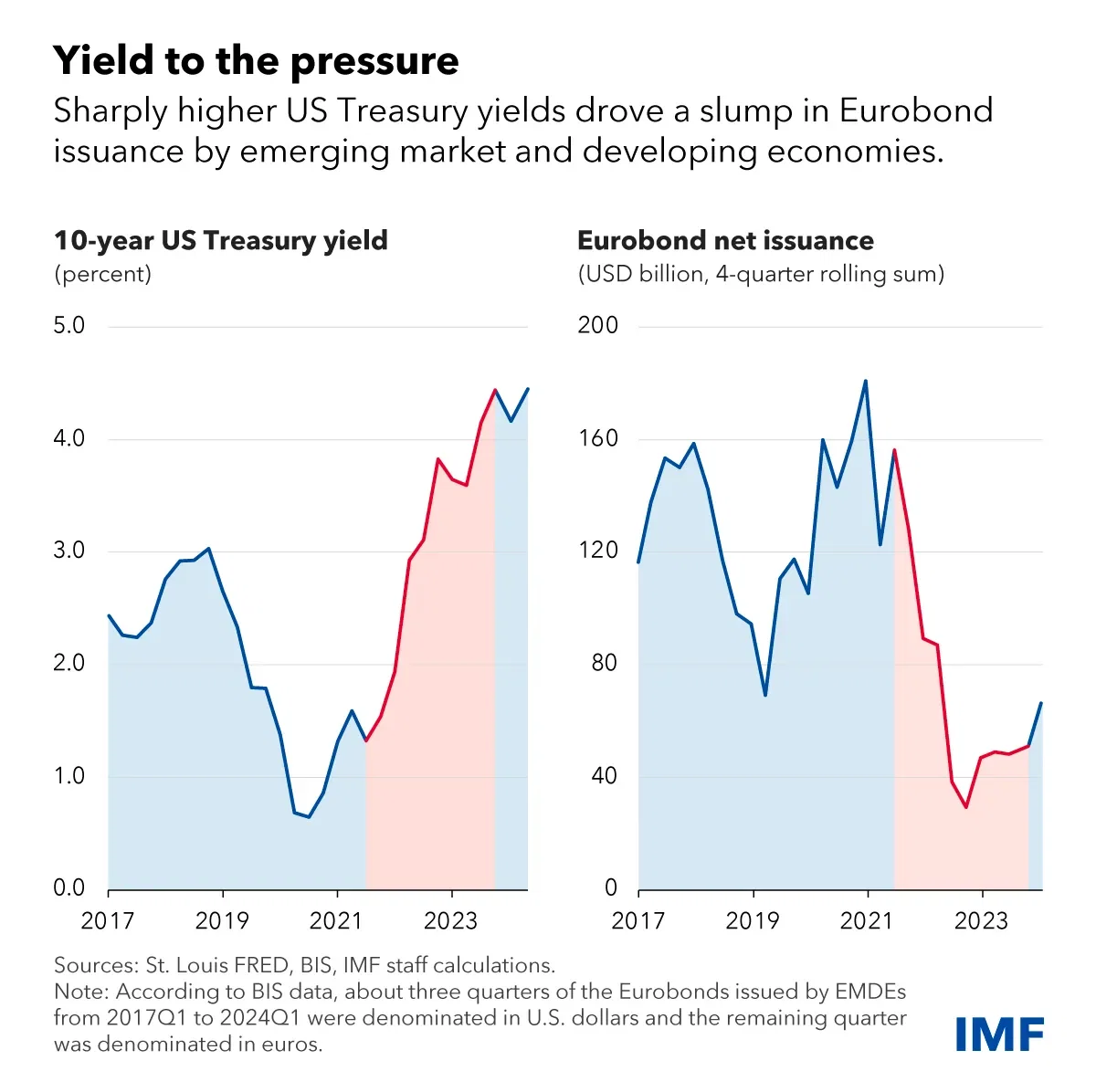

Fed Rate Cuts May Help Revive Bond Flows to Emerging, Developing Economies

This chart highlights the sharp slowdown of Eurobond net issuance by emerging market and developing economies, which fell to an annual $40 billion in 2022-23, down 70 percent relative to the prior two years. During this period, 26 of 75 countries saw net Eurobond outflows, totaling $58 billion (including countries like Bolivia and Mongolia). These outflows resulted from maturing Eurobonds exceeding new issuance, rather than outright sales by global investors.

The reduction in Eurobond flows reflected a combination of tightening external financial conditions and pre-existing vulnerabilities in affected economies, such as fiscal and external sustainability challenges. Some countries with more robust fundamentals and policy frameworks were able to substitute foreign currency issuance with local currency debt, funded in part by domestic investors. Many countries responded by cutting investment to reduce imports, weighing on economic growth. Many countries also drew on their reserve buffers, which could reduce their ability to withstand future shocks.

See the full article here.