Where Data Tells the Story

© Voronoi 2026. All rights reserved.

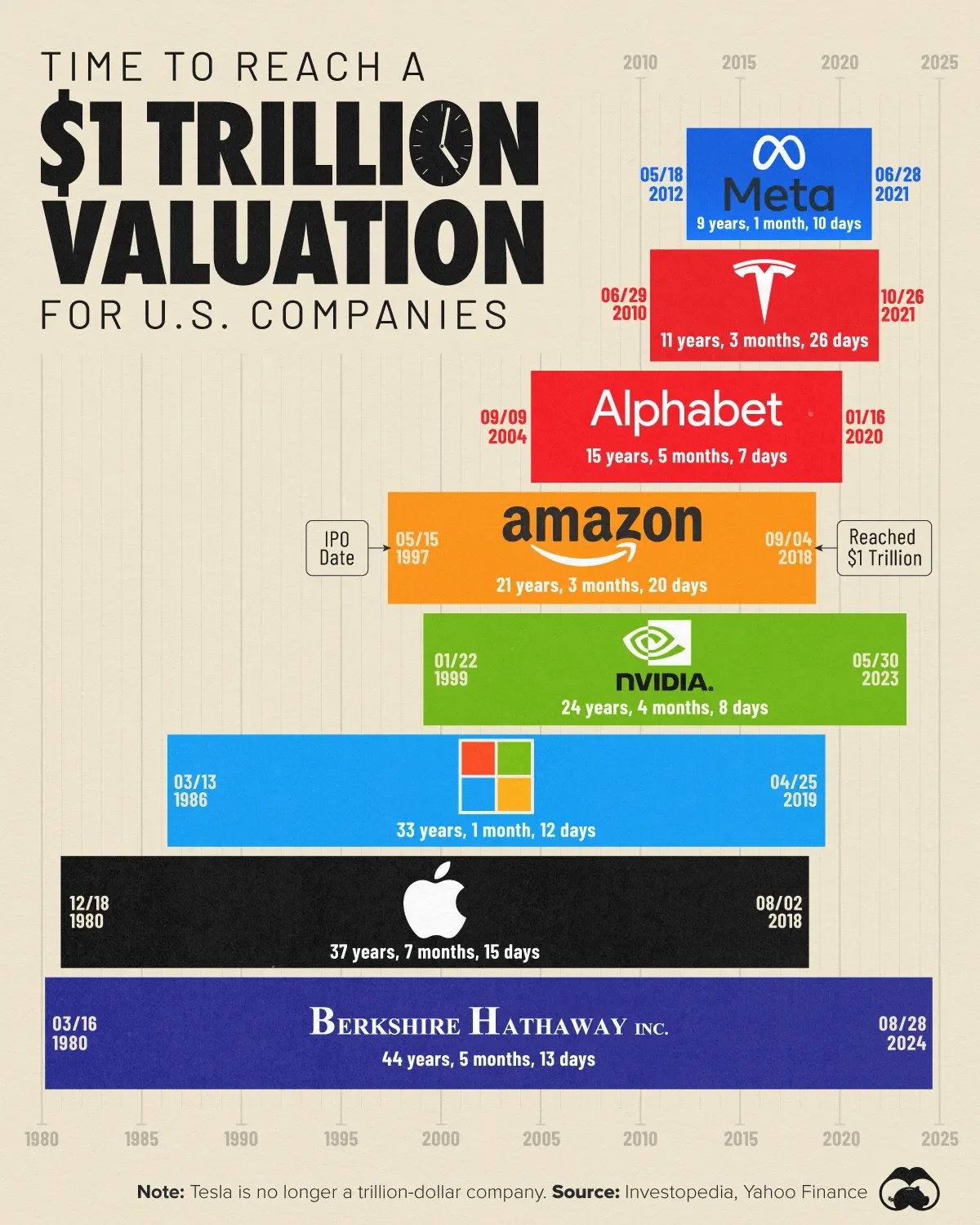

This graphic shows how long it took America’s trillion-dollar companies to reach the $1T milestone. This data was collected from Investopedia and Yahoo Finance.

Early on Wednesday, Aug 28. 2024, Berkshire Hathaway’s Class A shares (BRK.A) touched $699,699, giving the conglomerate a $1T valuation for the first time ever.

Berkshire has a dual-class share structure, where Class A shares are the original stock offering which began trading in 1980. Class B shares were issued in 1996 and offer a smaller stake in the company.

Notably, Berkshire is the first non-tech company in the U.S. to hit this milestone. It owns a wide variety of businesses such as Geico Insurance, Dairy Queen, Duracell, and Benjamin Moore.