Where Data Tells the Story

© Voronoi 2026. All rights reserved.

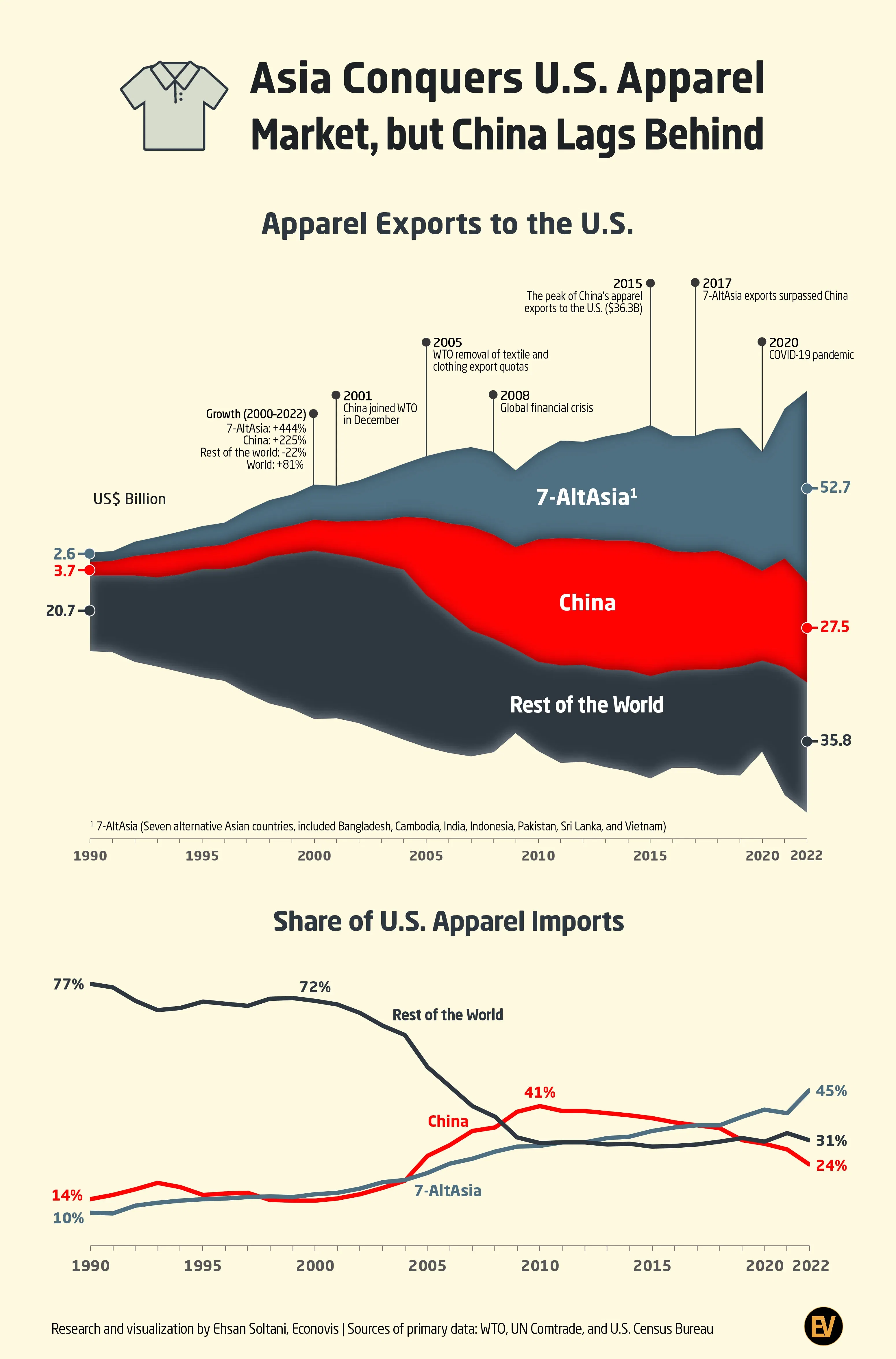

United States apparel imports surged by 81%, increasing from USD 64 billion in 2000 to USD 116 billion in 2022, while total goods imports grew by 168%. The share of apparel from total imports declined from 5.1% to 3.4% during this period. Notably, the share of knitted apparel from total woven and knitted apparels rose from 45% in 2000 to 58% in 2022, indicating an increased preference for more casual apparel imports with lower prices.

From 1995 to 2000, the share of the world, excluding China and the 7-AltAsia countries (Bangladesh, Cambodia, India, Indonesia, Pakistan, Sri Lanka, and Vietnam), in total US apparel imports was around 72%. This dominance was attributed to import quotas that protected the US market from cheap Asian exporters.

Two significant turning points unfolded in the 2000s. China joined the WTO in December 2001, and more importantly, from January 2005, quotas on textile and apparel exports were eliminated, marking the removal of all quantitative restrictions on imports from WTO members under the Multi-Fiber Arrangement (MFA), which had been in place for over four decades.

Apparel exports from the world, excluding China and the 7-AltAsia countries, which amounted to approximately USD 46 billion from 2000 to 2004, experienced a notable decline, falling to USD 24.6 billion in 2010. In contrast, China's exports surged by 133%, while the 7-AltAsia countries witnessed a 64% increase from 2004 to 2010. As a result, the share of the world, excluding China and the 7-AltAsia countries, in total United States apparel imports was halved, remaining at around 30% throughout the 2010s.

China's apparel exports to the United States peaked at USD 36.3 billion in 2015. From 2015 to 2022, China's apparel exports to the United States decreased by 24%, and the 7-AltAsia countries increased by 62%. As a result, China's share of total US apparel imports dropped from 37.4% to 23.7%.

In 2022, the 7-AltAsia countries, with a total export value of USD 52.7 billion, constituted 45% of United States apparel imports. Notably, Vietnam and Bangladesh, with apparel exports amounting to USD 19.5 billion and USD 10.3 billion, respectively, surpassed China, whose exports stood at USD 27.5 billion. Furthermore, India, Indonesia, and Cambodia recorded apparel exports of USD 6.3 billion, USD 6.2 billion, and USD 4.8 billion in 2022, respectively.

The production and export of textiles and clothing played a central role in generating export revenue and fostering economic development in China. Until the mid-2010s, textiles and clothing constituted the primary source of export revenue for China. Notably, textiles and clothing still hold significance for the Chinese economy, with a trade surplus share of 16% and 35% of total manufacturing and goods exports, respectively, in 2022. However, the apparel share from China's total goods exports gradually decreased from 20.1% in 1993 to 5.1% in 2022. Due to industrial and economic development, demographic changes, and a more than threefold increase in labor costs compared to the 7-AltAsia countries, these nations are poised to gain a larger share in the United States market, while China's share is expected to continue declining in the future.