Where Data Tells the Story

© Voronoi 2026. All rights reserved.

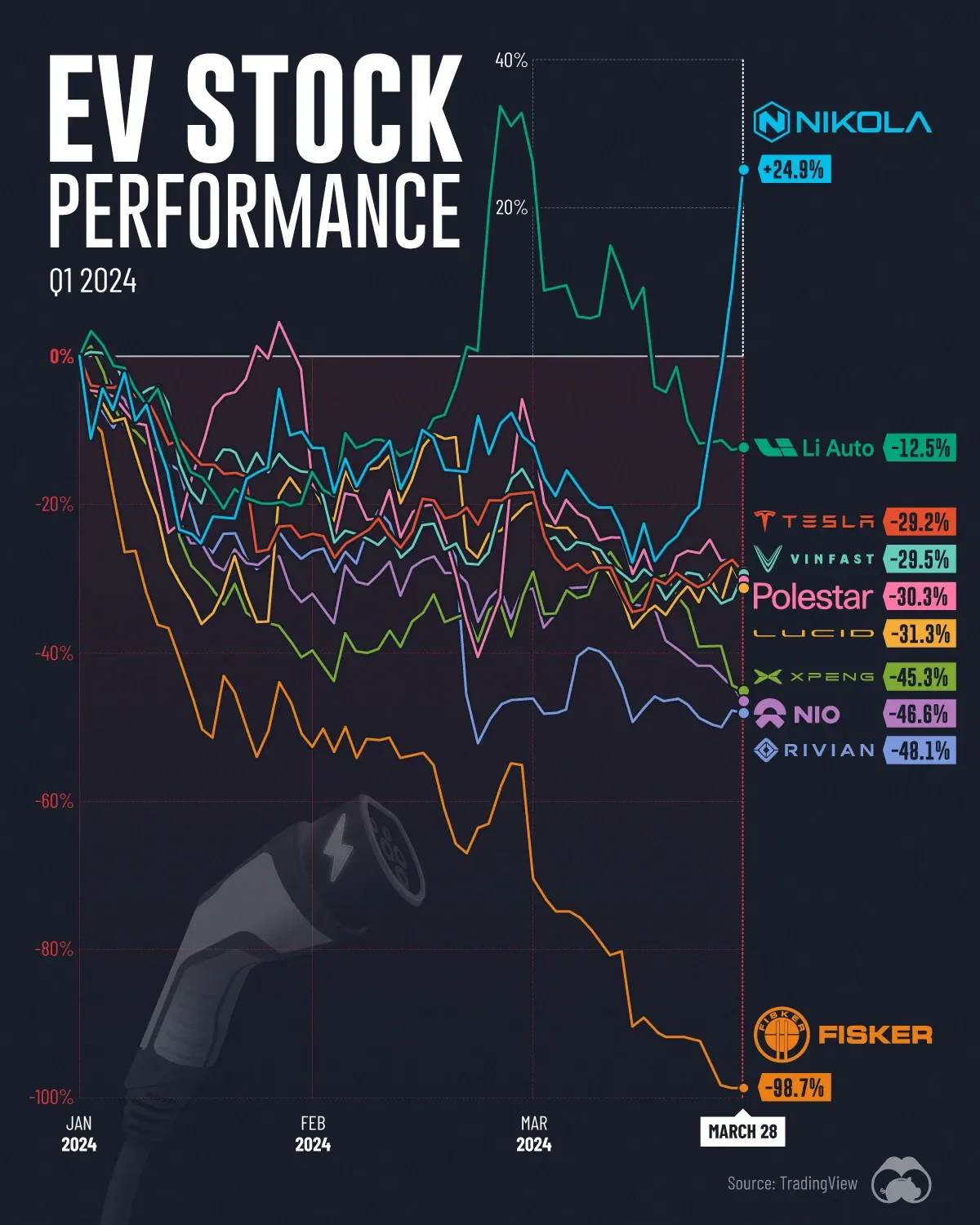

The Q1 2024 stock performance of prominent pure-play EV companies. These are companies that only produce electric vehicles.

EV sales have slowed in major markets like the U.S. and China, causing trouble for EV startups like Rivian and Lucid which are not yet profitable.

As legacy automakers now look to ramp up production of hybrid vehicles, many investors appear to be turning away from the EV sector.

Nikola shares have rallied in recent weeks as the company reports positive momentum in its hydrogen fuel cell truck business. The company also opened its first hydrogen refueling station in Southern California, and has 5 more in the works.

On the flipside, Fisker Inc. has struggled enormously, even being delisted from the NYSE in late March 2024. Fisker Inc. is the successor to Fisker Automotive, which went bankrupt in 2013. Fisker Automotive was known for producing the Karma, a luxury EV sedan that competed with the Tesla Model S.