Where Data Tells the Story

© Voronoi 2025. All rights reserved.

Subscribe to Insight Scoop to get amazing visualizations in your Inbox every Tuesday!

---

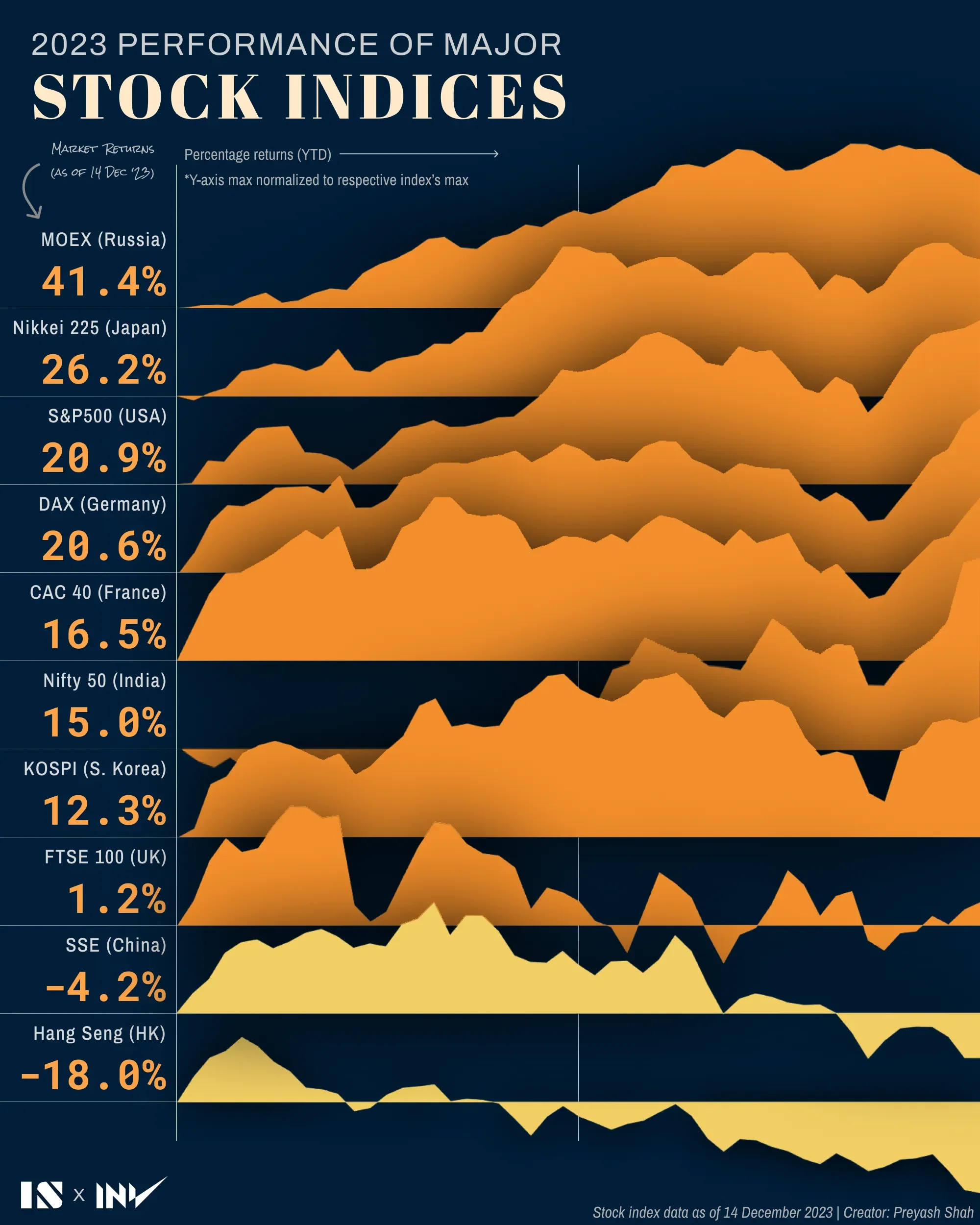

The year 2023 has been a remarkable one for global stock markets, with many major indices posting strong gains.

The MOEX Index of Russia led the way with a return of 41.4% year-to-date (YTD) as of December 14, 2023. The Nikkei 225 Index of Japan was close behind with a YTD return of 26.2%.

Other notable performers included the S&P 500 Index of the United States (20.9%), the DAX Index of Germany (20.6%), and the CAC 40 Index of France (16.5%).

The Nifty 50 Index of India and the KOSPI Index of South Korea also posted solid gains, with YTD returns of 15.0% and 12.3%, respectively.

The FTSE 100 Index of the United Kingdom was the only major index to underperform in 2023, with a YTD return of just 1.2%.

The Shanghai Stock Exchange Composite Index of China and the Hang Seng Index of Hong Kong also posted negative returns for the year, with YTD declines of 4.2% and 18.0%, respectively.

While I am not a certified financial analyst, a Business Insider article attempted to shed some light on the possible explanations for the good stock market performance. Here are the key factors:

Big Tech earnings:

Interest rates:

Fed policy:

Fears of a recession:

While these are some factors, I am sure there are many more explanations. Nevertheless, if your investments in 2023 ended in the green, then congratulations; and if they did not, then you get another shot in 2024.