Where Data Tells the Story

© Voronoi 2026. All rights reserved.

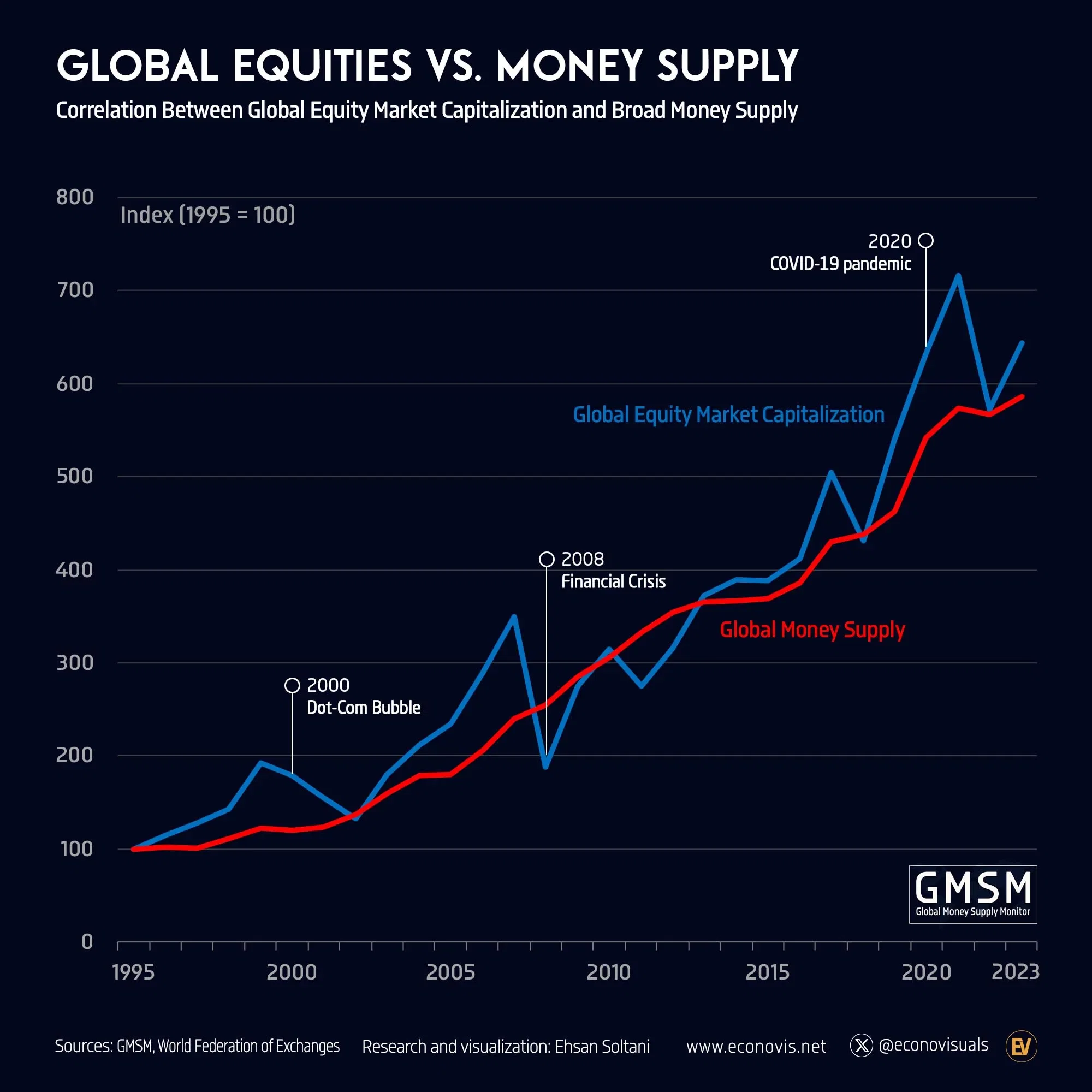

Correlation Between Global Equity Market Capitalization and Broad Money Supply (1995-2023)

Key Insights:

Strong Positive Correlation:

The correlation coefficient of approximately 0.96 indicates a very strong positive relationship between global equity market capitalization and broad money supply. This suggests that as the money supply increases, the value of global equities tends to rise as well.

Trends and Patterns:

-Upward Trend: Both the money supply and equity market capitalization have shown a general upward trend from 1995 to 2023. This is indicative of global economic growth, increased liquidity, and possibly inflationary pressures.

- Economic Cycles: The data likely reflects various economic cycles, including periods of rapid growth, recessions, and recoveries. For instance, notable increases around 2000 (dot-com bubble), 2008 (global financial crisis), and post-2020 (COVID-19 pandemic stimulus) may be observed.

Implications:

- Investment Strategies: Understanding this correlation can help investors and policymakers anticipate market movements based on monetary policy. For instance, periods of quantitative easing or increased money supply can lead to higher equity market valuations.

- Monetary Policy Impact: Central banks' decisions to adjust the money supply (through interest rate changes, quantitative easing, etc.) have a significant impact on equity markets. This relationship underscores the importance of monetary policy in financial market stability and growth.

Limitations:

- Causation vs. Correlation: While there is a strong correlation, it is essential to recognize that correlation does not imply causation. Other factors, such as technological advancements, geopolitical events, and fiscal policies, also play crucial roles in influencing market capitalization.

- External Shocks: Unforeseen events (e.g., pandemics, wars) can disrupt typical patterns and introduce volatility that may not be fully explained by money supply changes alone.

Conclusion:

The relationship between global equity market capitalization and broad money supply from 1995 to 2023 highlights the interconnected nature of monetary policy and financial markets. The strong positive correlation suggests that increases in money supply are typically associated with higher equity valuations, making this an important consideration for investors, economists, and policymakers alike. However, it is crucial to consider the broader economic context and other influencing factors when interpreting these trends.