Where Data Tells the Story

© Voronoi 2026. All rights reserved.

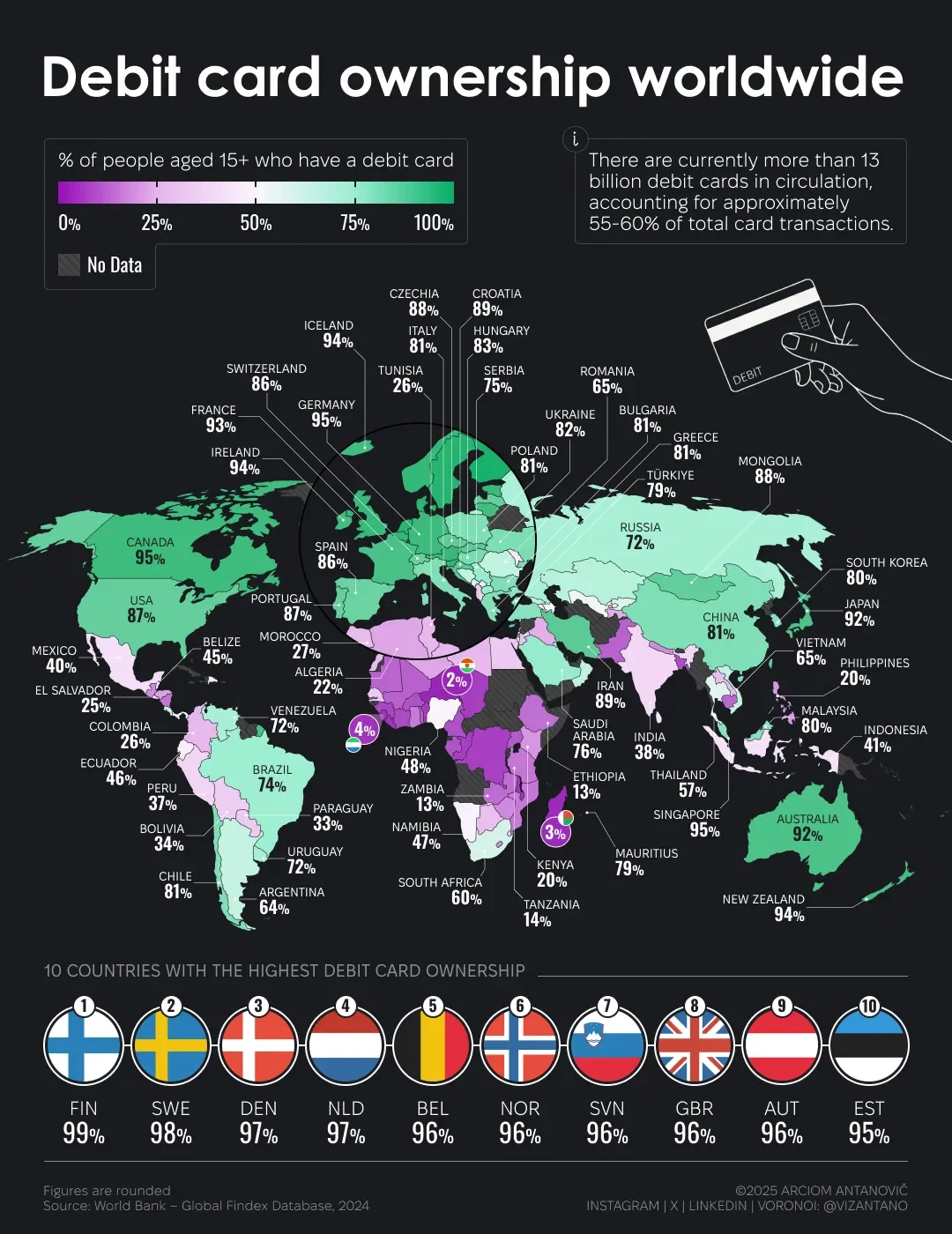

In the 21st century, debit cards have become a natural part of everyday financial life. Today, about half of all adults – roughly 4 billion people – use them. This growth goes hand in hand with better financial access: 79% of adults now have a bank account or mobile financial services, even though usage still varies widely across regions.

In countries with developed financial systems, debit cards are already a daily routine. In the US in 2024, around 60% of transactions were made by card, while cash accounted for only about 16%. In high-income countries, around 87% of adults have debit cards – and in some places, the figure is above 95%. This is largely driven by convenient payment infrastructure, contactless technology, and the post-pandemic shift toward cash-free spending.

Cashless payments are growing fast in emerging economies as well. In 2024, 42% of adults in low- and middle-income countries used digital payments – a sign of a steady move away from cash. The strongest growth is seen in Asia and Africa, where debit cards often become people’s first financial tool: they’re used to receive salaries, social benefits, transfers, and everyday payments. Smartphones play a key role here – mobile apps and mobile money services are opening financial access for millions.

As the economy becomes more digital, more debit card operations are made through mobile apps – in developed countries, up to 90% of transactions. The number of issued cards is higher than the number of users, since many people hold several cards for different banks, currencies, or purposes. Globally, debit cards make up around 55-60% of all card transactions and are used more often than credit cards for daily spending. Their share is about 65% in Europe, 53% in the US, and up to 70% of retail transactions in the Asia-Pacific region. On average, a single debit card purchase is about $55.

By the end of 2025, the number of debit cards worldwide is estimated at about 13.4 billion, with a market volume of around $96.8 billion. The market is expected to keep growing and may reach about $103.7 billion by 2029. The expansion of debit cards is part of a much broader global shift – from cash to digital finance, making payments faster, more convenient, and more accessible.