Where Data Tells the Story

© Voronoi 2026. All rights reserved.

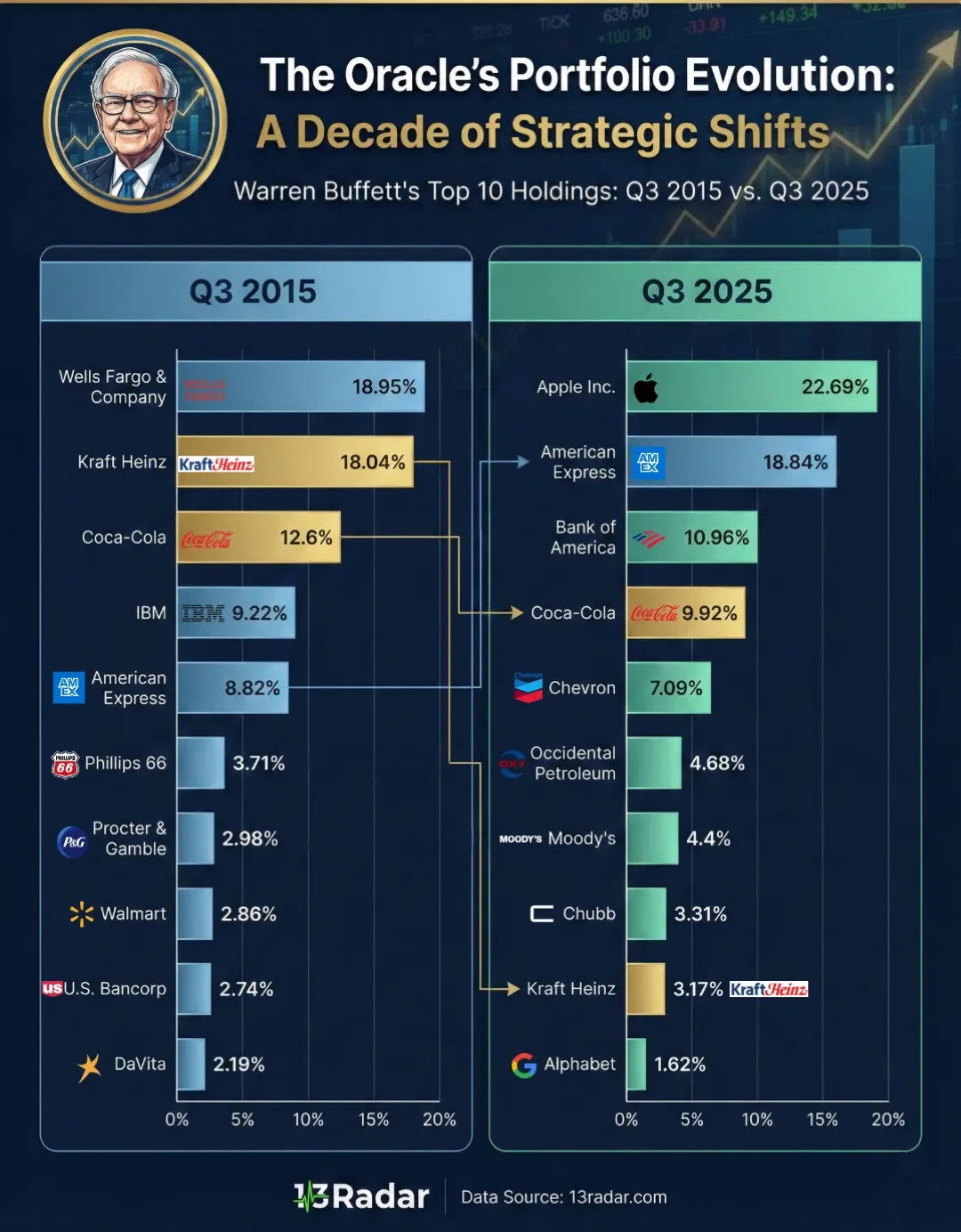

This bar chart tracks the strategic transformation of Buffett’s top holdings(Berkshire Hathaway Portfolio Companies) over a decade. In 2015, the portfolio leaned heavily on banks (Wells Fargo, U.S. Bancorp), consumer staples (Coca-Cola, Kraft Heinz), and legacy tech (IBM). By 2025, it’s dominated by Apple (22.7%), American Express, Bank of America, and energy plays like Chevron and Occidental.

🧠 Takeaway:

Buffett’s shift reflects a pragmatic embrace of platform tech and inflation-resilient assets — while retaining core consumer and financial anchors.

📊 Analysis: