Where Data Tells the Story

© Voronoi 2026. All rights reserved.

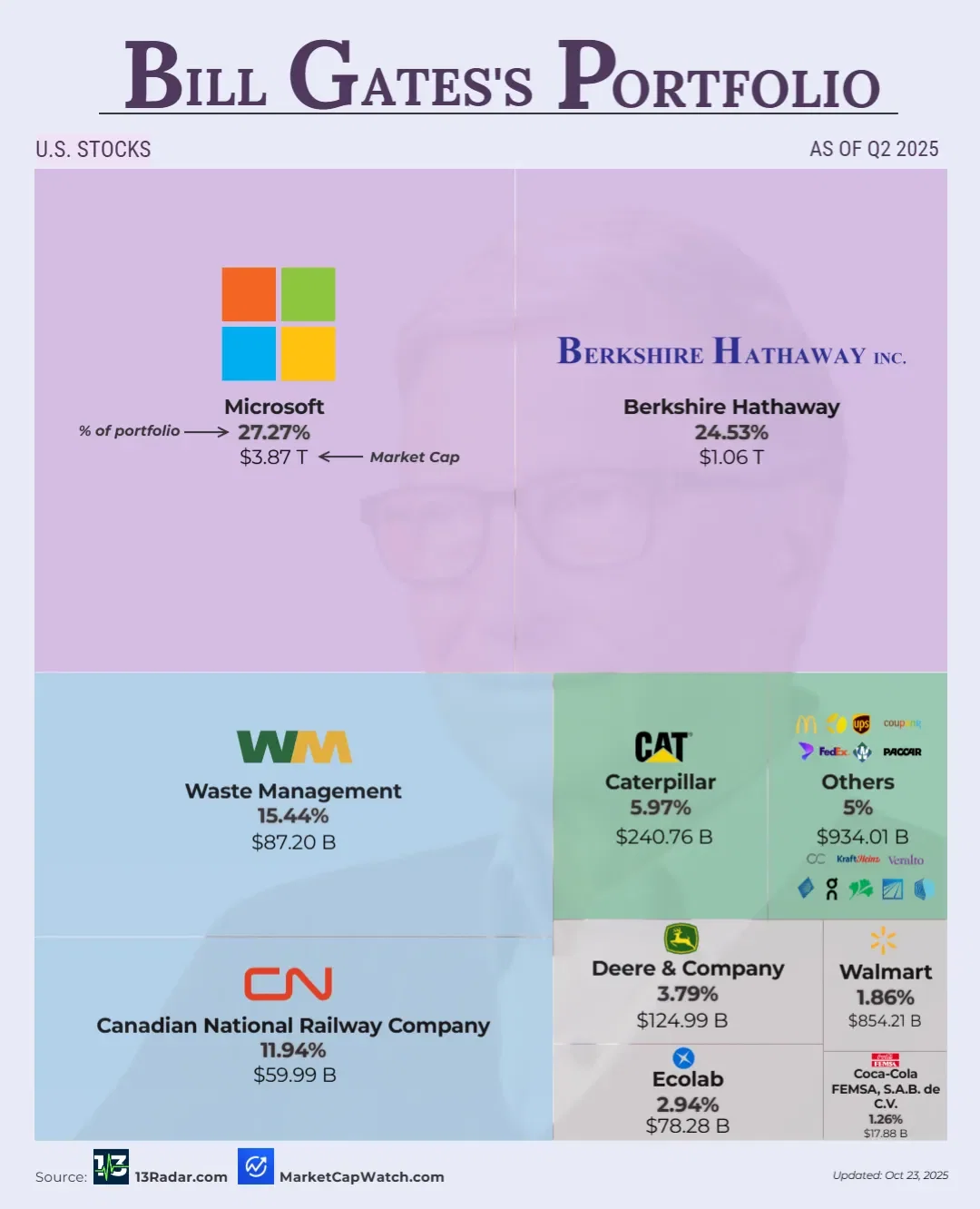

This chart breaks down Bill Gates’s U.S. equity holdings, showing how his portfolio balances tech dominance with industrial resilience. Microsoft ($3.87T) remains the anchor at 27%, while Berkshire Hathaway (25%) provides diversified exposure. Beyond these two giants, Gates leans into infrastructure and sustainability: Waste Management (15%), Canadian National Railway (12%), Caterpillar (6%), and Deere (4%). Retail (Walmart, 2%) and environmental services (Ecolab, 3%) round out the mix.

Takeaway: Gates’s portfolio reflects a dual strategy — tech leadership through Microsoft paired with long‑term bets on essential services, industrials, and sustainability.

Analysis: