Where Data Tells the Story

© Voronoi 2026. All rights reserved.

The Trump Administration is upending the global trade order, escalating tariff actions against key partners — including India. Citing continued purchases of Russian crude, India now faces a cumulative 50% tariff on its exports to the U.S.

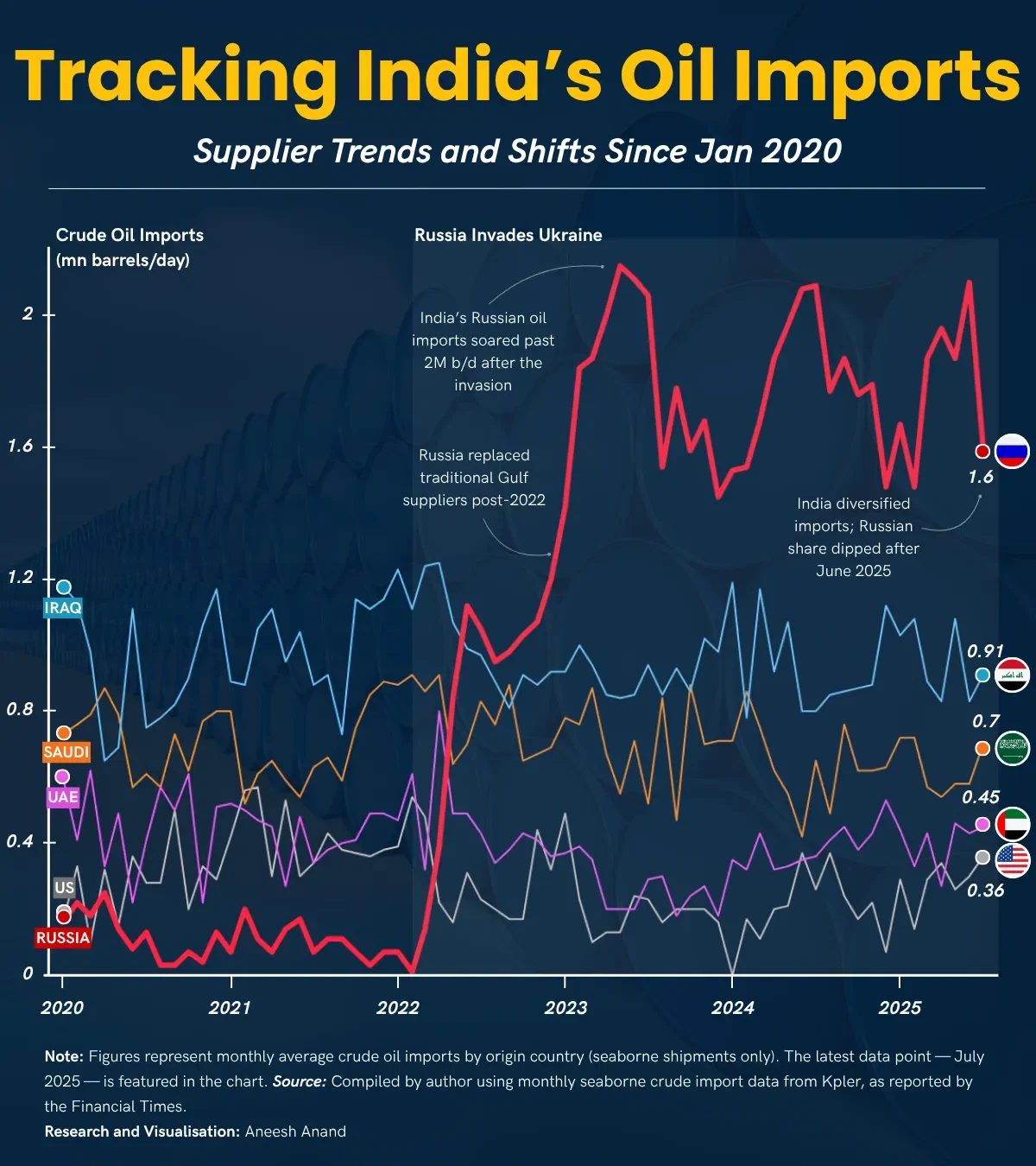

Following Russia’s invasion of Ukraine in early 2022 and the imposition of Western sanctions, India increased its intake of Russian seaborne crude from ~ 0.2 million barrels/day (Jan 2022) to over 2 million barrels/day (mid-2023). Russia became India’s leading oil supplier through 2024 and holds the position in 2025 (July).

This shift coincided with a relative decline in imports from traditional suppliers including Iraq, Saudi Arabia, and the UAE.

Since June 2025, Russian volumes have moderated, while U.S. crude exports to India have increased to 0.36 million barrels/day.

Note: Figures represent monthly average crude oil imports by origin country, based on seaborne shipment volumes only.

Source: Compiled by author using Kpler data, as reported by the Financial Times.