Where Data Tells the Story

© Voronoi 2026. All rights reserved.

In 2022, the average quarterly U.S. household spending on plays, theater, opera, and concerts amounted to $79 according to the Bureau of Labor Statistics, a drastic increase both compared to pre-pandemic levels as well as to 2020 and 2021. While this evidence is anecdotal, it suggests that either Americans are willing to spend more on live entertainment or costs for such events have risen by such a degree that could explain the spending jump. Whichever reason might be true: The live industry is back from its coronavirus slump, at least in terms of the volume of concerts, festivals and other cultural live events booked. PwC noted in their latest Global Entertainment and Media Outlook that in 2022, live music generated $20 billion worldwide, while cinema box office revenues stood at $25 billion.

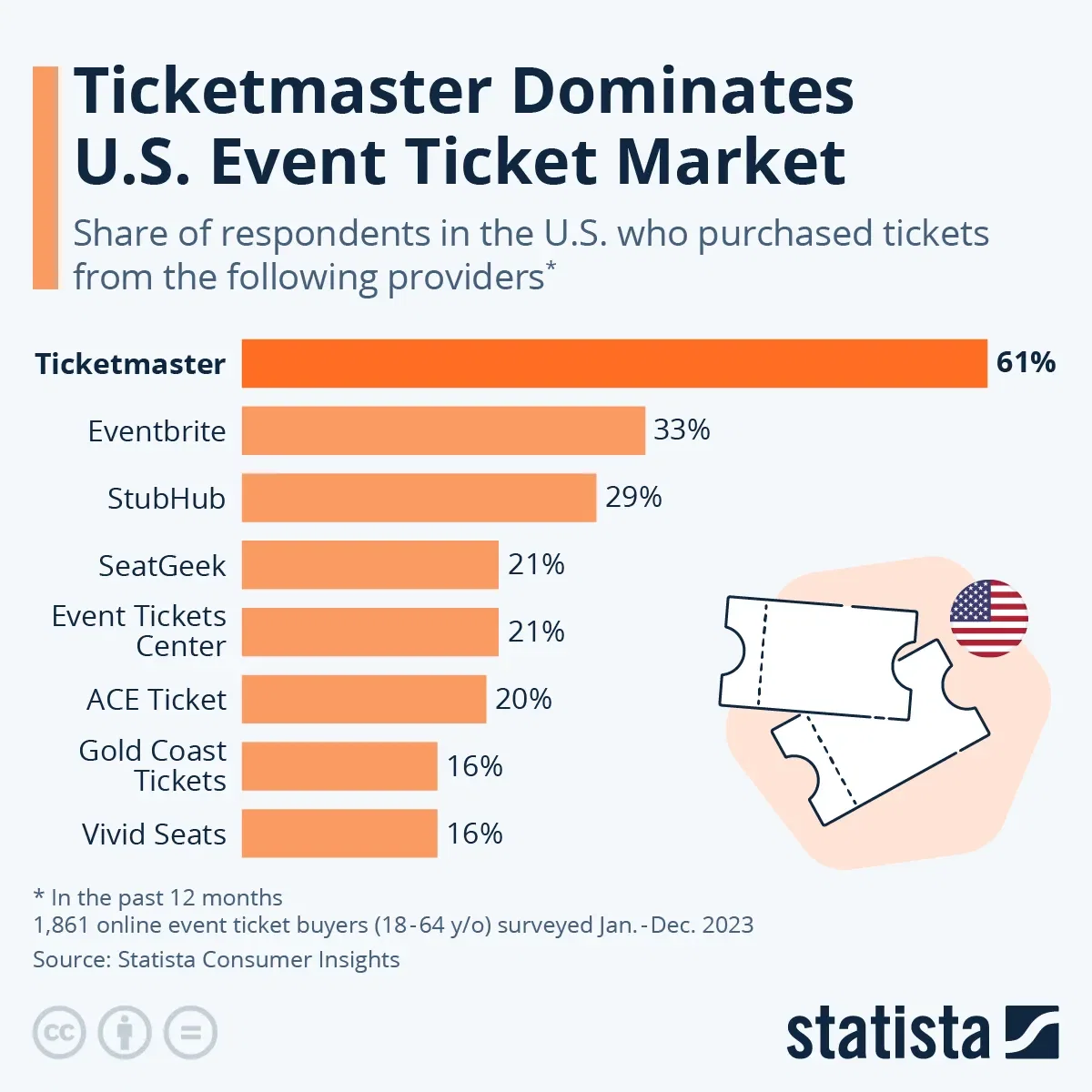

A recent Statista Consumer Insights survey shows that when it comes to choosing where to buy a ticket for an event, a majority of U.S. Americans surveyed favored Ticketmaster. 61 percent of online event ticket buyers had engaged in business with the platform, which was merged with Live Nation in 2010 and has recently come under anti-trust scrutiny due to the problems with the pre-sale of Taylor Swift's Eras tour in 2022, in the past 12 months.

Ranking second and third are Eventbrite and StubHub with 33 and 29 percent, respectively. The former company was founded in 2006 and went public in 2018, while the latter is not a first-party seller but rather a ticket exchange and resale platform which has also come under scrutiny for sellers buying up tickets in bulk and reselling them for highly inflated prices. Of the eight most popular ticketing websites, five are at least partially in the ticket reselling business, with SeatGeek offering up tickets directly from the venues and organizers as well as resale tickets.