Where Data Tells the Story

© Voronoi 2026. All rights reserved.

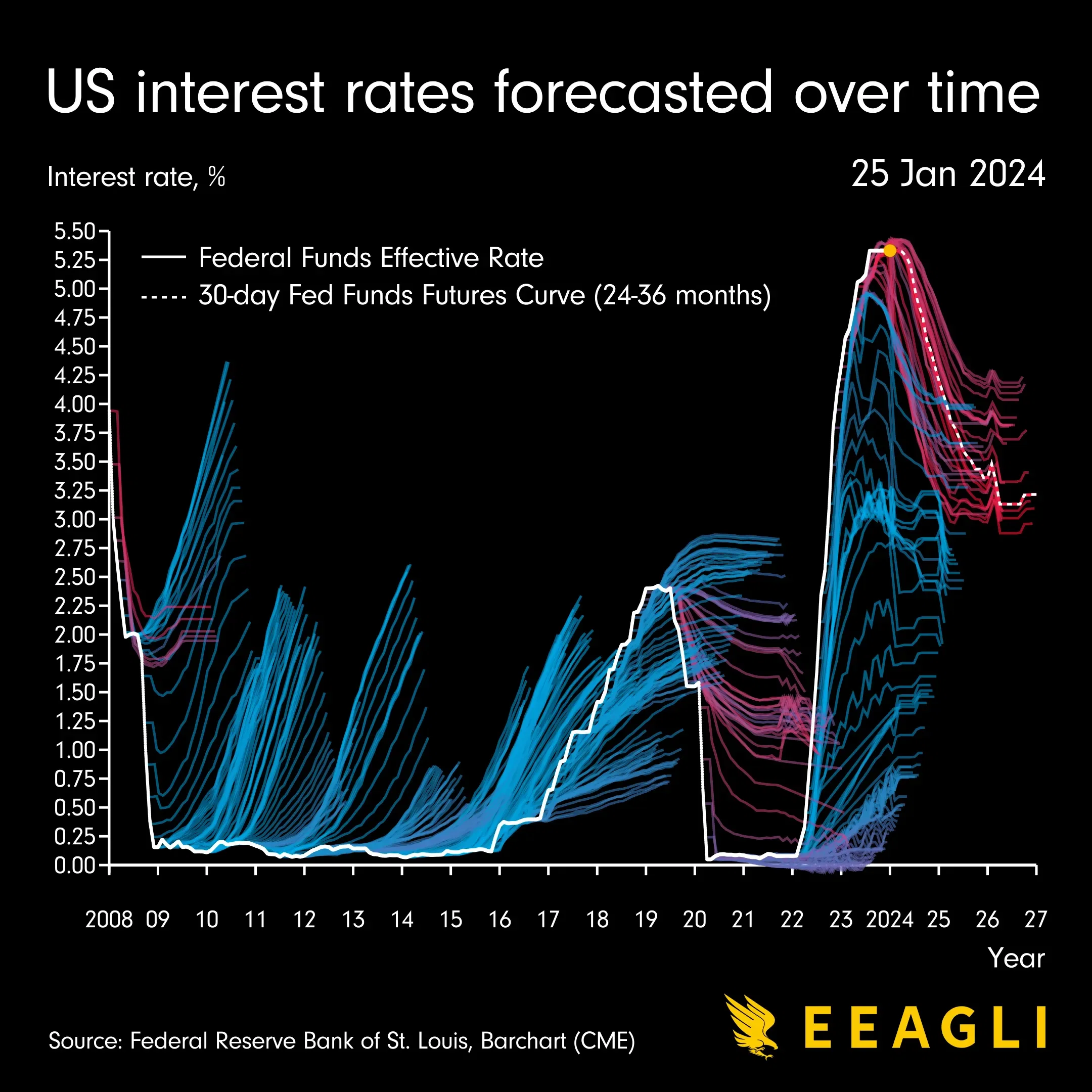

Here are US interest rates forecasted by the futures market. The market rarely gets it right, but this is a story more about sentiment and long-term financing.

When you look at the futures curve (or the SOFR curve), depicted by the red and blue lines in this chart, what you are seeing are the emotions of the market, which is really where the story lies.

For instance, when interest rates were at rock bottom levels, those upward-sloping futures curves were less about predicting the future, and more about just how uncomfortable the market was with ultra-low interest rates. They expected some reversion to the mean as liquidity continued to flood into capital markets. It wasn't that the market was wrong. It was worried about extremely unusual financial conditions.

So it might be a bit simplistic to just say the market just “got it wrong,” which unfortunately seems to be the conclusion many have drawn when view this type of chart. Right now, the curve is downward-sloping. That doesn’t mean the US Federal Reserve is going to slash interest rates (they care about price stability, not market sentiment). It just means that the market is nervous about a slowdown in the current robust levels of US economic growth and this shouldn’t be seen as an accurate path for US interest rates.

So, what are the takeaways here:

The futures curve of interest rates significantly impacts long-term financing costs. Imagine a corporation, XYZ Inc., plans to issue a 10-year bond to finance a new project. The interest rate on this bond will largely depend on the 10-year point on the yield curve, which reflects the market's expectations for the average level of short-term interest rates over the next 10 years.

If this curve inverts, long-term rates are actually lower than short-term rates. If XYZ Inc. issues its bond in these conditions, the long-term financing cost might be similar to or even less than short-term financing. This could be advantageous for XYZ Inc. in terms of interest expenses. For a CFO of a large company, this is pretty important.

In short, the futures curve gives a glimpse of where the direct costs of financing are heading (like the interest rate on a bond) and can influence corporate decisions regarding the structure of financing (choosing between short-term vs. long-term debt).