Where Data Tells the Story

© Voronoi 2025. All rights reserved.

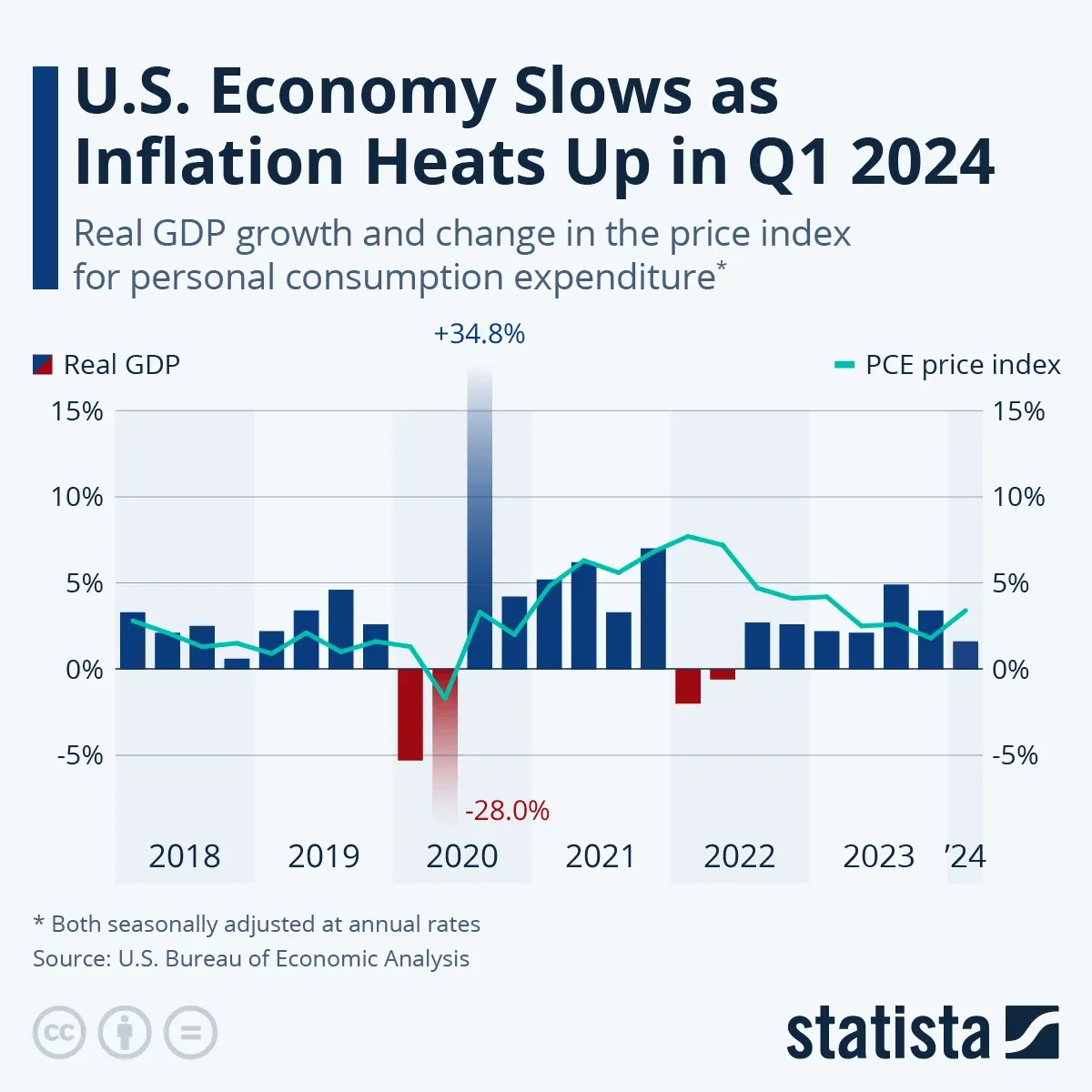

The U.S. economy grew slower than expected in Q1 2024 as inflation reaccelerated through the first three months of 2024. According to the BEA's advance estimate of U.S. gross domestic product for the first quarter of 2024, the economy grew at an annualized rate of 1.6 percent during the period, missing the 2.5 percent expected by economists. According to the BEA, the slowdown compared to Q4 2023, when real GDP increased had 3.4 percent, primarily reflected decelerations in consumer spending, exports and government spending as well as an increase in imports, which are a subtraction in the calculation of GDP. While the latest reading marks the slowest growth since Q2 2022, economists won't be overly concerned by it as the Fed has been trying to pour cold water on the economy for two years in its continued efforts to tame inflation.

The more worrying outcome from yesterday's GDP report was the fact that the price index for personal consumption expenditure (PCE), the Fed's preferred inflation gauge, heated up in the first three months of 2024, further dashing hopes of any imminent rate cuts. The PCE price index increased at an annual rate of 3.4 percent in Q1 2024, almost double the pace of the previous quarter, when prices grew 1.8 percent. The core PCE index, excluding food and energy, increased 3.7 percent in the first quarter, up from the Fed's target level of 2.0 percent in the past two quarters.