Where Data Tells the Story

© Voronoi 2026. All rights reserved.

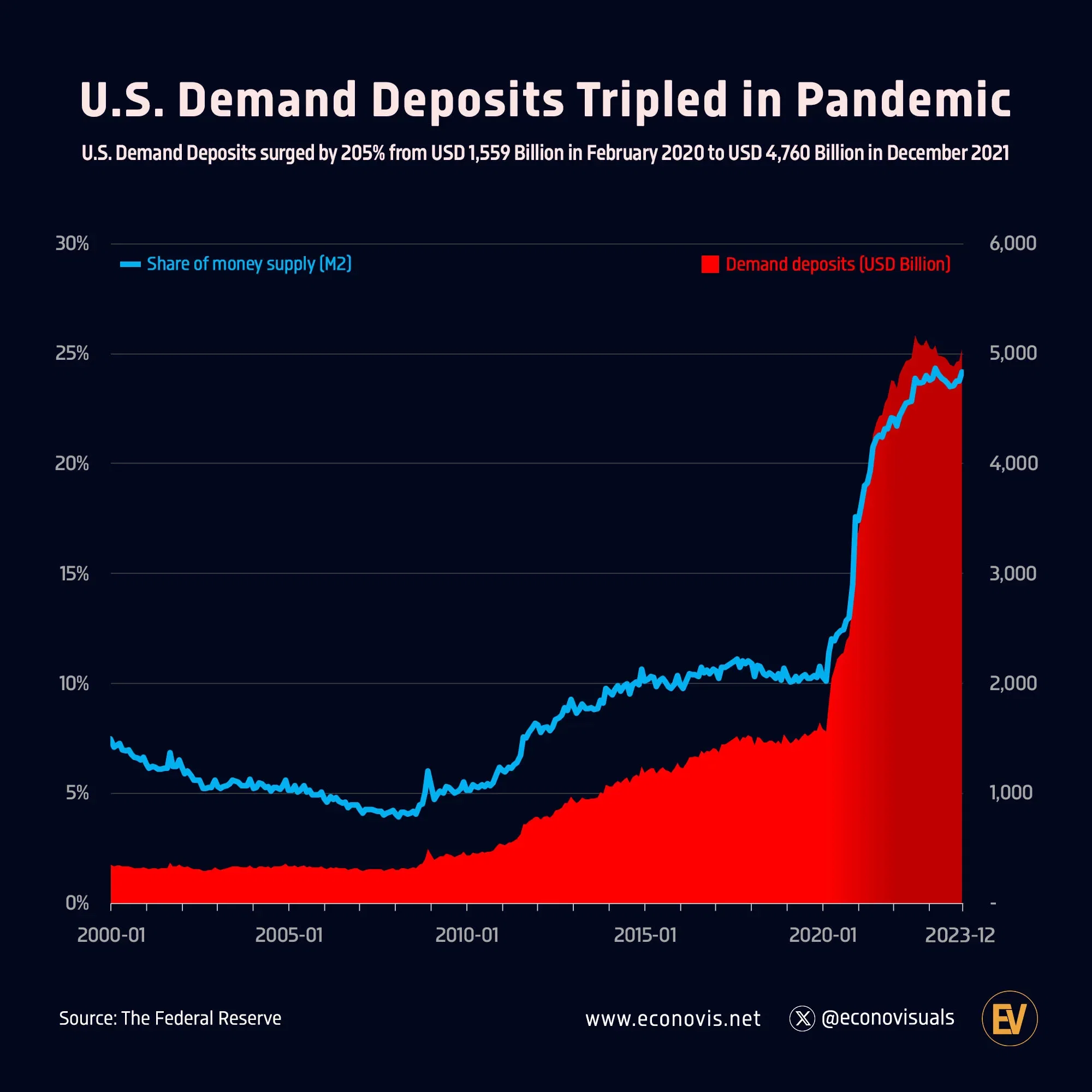

Money supply typically consists of money (currency in circulation + demand deposits) and quasi-money (savings deposits). Demand deposits represent funds that are readily available for withdrawal on demand. They are considered highly liquid since account holders can easily access their funds using methods such as checks, debit cards, or electronic transfers. Due to this high level of liquidity, demand deposits are included in the narrowest definition of the money supply, often referred to as M1.

Historically, U.S. demand deposits averaged USD 390 billion monthly from 1994 to 1997, gradually decreasing to a monthly average of USD 320 billion from 2000 to 2007. However, from 2007 to 2014 (encompassing quantitative easing 1 to 3), demand deposits experienced a fourfold increase (CAGR 22%).

U.S. demand deposits surged by 205% (CAGR 95%) in just 20 months, escalating from USD 1,559 billion in February 2020 to USD 4,760 billion in December 2021. The implementation of stimulus packages, such as the CARES Act (March 2020), Consolidated Appropriations Act, 2021 (December 2020), and the American Rescue Plan Act (March 2021), which provided direct payments to individuals, enhanced unemployment benefits, and funding for businesses in response to the COVID-19 pandemic, played a central role in injecting new money into the economy. However, after reaching a peak of USD 5,172 billion in August 2022, demand deposits decreased to USD 5,043 billion in December 2023.

The ratio of demand deposits to the total U.S. money supply (M2) increased from a monthly average of 10% in 2014-2019 to 22% in December 2022 and 24% in 2023. Demand deposits contributed to more than half of the money supply (M2) created from February 2020 to December 2021.