Where Data Tells the Story

© Voronoi 2026. All rights reserved.

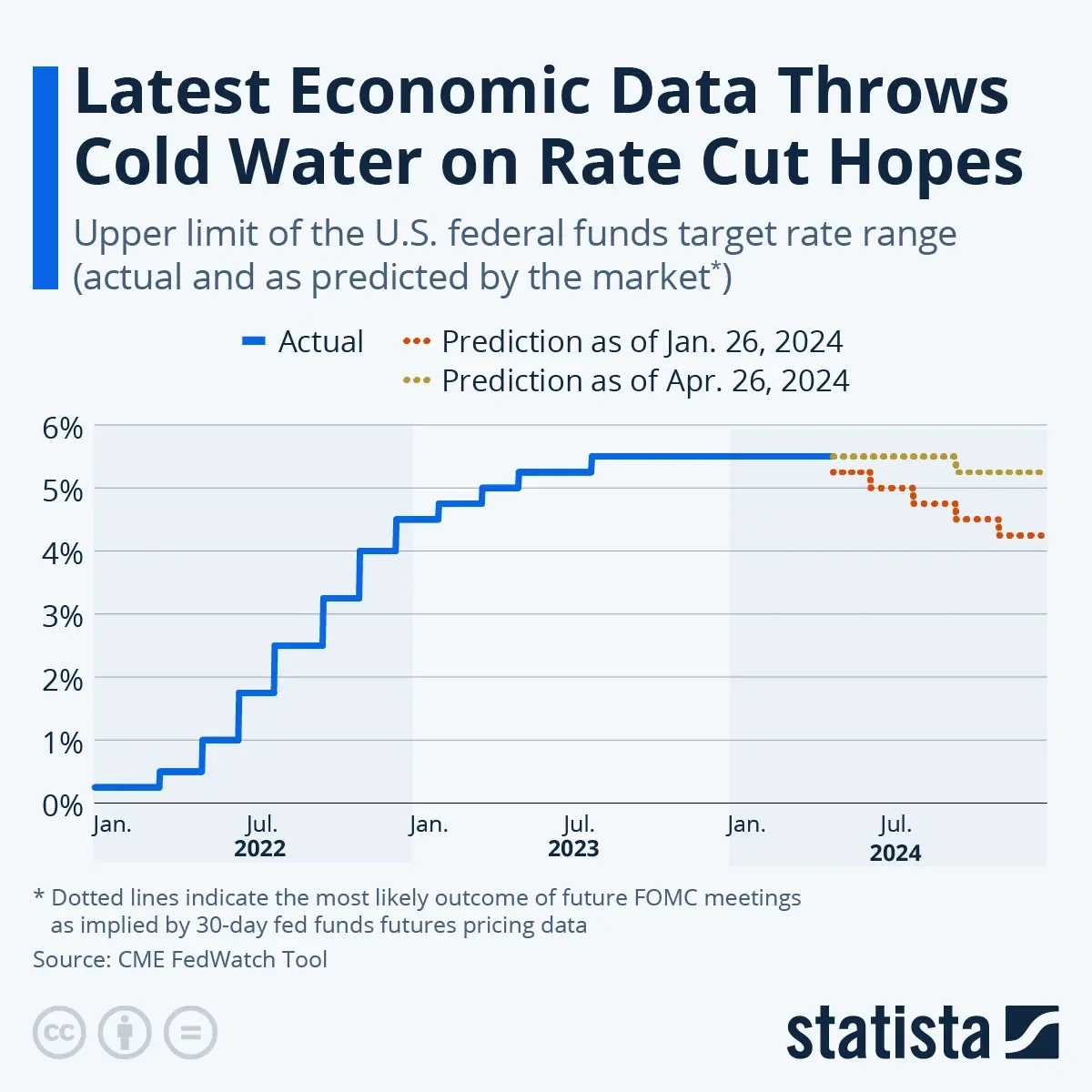

Due to a lack of further progress in bringing inflation back to its target level of two percent, hopes of several rate cuts in 2024 have all but evaporated in the United States. While the Fed's latest projection materials, published in mid-March, still predicted three 25-point cuts by the end of this year, economic data that has come out since has poured cold water on any hopes of imminent rate cuts.

After a hotter-than-expected inflation reading and yet another strong jobs report in March, Thursday's GDP report, which also showed an re-acceleration in the Fed's preferred inflation gauge, further dashed such hopes as analysts are now questioning whether the Fed will start cutting rates at all this year. Just three months ago, hopes of a so-called soft landing were very high, and the question was not if but how soon the Fed would start cutting rates. Speaking at a policy forum last week, Fed Chair Jerome Powell had already warned that rates could remain higher for longer than expected. "The recent data have clearly not given us greater confidence, and instead indicate that it’s likely to take longer than expected to achieve that confidence," he said, adding that the Fed would and could "maintain the current level of restriction for as long as needed."

After a period of rate cut euphoria, markets have already reacted to the latest developments. According to the CME FedWatch Tool, which gauges the probability of changes to the Fed's policy rate based on 30-day fed funds futures pricing data, the market is now expecting just one instead of several rate cuts this year. Looking at the next few FOMC policy meetings, the CME FedWatch Tool puts the likelyhood of rate cuts at 3 percent for the May meeting, 11 percent for the June meeting and 33 percent for the July meeting.