Where Data Tells the Story

© Voronoi 2026. All rights reserved.

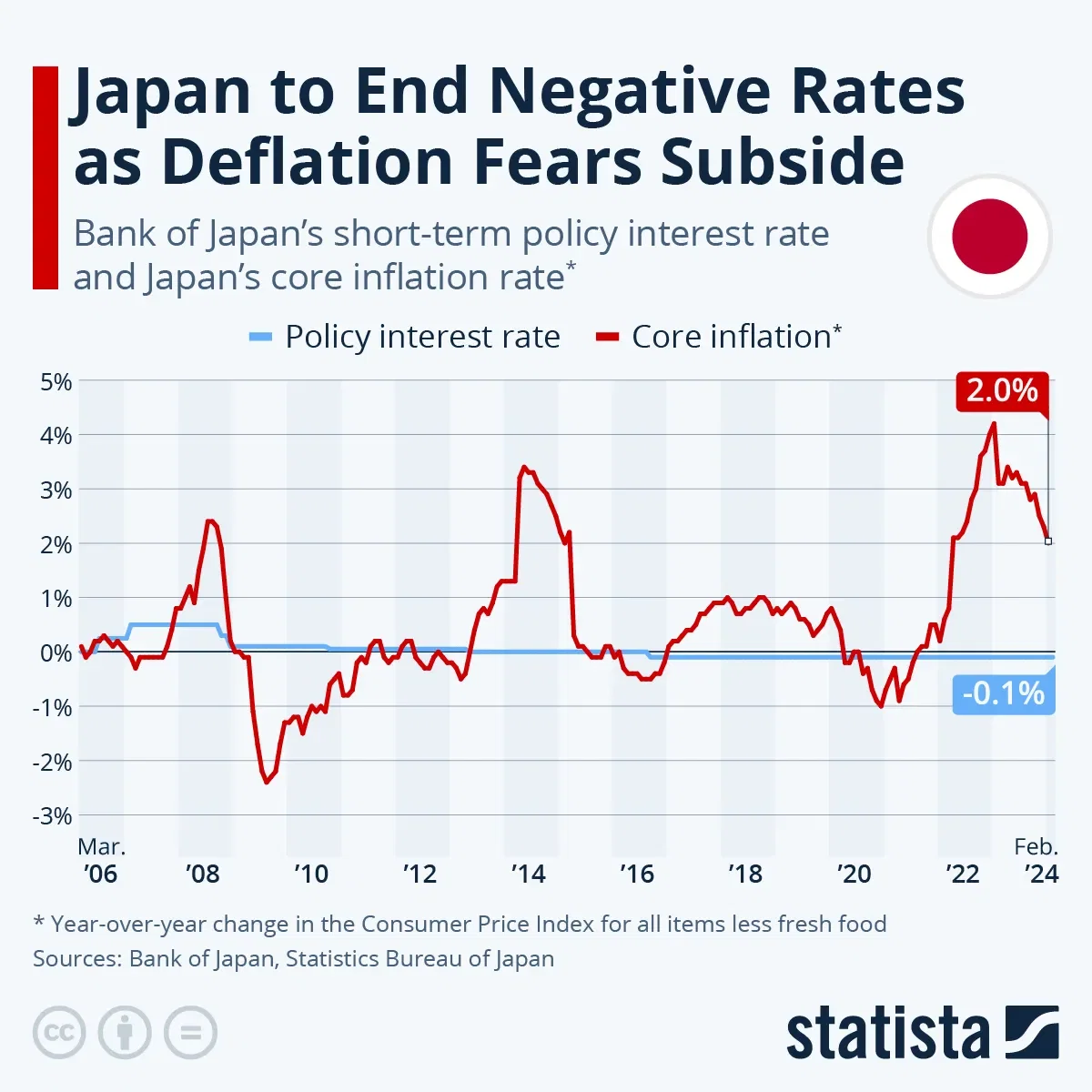

Japan is about to end its negative interest rate policy eight years after cutting its short-term policy rate to -0.1 percent in February 2016. Back then, the negative interest rate was introduced to supplement the policy of “Quantitative and Qualitative Monetary Easing” in the country’s long battle with deflation and subdued economic growth. Since the 1990s, Japan has repeatedly seen protracted periods with very low or negative inflation, forcing the country’s central bank to implement aggressive policies aiming to stimulate the economy and return to its 2-percent inflation target.

The Bank of Japan is expected to announce the first rate hike since February 2007 after the conclusion of its two-day meeting on Tuesday, as it has apparently seen enough evidence of core inflation stabilizing at or above the target level of 2 percent – the BOJ’s stated prerequisite for altering its policy stance. Last Friday, the Japanese Trade Union Confederation, known as Rengo, announced that this year's spring wage negotiations resulted in average pay increases of 5.28 percent, the highest level in 33 years. Meaningful wage growth is considered key in the fight against deflationary pressures in the hopes that higher wages boost consumer demand and keep prices aloft. According to a BOJ source cited by Nikkei on the weekend, this year’s wage hikes are high enough that “even reflationists who are cautious about modifying monetary policy would accept a change in policy.”

Japan is the last major economy to employ a zero or negative interest rate policy, after central banks around the world rapidly hiked rates to curb inflation in the wake of Russia’s invasion of Ukraine and global supply chain issues. Japan’s Nikkei index rallied in anticipation to the BOJ’s possible landmark decision, rising 2.67 percent on Monday for its largest daily increase since February 13.