Where Data Tells the Story

© Voronoi 2025. All rights reserved.

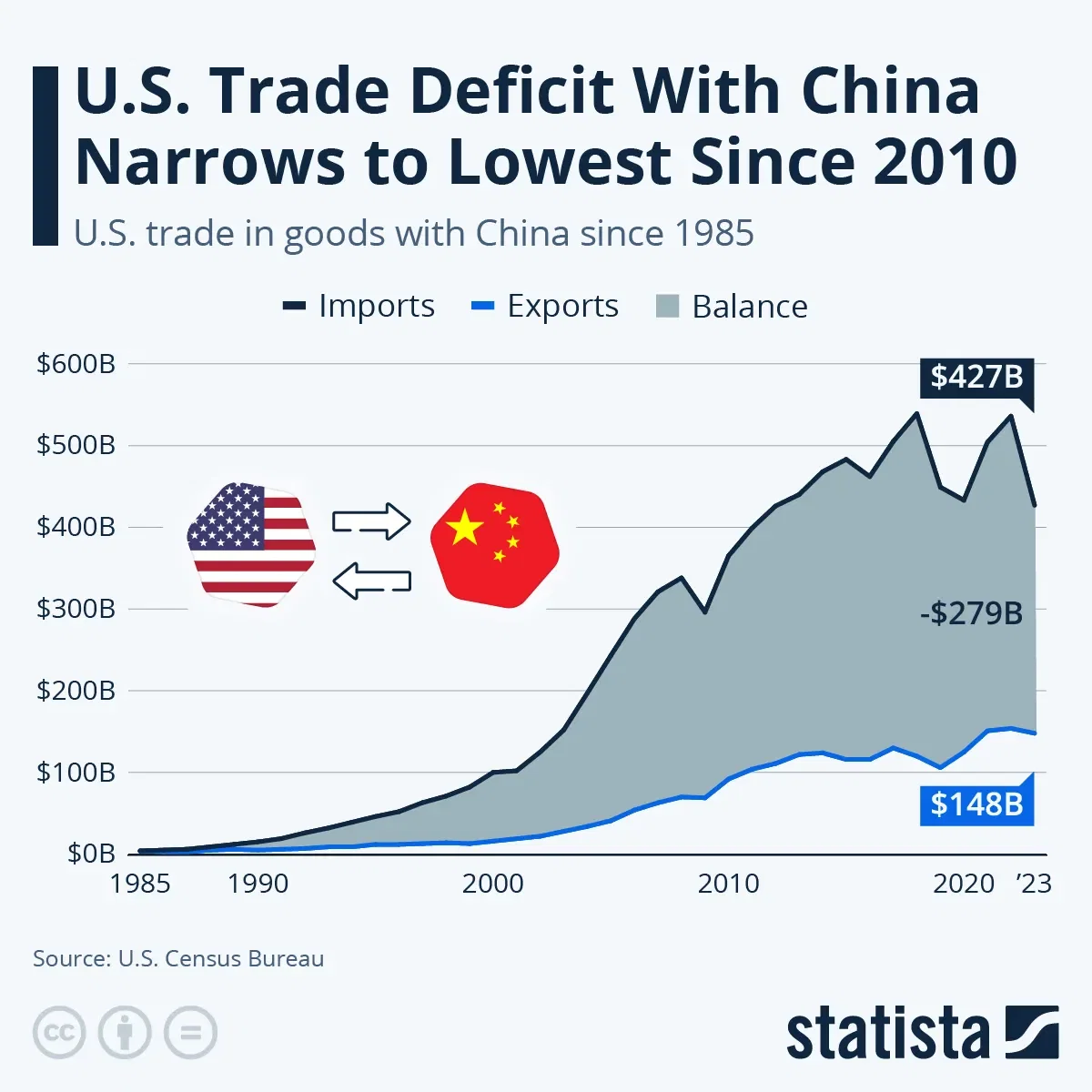

The U.S. trade deficit in goods trade with China narrowed to its lowest level since 2010 last year, as imports from China fell by more than $100 billion compared to the previous year. In fact, imports from the world’s largest exporter were even lower than in 2020, when imports from China had fallen to $432 billion amid an ongoing trade war between the two countries and disruptions caused by the Covid-19 pandemic.

According to the U.S. Census Bureau, the deficit with China decreased more than 25 percent to $279 billion in 2023, as tensions – both economic and political – between the two superpowers have remained high. Amid those tensions, many companies have tried to reduce their dependency on China by diversifying their supply chain or moving final assembly to other Asian countries.

Moreover, Chinese platforms like Temu, which are shipping increasingly large quantities of packages directly to U.S. consumers, take advantage of the so-called de minimis exception, which allows packages worth less than $800 to enter the U.S. tariff free. These shipments aren’t counted in U.S. trade data, meaning that actual imports from China are higher than official data suggests.