The G20 brings together the world’s largest advanced and emerging economies, accounting for more than 85% of global GDP and over three-quarters of global trade. Tracking inflation across this group offers a clear snapshot of global price dynamics and the forces shaping monetary policy.

Diverging inflation paths across the G20 continue to signal an uneven global recovery. While several economies are seeing steady disinflation, others remain under pressure from currency weakness, supply issues, and domestic demand trends.

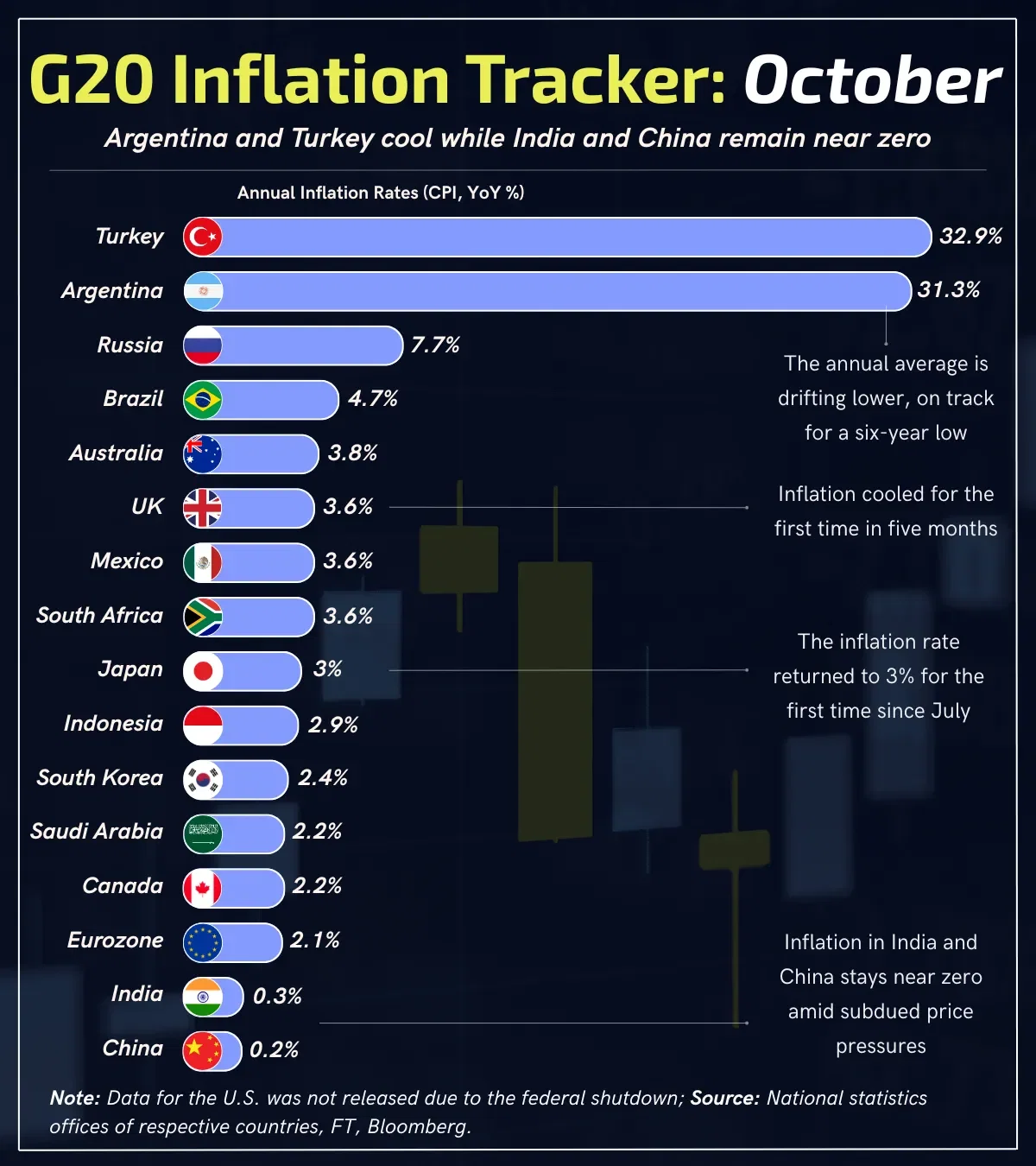

In October 2025, inflation across the G20 again showed wide contrasts and here are the key highlights:

- Turkey recorded the highest inflation in the G20, even as the annual average continued its downward trajectory. Risks to the disinflation path remain elevated amid policy uncertainty.

- Argentina saw its slowest annual inflation rate since mid-2018, though monthly inflation ticked up slightly ahead of the mid-term election.

- Russia posted the highest inflation outside the top two. Despite a modest decline, inflation remains well above the central bank’s 4% target as the war in Ukraine, sanctions, and supply strains persist.

- United Kingdom inflation cooled as gas and electricity prices eased, though rising food prices continue to pose a concern.

- Japan held above the Bank of Japan’s 2% target for the 43rd consecutive month, with food prices pushing inflation back to the 3% mark in October.

- India and China remained near zero, underscoring subdued price pressures in Asia’s two largest economies.

- Other G20 economies—including Brazil, Australia, Mexico, South Africa, South Korea, Canada, and the Eurozone—remained broadly anchored within the 2–4% range.

- United States data was not released due to the federal shutdown.

Source: National statistics offices of respective countries, FT, Bloomberg.National statistics offices of respective countries, FT, Bloomberg