Where Data Tells the Story

© Voronoi 2026. All rights reserved.

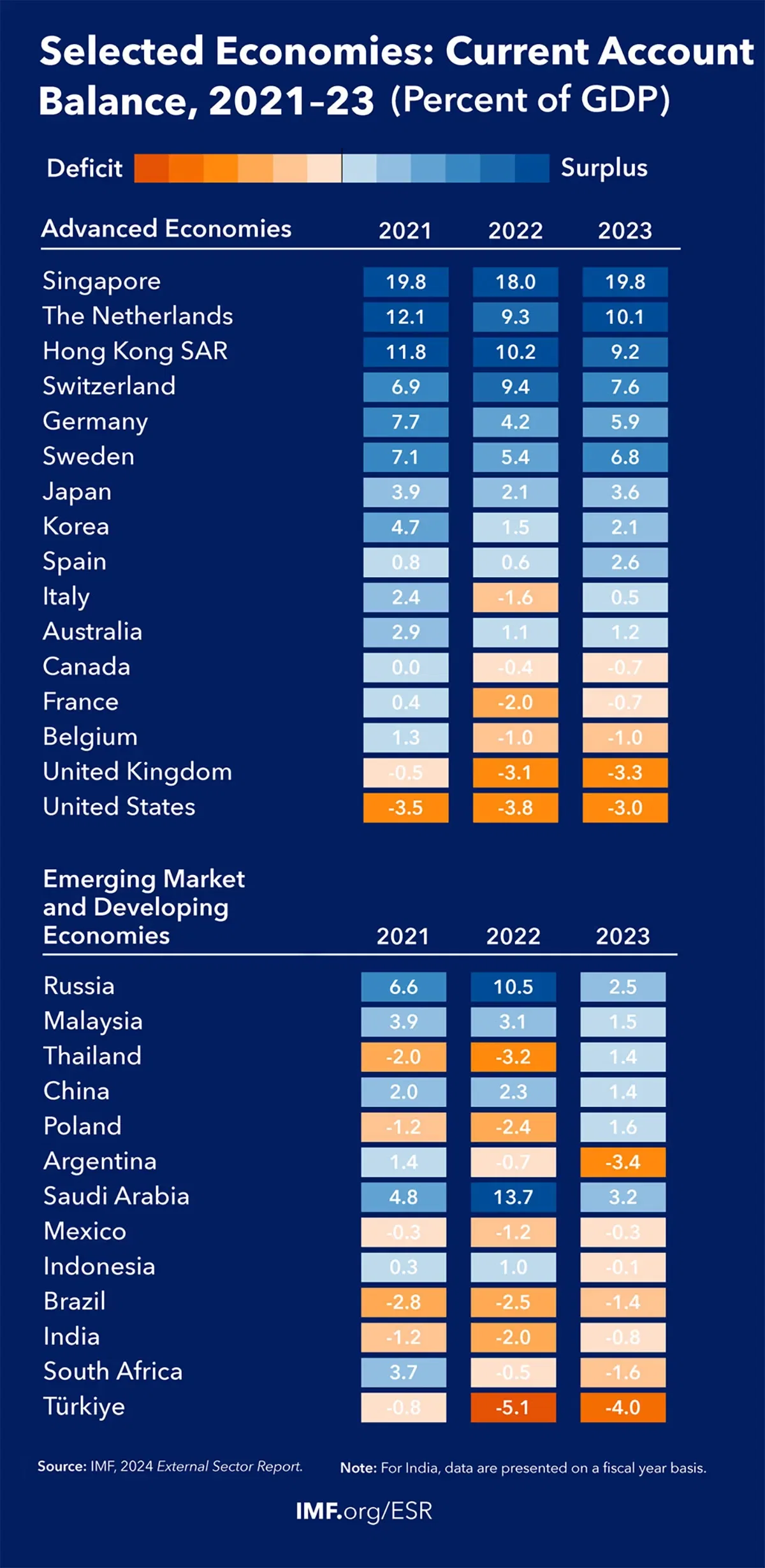

The global balance is projected to narrow further over the medium term, with some heterogeneity across countries. Current account surpluses in China and oil exporters are projected to continue to decline as imports of services continue to grow in China and as energy prices continue to moderate. The current account deficit of the United States is also projected to contribute to the narrowing of the global balance as the trade deficit continues to decline toward prepandemic levels.

The decline in the global balance is dampened by the projected widening of the current account deficit in several deficit emerging markets, including Brazil, India, Indonesia, and Mexico. In terms of macroeconomic factors, the narrowing of the medium-term global balance is supported by moderating commodity prices and projected medium-term fiscal consolidation in current account deficit countries, including the United States, outweighing a projected gradual recovery in global trade volumes. The medium-term global balance has decreased by 0.2 percent of world GDP relative to the path reported in the 2023 External Sector Report.

See the full report here.

They are roughly the difference between a country's exports and imports. More exports than imports makes a surplus, less exports than imports make a deficit.

Often deficits and surpluses can be appropriate and even healthy. However, sometimes they can be excessive, leading to trade tensions and financial disruption, which hurts global growth.

The IMF conducts annual assessments of surpluses and deficits in the largest economies to alert the global community to potential risks that countries need to address together.