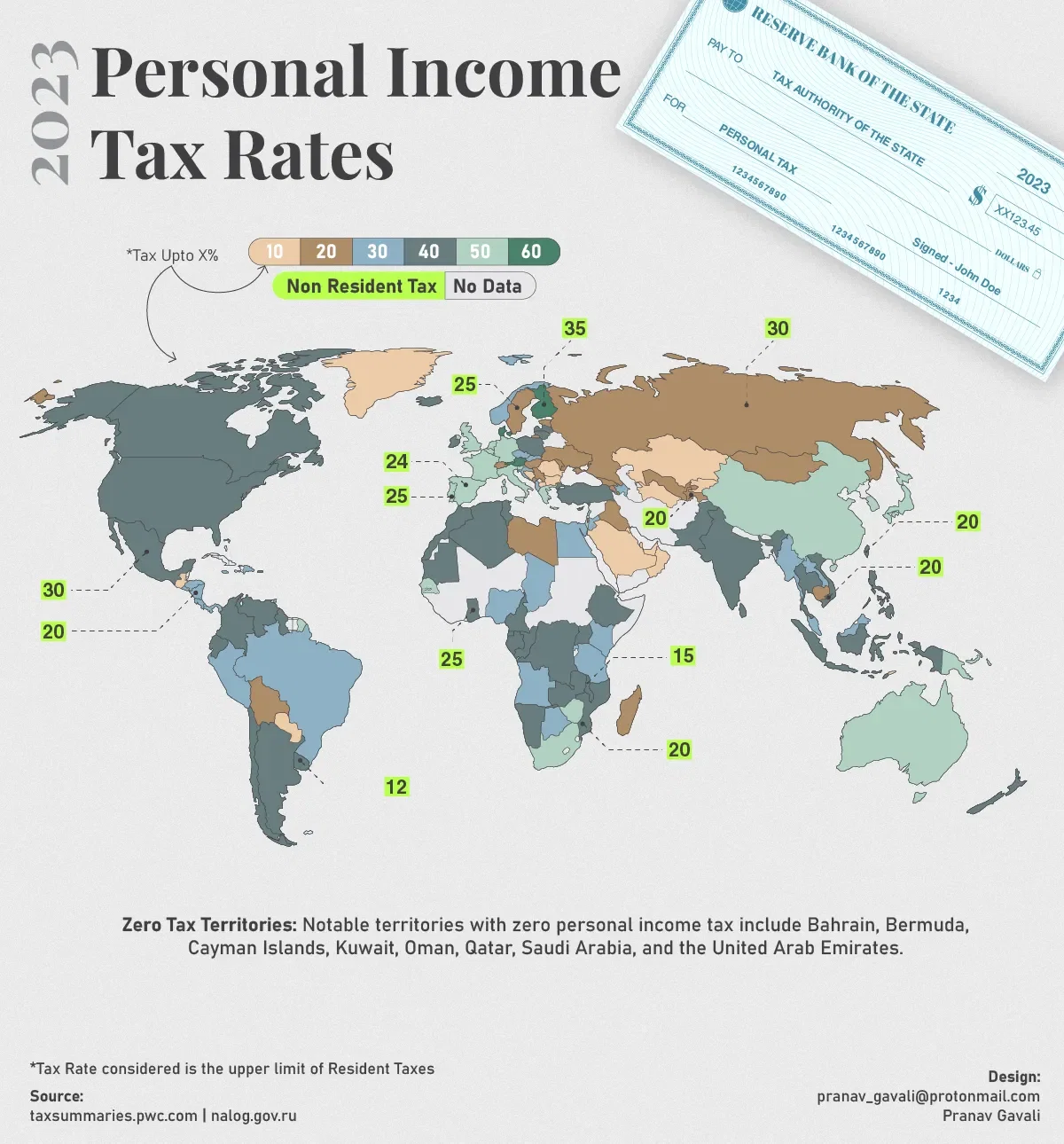

Embark on a visual journey across the world to understand the diverse landscape of personal income tax rates. This choropleth map showcases the headline personal income tax rates across different territories, providing a comprehensive view of the global tax environment.

Key Observations:

- Highest Tax Rates: Austria (55%), Finland (55%), and Denmark (56%) lead with the highest headline personal income tax rates.

- Zero Tax Territories: Notable territories with zero personal income tax include Bahrain, Bermuda, Cayman Islands, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates.

- Global Diversity: Ranging from 0% in tax havens to 56% in high-tax European countries, the map reflects the diverse tax policies implemented worldwide.

Regional Insights:

- European Landscape: A significant portion of European countries, including Belgium, France, Germany, and Italy, feature high personal income tax rates.

- Asian Variances: Hong Kong SAR (15%), Singapore (22%), and Taiwan (40%) showcase the diversity of tax policies in Asia.

- North America: While the United States stands at 37%, neighboring Canada is at 33%, demonstrating regional differences.

Conclusion: This choropleth map serves as a powerful tool for investors, businesses, and individuals to navigate the global tax landscape. Understanding the variations in personal income tax rates provides valuable insights for financial planning, investment decisions, and international business considerations. Stay informed as we delve into the nuanced world of global taxation trends.