Where Data Tells the Story

© Voronoi 2026. All rights reserved.

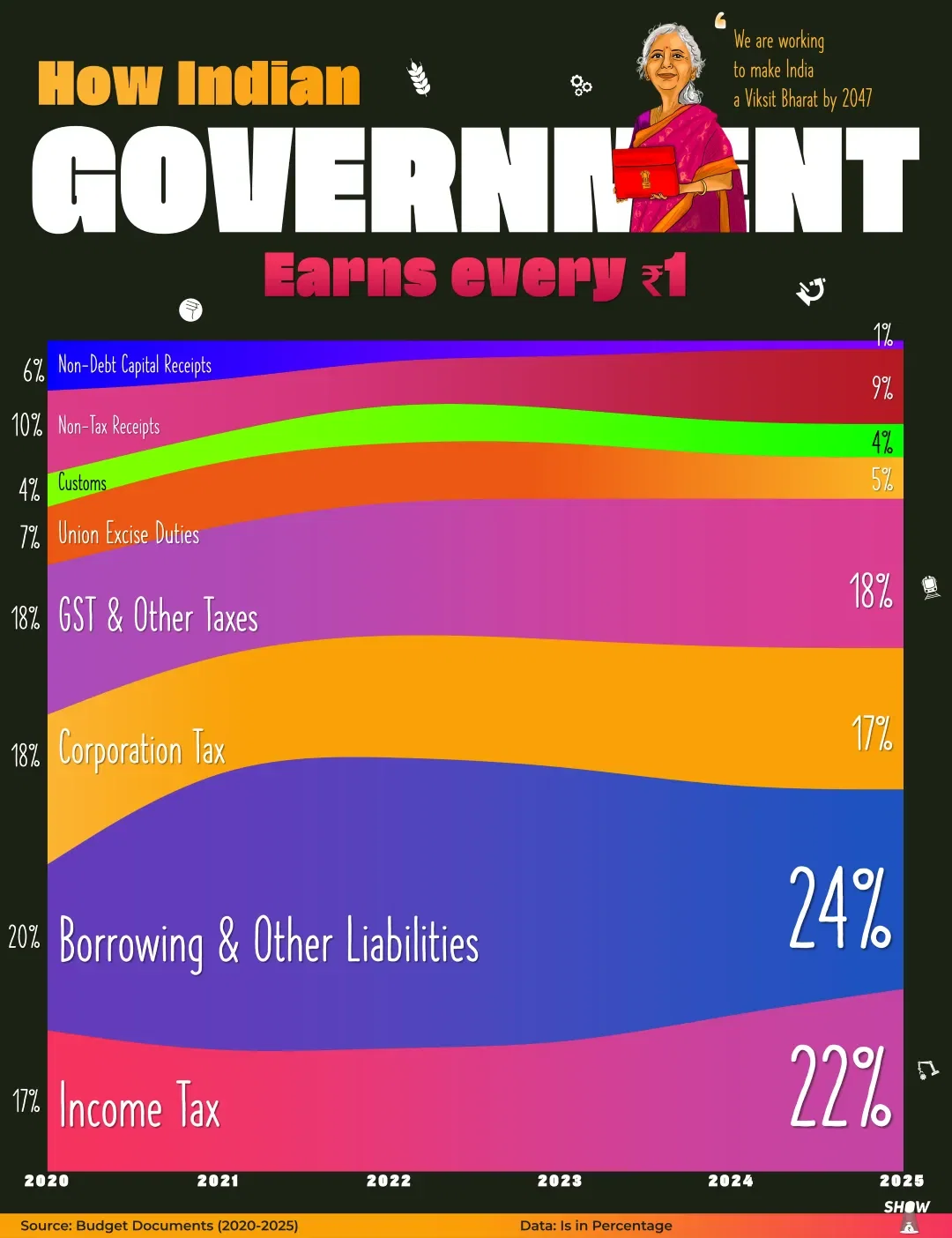

Between 2020 and 2025, the structure of the Indian government’s revenue has remained broadly consistent, with taxes and borrowings forming the backbone of receipts. On average, 55–60 paise of every ₹1 earned by the Union Government comes from tax revenues, including income tax, corporation tax, and Goods & Services Tax (GST). Among these, income tax and corporate tax together contribute around 30–35 paise, reflecting the growing role of direct taxation in government finances.

Indirect taxes, mainly GST, excise duties, and customs duties, contribute roughly 25–30 paise per rupee, with GST emerging as the single largest indirect tax source after its stabilisation post-2020.

Despite strong tax collections in recent years, the government continues to rely significantly on borrowings and other liabilities, which account for 25–35 paise of every ₹1 across this period. Borrowing dependence peaked during the COVID-19 years (2020–21) due to economic slowdown and higher public spending, and gradually moderated by 2024–25 as revenues improved.

The remaining 8–10 paise comes from non-tax revenues, such as dividends from RBI and public sector enterprises, fees, and interest receipts, along with non-debt capital receipts like disinvestment.

Overall, the 2020–2025 period shows a gradual shift toward stronger tax-led revenue growth, while borrowings continue to play a crucial role in funding development and welfare priorities.